A district court has agreed to halt compliance with the Consumer Financial Protection Bureau's Biden-era open banking rule while the Trump administration pursues its own rule.

Amazon.com's cloud-computing service, used by Capital One and other large companies, was beset by "high error rates" on parts of its S3 data-storage system, disrupting many sites and mobile apps.

-

The card brand uses a new form of generative AI that improves data sourcing, making human involvement less necessary.

-

Real-time payments and FedNow were top of mind at The Clearing House's annual conference this week. Here's how banks and payment companies see RTP's potential evolution.

-

The Financial Conduct Authority plans to regulate specific technology products that banks use to process payments and require testing. That and more in our global payments roundup.

As CFPB mulls privatizing database, consumer complaints are on the rise; an argument for continued human oversight of artificial intelligence; how some banks are luring talent from big tech; and more from this week's most-read stories.

Regulatory shifts and loan growth are some of the hot-button topics banks will seek to address as they start sharing their fourth-quarter reports next week.

The Senate's version of a stablecoin regulation bill cleared a key procedural hurdle as the Senate voted 66-32 to invoke cloture on the legislation. A final vote on the Senate floor is expected within weeks.

-

Organizations that emphasize not just coaching but the importance of remaining coachable, tend to develop more talented and engaged teams.

-

The recent leadership turmoil at OpenAI underscored the importance of the due diligence banks must conduct before working with a generative artificial intelligence vendor.

-

Financial services companies are still in the early days of utilizing artificial intelligence, meaning they must closely examine any partnership with a third party. This includes demanding evidence to back up any performance claims these outside companies make.

-

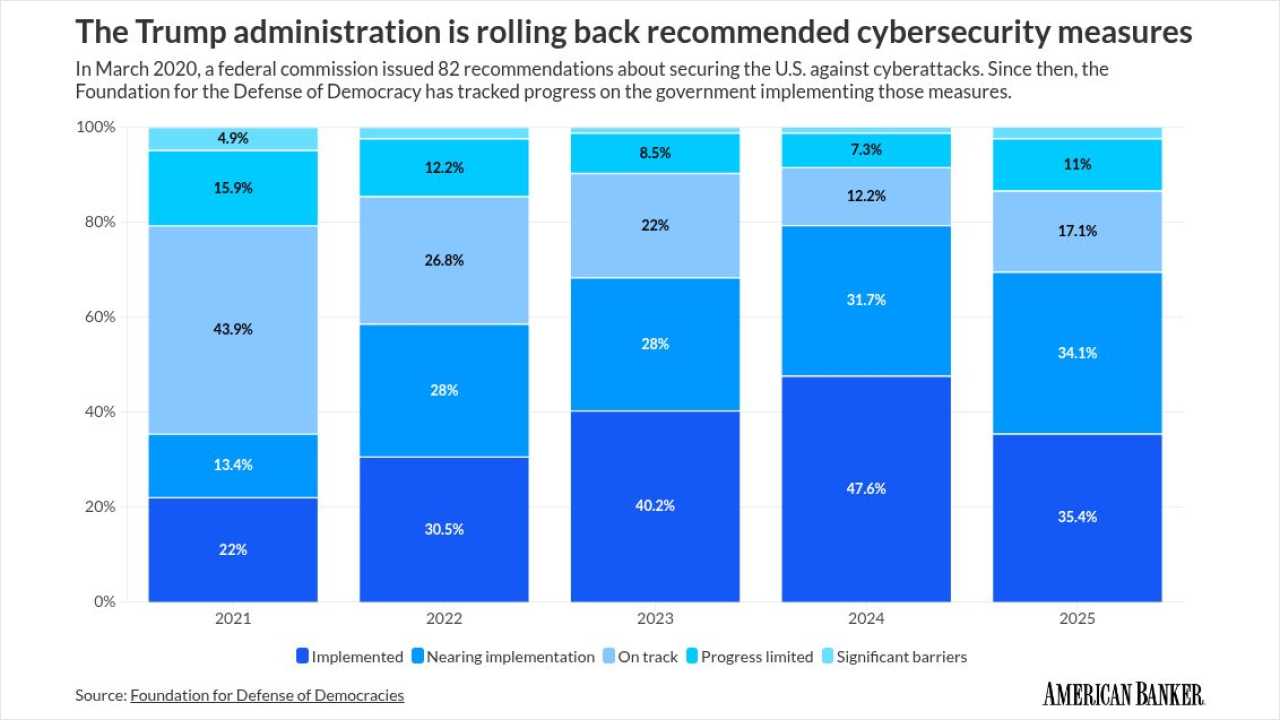

A think tank report details setbacks in U.S. cyber strategy, from shuttered partnerships and staff cuts to the expiration of key info-sharing laws.

-

Needham and Provident banks received all regulatory approvals and merge date; JPMorganChase hired veteran tech dealmaker Kevin Brunner from Bank of America; RBC Capital Markets will expand its presence in the equity derivatives market with two senior hires from UBS; and more in this week's banking news roundup.

-

The Federal Reserve Friday issued a set of proposed changes to its stress testing program for the largest banks that would disclose the central bank's back-end stress testing models, a move that the Fed had long opposed out of fear of making the tests easier for banks to pass.

-

Robert Hartheimer's arrest comes at a time when the bank is trying to recover from a consent order and the Synapse mess.

-

Boston-based Eastern Bankshares is focused on organic growth, but it would "evaluate the opportunity" for M&A if a deal presents itself, its CEO said Friday. The comments came four days after an activist investor criticized the bank's recent M&A transactions.

-

There are regulatory and technology efforts to reform international payments, but it's a multifaceted, long process. Swift, The Federal Reserve, and fintechs like Wise and Revolut are pushing potential solutions. Here's what banks need to know.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Former Comptroller of the Currency Eugene Ludwig has written a book called The Mismeasurement of America that lays out the shortcomings of the standard economic data that U.S. government and businesses use to make decisions, and how this data obscures the truth about how low-income Americans are actually faring.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsored by S&P Global

- Sponsored by S&P Global

-

-