Fintech

Fintech

-

CFPB to scrap key underwriting portion of payday rule; Fiserv-First Data — why small banks fear big fintech; banks, credit unions help federal workers hurt by shutdown; and more from this week's most-read stories.

January 18 -

Citi is the first to share its unadjusted pay gap and lays out its goals for improvement. Bankers will be getting to know the progressive female freshmen who are storming D.C. a lot better. Plus, lots of fintech people moves and Gillette's take on toxic masculinity.

January 18 -

Executives at Key pushed back against doubts over a deal for Laurel Road Bank’s digital lending platform so late in the credit cycle, arguing that its customers are prime borrowers with high incomes.

January 17 -

The online platform, created by Laurel Road Bank in 2013, allows users to refinance student loans and originate mortgages.

January 17 -

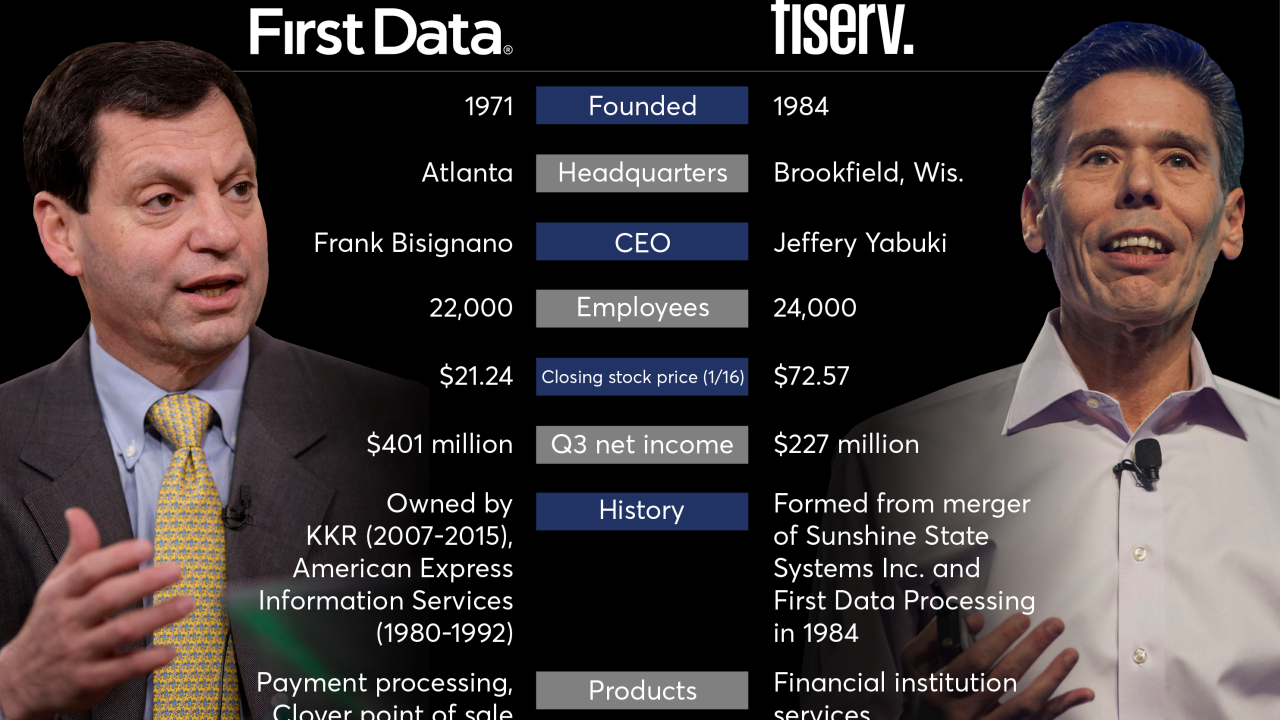

The Fiserv-First Data deal, valued at about $22 billion, will combine two of the financial services industry's largest technology and processing companies.

January 16 -

The large core banking software vendors are already criticized as large and slow-moving. Consolidations like these are only likely to make them more so.

January 16 -

The large core banking software vendors are already criticized as large and slow-moving. Consolidations like these are only likely to make them more so.

January 16 -

The numbers behind Fiserv's deal to acquire First Data are huge, particularly considering each company's existing tonnage still makes consolidation the best play when faced with nimble fintechs and mobile startups.

January 16 -

Fiserv will acquire First Data in an all-stock deal with a value of about $22 billion that will combine two of the financial services industry's largest technology and processing companies.

January 16 -

The Financial Solutions Lab, a joint initiative, has announced the winners of its annual competition to identify solutions to consumer financial challenges, this year focusing on startups dedicated to improving financial health in the workplace.

January 15 -

The bank missed expectations although profit rose 67%; with the California Democrat leading the House Financial Services Committee, deregulation could slow.

January 15 -

Americans are living longer yet retiring earlier and saving less, says Matt Fellowes, CEO and founder of United Income. But there's no need to panic.

January 15 -

The U.S. online lender provides credit lines of up to $150,000 to small businesses that shop at Alibaba.com.

January 14 -

The Ohio-based corporate has unveiled Sherpa Technologies, a credit union service organization intended to help CUs better navigate the tech landscape for financial institutions.

January 14 -

Todder Moning of U.S. Bank scoured the 2.7 million square feet of the Consumer Electronics Show this week. Here’s what he liked, what he thinks bankers could work with ... and what he thought was weird.

January 11 -

Nicolas Kopp, head of N26 in this country, explains how the company plans to spend a chunk of the proceeds on its expansion here and add to the intensifying competition among fintechs.

January 10 -

The subprime online lender said Thursday that it will spin off its credit card business into a new entity, Mission Lane. It also named a new CEO to replace its founder, Sasha Orloff.

January 10 -

As BillingTree moves deeper into verticals such as health care, it will be helmed by new leadership as Christine Lee becomes CEO.

January 10 -

Its data-driven financial management services for workers who live paycheck to paycheck — and a contract with Walmart — have attracted executives from Facebook, Slack and elsewhere as well as a major investment from the head of Box.

January 10 -

Members prize good customer experience so to meet this expectation institutions need to develop a strategy for APIs.

January 10