-

Sherrod Brown, the top Democrat on the Senate Banking Committee, explains why consumer protection is so important as the coronavirus pandemic ravages the economy.

April 13 -

A familiar face is taking the reins at the Baytown, Texas-based credit union, following the departure of its former chief executive earlier this year.

April 13 -

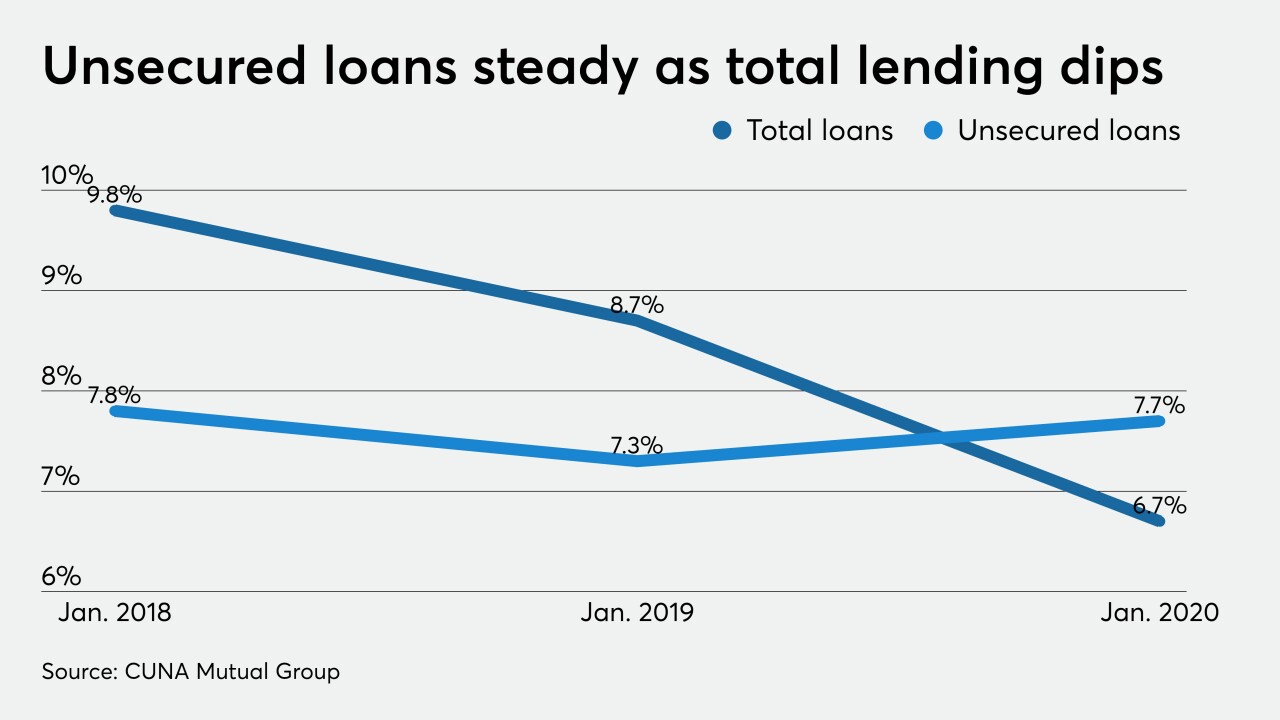

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

April 13 -

After opening-day fiasco, SBA upgrades lender portal with Amazon assist; West Virginia’s First State Bank closed by regulators; BofA offers emergency loans to borrowers first, freezing out depositors; and more from this week’s most-read stories.

April 10 -

Many states are offering additional flexibility as more consumers dip into their savings as a result of the pandemic’s economic fallout.

April 9 -

At just $3.7 million in assets, tiny Financial 1st Federal Credit Union has voted to merge into Horizon FCU.

April 9 -

Critics who argue this crisis mirrors the 2008 financial panic when Congress bailed out banks have it wrong. The new relief package in response to the coronavirus pandemic was necessary to save livelihoods, and more can be done.

April 9 Ludwig Advisors

Ludwig Advisors -

With the government pumping trillions of new spending into the economy, experts are questioning the Federal Reserve's ability to keep prices stable.

April 8 -

Toronto-Dominion Bank is moving almost all of its call center employees from 15 different U.S. and Canadian cities to their homes in response to the coronavirus.

April 8 -

Spirit of Texas Bancshares named an interim CEO for Dean Bass, though the company said he is recovering.

April 8 -

Lawmakers want to expand the two-day old small business loan program by another $250 billion; Calabria says nonbanks are exaggerating their financial woes as forbearance claims rise.

April 8 -

The OCC and FDIC are holding off on easing debt limits in response to the coronavirus pandemic, leaving billions of dollars locked up at banking subsidiaries that could be used for lending amid the deepening economic crisis.

April 7 -

Credit unions that take advantage of hedging could see better execution and increased profitability in their mortgage operations.

April 6 Vice Capital Markets

Vice Capital Markets -

Credit unions in the Great Lakes State saw widespread membership growth in 2019 but it was the third consecutive year in which the pace of growth slowed.

April 6 -

Few lenders are finding creative ways to provide much-needed financial advice and emergency services online.

April 6 SigFig

SigFig -

Ally, Discover and USAA have made technological, managerial and policy changes to help their centers' employees cope with the rush of calls from customers hurt by the pandemic.

April 5 -

Emergency loan program plagued by chaos on eve of launch; why Moven, one of the first challenger banks, is calling it quits; Fed faces conundrum on whether to remove Wells Fargo's asset cap; and more from this week's most-read stories.

April 3 -

Cobalt Credit Union is currently a state-chartered institution but is looking to once again become a federal one because of Iowa state taxes.

April 3 -

Yes, the Small Business Administration's emergency funding program for the coronavirus crisis is off to a rocky start, but that shouldn't stop banks from helping customers in need.

April 3 JRK Advisors LLC

JRK Advisors LLC -

Nonbank financial firms spent years lobbying against tougher regulation and stricter capital requirements, arguing they didn't pose a risk to the financial system. Now, many of those companies say they are in desperate need of a bailout.

April 3