The Toronto-based bank named Rahul Nalgirkar as incoming finance chief. Nalgirkar, who joined BMO in 2022 from Fifth Third, will succeed the retiring Tayfun Tuzun, who came to BMO in 2020 after working at Fifth Third.

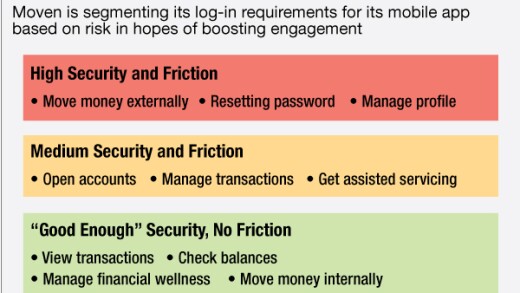

Moven will soon prompt its customers for usernames and passwords only for riskier transactions. By removing the login for most functions, the company aims to drive engagement in an app meant to be used on the go.

-

Fintechs' venture capital funding began to evaporate last year, while payments startups fared somewhat better by emphasizing quicker pathways to profits. It's a trend experts say is likely to persist this year as investors remain more cautious about costly or long-term plays.

-

Longtime executive Raymond Joabar discusses how the card network mixes direct outreach and fintech partnerships to build a global network covering the U.K., the Caribbean and other regions.

-

The technology company will allow outside processors, but plans to charge a commission. Epic Games vows to challenge the move in court.

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

Gone are the days when Wall Street executives dressed in conspicuously expensive clothing. Now the industry has adopted a more relaxed and casual dress code.

Committees in both the House and Senate will hold hearings this week about debanking — a term that means different things to different people.

-

Reports of the death of branch banking have been greatly exaggerated.

-

The middle of a housing market downturn is no time to experiment with untested underwriting tools.

-

The Federal Housing Finance Agency soon will commence a review of the Federal Home Loan Bank System. For the process to be successful, the actual users of the system and the institutions that will be the most impacted by any changes to its mission, mandate or role need to add their voice to the conversation.

-

Origin Bancorp, Renasant Bank and Triumph Financial are the latest financial institutions to report exposure to the bankrupt auto lender Tricolor, joining a list that includes Fifth Third, Barclays and JPMorganChase.

- Yahoo Finance Feed

First internet Bancorp, which has recently been grappling with credit quality issues, has agreed to sell an $869 million portfolio of single tenant commercial real estate loans to Blackstone.

-

A 2024 hospital ransomware breach highlights what Wyden calls Microsoft's systemic failures, urging the FTC to take action.

-

The Ohio bank sees 10% to 15% cost reductions coming from using generative AI in software development, customer service, personalization and other areas.

-

Block's transfer service partnered with fundraising and donor management platform Givebutter for philanthropic payments in an effort to capture even more young consumers' payment volume.

-

The Consumer Financial Protection Bureau told its staff to expect an upcoming reduction in force because the agency's budget was cut in half by the president's recently passed tax and budget bill.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Anchorage Digital Bank, Custodia Bank and Erebor Bank could be among the first recipients of limited, special-purpose payment accounts recently floated by Federal Reserve Gov. Christopher Waller.

How Community Banks Can Win in the Small Business Banking Space

The 23rd annual ranking of women leaders in the banking industry.