Federal Reserve Board Gov. Stephen Miran said the growth of stablecoins and cryptocurrencies will likely impact monetary policy and could lead to lower interest rates.

By banding together, banks can negotiate better terms with startups and other tech companies, FIS' chief operating officer says.

-

The cryptocurrency exchange made the move to follow the Markets in Crypto-Assets Regulation, which tightens rules for digital assets in the European Union.

-

The card network will provide payments support for the social network's financial app, potentially contributing to its ability to scale.

-

Money remittance provider Wise said it "strongly disagrees" with the Consumer Financial Protection Bureau's characterization that it advertised inaccurate fees and did not properly disclose exchange rates.

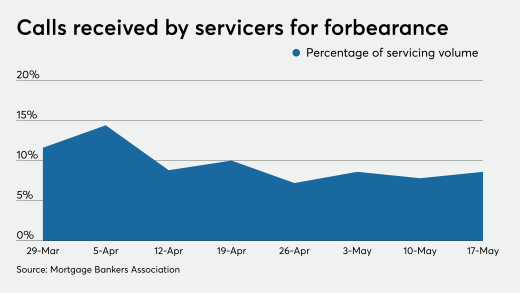

With no way of knowing just how many borrowers will need the mods after the coronavirus forbearance period ends, lenders are deploying artificial intelligence and servicing protocols to tame the ferocious piles of paperwork awaiting them.

Community Bankshares has launched a unit that is originating Small Business Administration 7(a) loans for itself and aims to service them for other small lenders around the country.

The House and Senate will need to resolve a slight difference between their versions of the bill before sending it to President Donald Trump for his signature.

-

Branches won't succeed without significant investment in mobile and in-branch technology; but failing to invest in bankers themselves is just as big a problem.

-

The Federal Reserve's new proposal to lower the cap on debit card fees will drive up the prices consumers pay for other services, while forcing some banks out of the market entirely.

-

An anti-ESG crusade in Texas exposes the degree to which conservative hype over companies' ESG policies has lost touch with the reality of the market, to the detriment of taxpayers.

-

Michael Barr said he believes artificial intelligence will have a positive long-term impact on the economy, though it may cause job losses in the short term.

-

The Federal Reserve Board finalized changes to its supervisory rating framework, allowing large bank holding companies to be considered "well managed," even with one deficient rating.

-

As the emerging form of artificial intelligence impacts payments, pace of payment disputes and the workload will change.

-

The chairman and CEO of First Independence Bank in Detroit is the new chairman of the American Bankers Association. He said his extensive involvement in industry advocacy roles over the past eight years has made him a better leader.

-

The Consumer Financial Protection Bureau is considering a proposal to reduce its oversight of auto finance lenders, saying the benefits of supervision may not justify the "increased compliance burdens."

-

A regulatory filing Wednesday sheds more light on how the megamerger came together. It also details the compensation arrangements for Comerica CEO Curtis Farmer, who will become Fifth Third's vice chair.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

PayPal and other fintechs already offer small business loans based on future payment flows, creating a competitive market.

The administration's haphazard overhaul of financial regulatory bodies has produced confusion and uncertainty. What regulators should be prioritizing now is bringing a sense of stability to the industry.

The 23rd annual ranking of women leaders in the banking industry.