Robert Hartheimer's arrest comes at a time when the bank is trying to recover from a consent order and the Synapse mess.

FIS is forming a network for the inaugural class of its VC Fintech Accelerator program.

-

The Conference of State Bank Supervisors cast doubt on an initiative unveiled by Treasury Under Secretary for Domestic Finance Nellie Liang that would establish a federal regulatory framework for domestic payments, saying that state-level supervision "does not … constitute a regulatory gap."

-

By offering its authentication technology to other issuers, the credit card lender can compete with payment networks and mobile wallets. But it will have to persuade other banks to get on board.

-

The company, which helped consumers strategize their credit card payments and pivoted to a B2B model earlier this year, has sold its intellectual property two months after it folded.

CFPB to scrap key underwriting portion of payday rule; Fiserv-First Data — why small banks fear big fintech; banks, credit unions help federal workers hurt by shutdown; and more from this week's most-read stories.

Months of painful restructuring may be paying off as the Charlottesville, Virginia-based company reported a modest third-quarter profit after more than a year of losses.

In a party-line vote, the committee sent the nomination of Michelle Bowman as the Federal Reserve's vice chair of supervision to the full Senate.

-

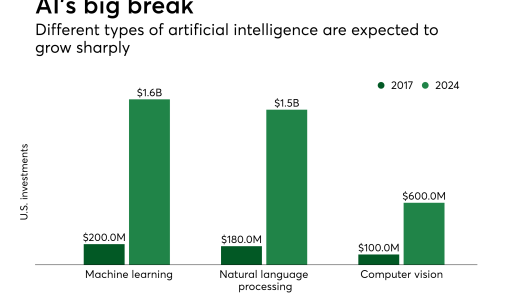

The multiple potential applications of generative artificial intelligence to the financial services industry are a huge opportunity — for the institutions prepared to adapt.

-

Too few lenders are underwriting unsecured consumer debt, which could help borrowers pay down credit card balances with little risk to lenders.

-

The passage of a Congressional Review Act resolution to rescind the Consumer Financial Protection Bureau's small-business data collection rule may be only symbolic, but the rule is designed to detect and stop discrimination — something everyone should support.

-

A failure at an Amazon Web Services data center in Virginia caused widespread outages, hitting services at several banks and fintechs.

-

Spring Bank CEO Barry Mann has accumulated a 6% stake in New York City-based Carver Bancorp. Carver has a history of underperforming, but Mann is optimistic about its chances under new CEO Donald Felix.

-

The number of states with earned wage access legislation doubled in 2025 with six states passing new laws. Connecticut regulators have been particularly strict, creating conflict between lenders and the government.

-

Following the lead of banking regulators, the National Credit Union Administration has proposed a rule that would eliminate references to reputational risk from its examination manuals and would forbid debanking based on political views.

-

The effort to establish rules governing consumers' access to their financial data has been effectively derailed by litigation, moves made by the Trump-era CFPB and JPMorganChase's decision to start charging data aggregators for access to customer data.

-

Strong loan and deposit growth led to a double-digit increase in revenues and an even bigger jump in profits at the Columbus, Ohio-based regional bank.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Mark McDonald is president of

Reza Amin, PhD, is a visionary leader in health technology and the founder of Bastion Health, a groundbreaking digital platform redefining male healthcare through innovative technology. With a career spanning Health Tech and Med Tech, he seamlessly integrates advanced solutions with essential healthcare services, showcasing his deep expertise and entrepreneurial spirit. Amin's work continues to bridge gaps in care, transforming lives and advancing healthcare innovation.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsor Content from Total Expert

-

-

- Partner Insights from Temenos