In addition to swiping exchange business from rival NYSE, Friedman has diversified with compliance software and anti-financial crime offerings for banks and securities firms.

For years, U.S. financial institutions have taken the position that it was riskier to replace legacy core systems than to leave well enough alone. Here's why that's beginning to change.

-

Any approval of the proposed Capital One-Discover merger must come with a pro-competitive 1% interchange fee condition to benefit consumers and small businesses and challenge the dominating duopolist Visa, and a pro-community 5% deposit reinvestment condition.

-

A digital-payment trend that began during the COVID pandemic is being bolstered by features such as rewards and state ID storage.

-

The Federal Reserve scored some important legal victories in lawsuits challenging its discretion to grant or deny applicants for master accounts. But whether those victories will last through the appeals process or scrutiny from Congress is uncertain.

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

Shares in U.S. banks weren't immune to a global market sell-off, as worries mounted over whether the U.S. economy's recent resilience is faltering. The turmoil hit some tech stocks hard and led to the worst day for Japanese stocks since the 1980s.

The Biden-era suit against Zelle's parent company and its largest bank parent owners sought to require banks to reimburse consumers for "induced fraud," when a consumer is tricked into sending money to someone under false pretenses.

-

Properly executed, the new anti-money-laundering program has the potential to cripple laundering networks by altering the landscape for financial services professionals.

-

The Home Loan banks should not be held harmless when they shovel billions of dollars in loans into troubled banks.

-

The idea that consumers and small businesses should be assessing banks' safety and soundness makes no sense today, if it ever did at all.

-

Richard says that managing liquidity and interest rate risk have been a top priority last year and this year for the bank.

-

The head of Santander's stateside operations built a career in banking by finding ways to "yes" to opportunities, even if they didn't seem like "the perfect fit," she said.

-

In a newly created role, Kerrins' mandate is to modernize the bank's platforms and embed AI capabilities across the enterprise.

-

Schoneman takes the long-term view on investing to navigate market volatility.

-

Guild said that the rapid acceleration of AI is creating "new, expansive cybersecurity challenges" for banks.

-

Sen's remit spans domestic and cross-border payments, commercial cards, clearing, and payments acceptance.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

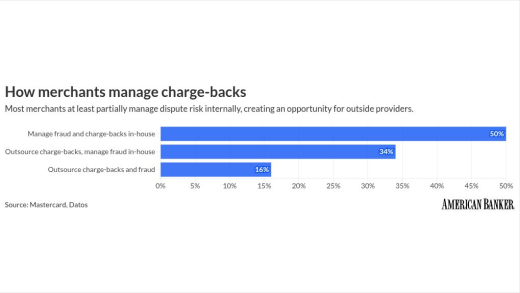

As the emerging form of artificial intelligence impacts payments, pace of payment disputes and the workload will change.

The urgency for financial institutions to develop new systems to detect and prevent sophisticated fraud schemes is growing.

The 23rd annual ranking of women leaders in the banking industry.

-

-

- Sponsor Content from Resonate

- Sponsor Content from Smart Communications