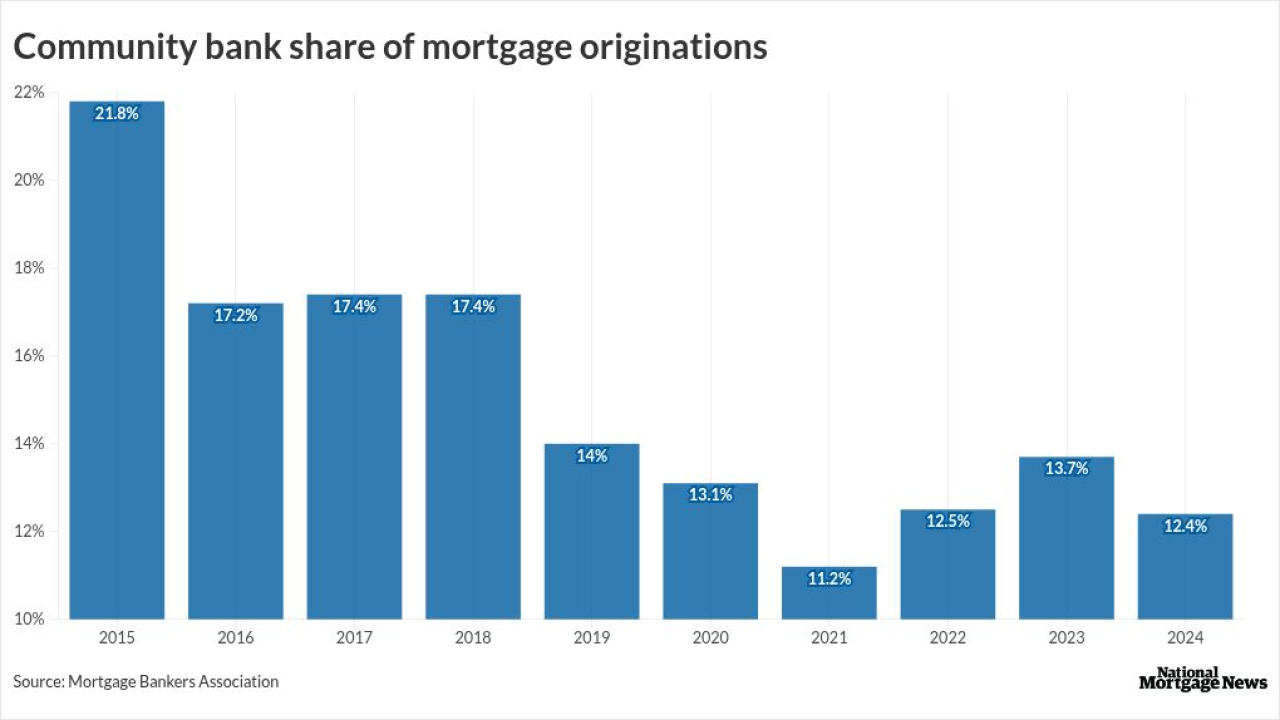

Though changes to bank capital rules previewed by Federal Reserve Vice Chair for Supervision Michelle Bowman in February are being viewed as welcome, experts say other more significant hurdles — not all of them regulatory — are keeping banks on the sidelines of mortgage servicing and lending.

Bank employees are likely adopting the OpenClaw AI assistant on the sly to boost productivity, but the tool's deep integration exposes networks to cyber threats.

-

Recent reports from JD Power suggest that more customers choose payment alternatives to avoid surcharge fees.

-

Noelle Acheson argues that stablecoins can help community banks deepen relationships with their customers, help them explore new forms of capital formation and strengthen their own exposure to risk.

-

In this week's American Banker global payments and fintech roundup, Revolut, Tether and Circle made announcements designed to improve their standing in the stablecoin market. That comes amid new research from McKinsey that says the digital asset is growing quickly, but has not made even a small dent in payments.

Cybersecurity stocks tumbled after Anthropic unveiled a new vulnerability scanner, prompting vendors to defend their runtime protection platforms.

Fulton Financial received the necessary approvals to acquire Blue Foundry Bancorp; JPMorgan hired two Bank of America health care veterans while shuffling leadership; Mizuho Financial Group has plans to replace about 5,000 administrative jobs with artificial intelligence over the next 10 years; and more in this week's banking news roundup.

Experts said that judges reviewing ongoing litigation between the Consumer Financial Protection Bureau and its employee union seem inclined to allow reductions in force to proceed if the CFPB presented a credible plan for running the agency.

-

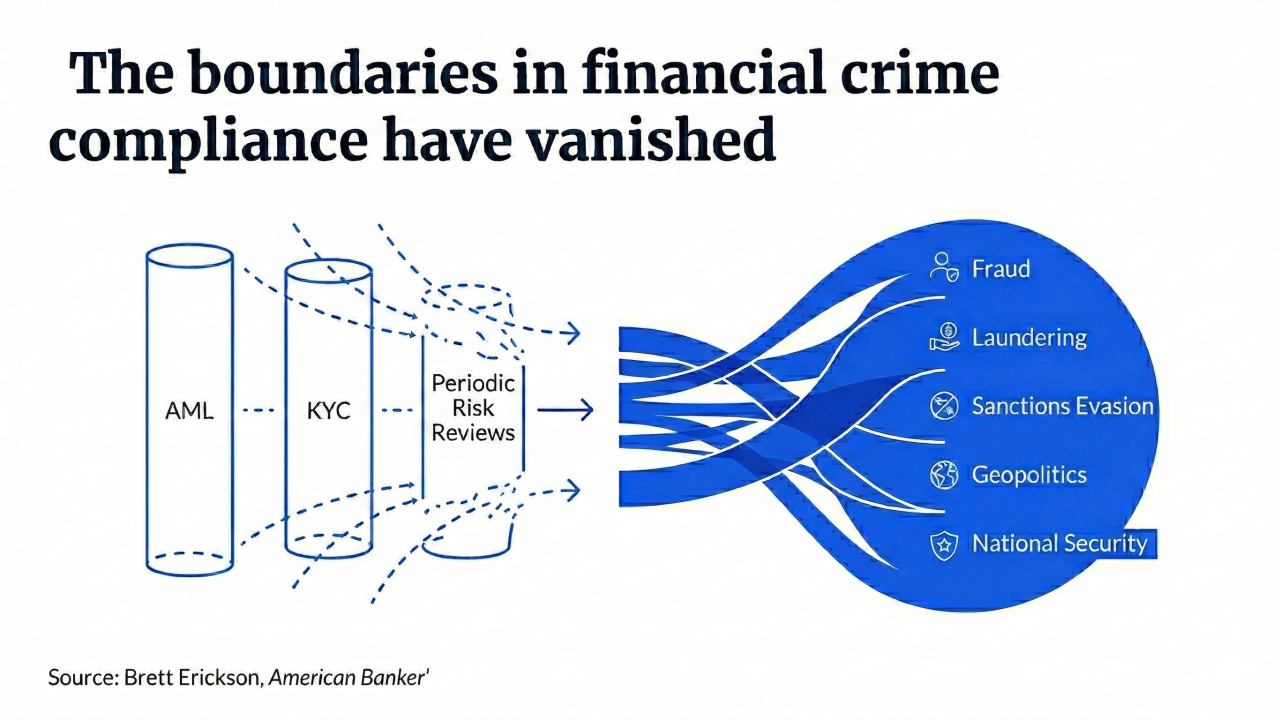

The threats posed by financial criminals, from fraudsters to money launderers, are evolving at a pace that far outstrips the education of bankers charged with combating them. That needs to change.

-

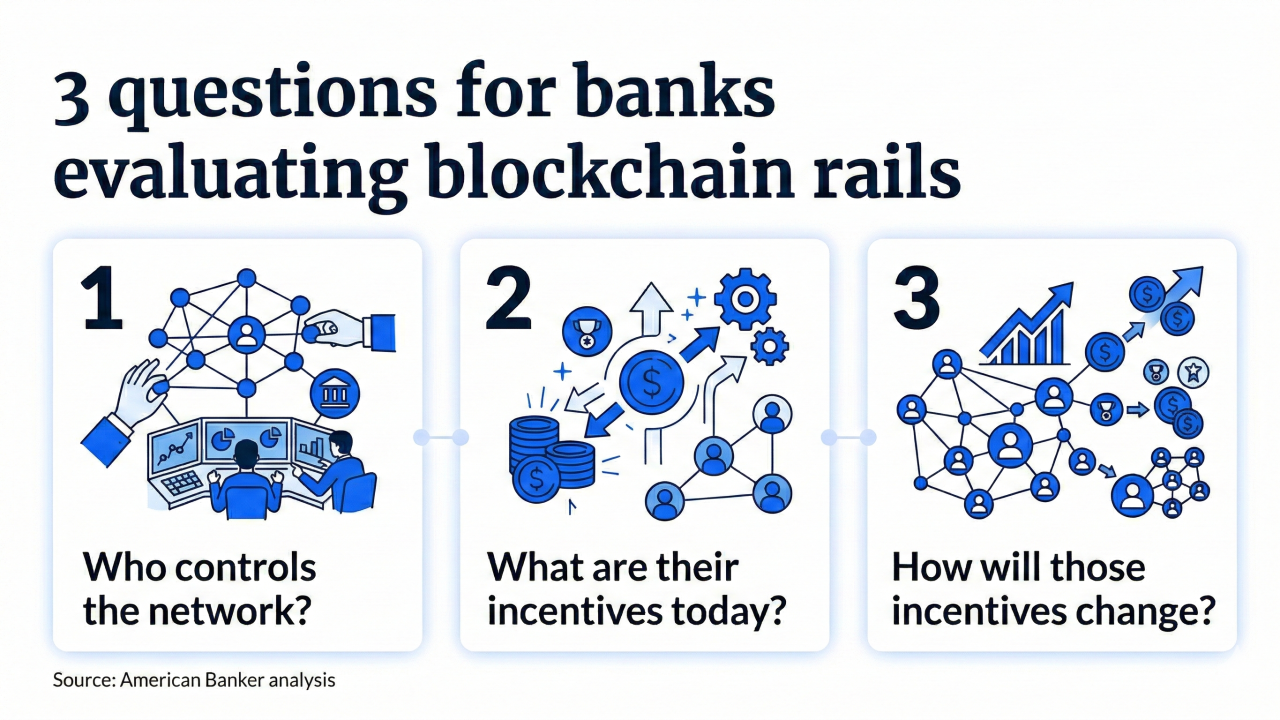

Decisions about the kind of blockchains to use in rolling out banking products creates future path dependencies. It's important that banks get this decision right.

-

A negative work environment with unhappy employees is going to adversely impact the customer experience, even when employees don't voice their dissatisfaction out loud. Bank managers need to create a positive culture.

-

The Royal Bank of Canada's base outlook is that tariffs will remain at their current levels. But it also sees a possibility that U.S. trade policy will bring on a severe North American recession.

-

Willamette Valley Bank cited consumer shifts to nonbanks and stubborn interest rates behind the decision, joining a line of institutions to exit since 2025.

-

Comptroller of the Currency Jonathan Gould took several assertive stances at a Senate Banking Committee hearing Thursday, minimizing concerns about banks' potential compliance costs to collect citizenship data and sidestepping questions about World Liberty Financial's trust charter application.

-

For the first time since early September 2022, the Freddie Mac Primary Mortgage Market Survey has the 30-year below 6%, but the 15-year gained this week.

-

At an investor day in London, Banco Santander executives laid out the Spanish company's new financial goals, including a goal to improve a key profitability metric in the U.S. The pending acquisition of Webster Financial in Connecticut is part of the strategy to achieve higher returns, they said.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The annual rankings honor the notable performances of individuals in banking and finance and as teams.

Call for submissions for women 40 years and younger who are rising leaders at their bank or financial institution.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsored by S&P Global

- Sponsored by S&P Global

- Sponsored by S&P Global

- Sponsored by S&P Global