The Consumer Financial Protection Bureau will delay its small-business lending data rule by a year, citing litigation and plans to rewrite the regulation in the interim as reasons for the delay.

WASHINGTON Seven financial trade groups announced Monday that they are banding together to push legislation that would extend banklike data security standards to retailers and nonbank businesses.

-

The embedded banking services Amazon offers to third-party sellers come from the hidden hand of JPMorgan Chase's corporate payments arm, which markets its services to e-commerce platforms on a white-label basis.

-

Bolstered by healthy first-quarter global card-spending trends, Mastercard is focusing on opportunities outside the U.S., including a unique card-processing arrangement beginning this month in China.

-

The Bank of England set a date of March 2025 for local banks to establish operational resilience plans, Ant Group is using artificial intelligence to aid shopping, and more.

JCPenney and Dick’s Sporting Goods were among the first to launch the new SyPi plug-in technology, with others expected to come on board soon.

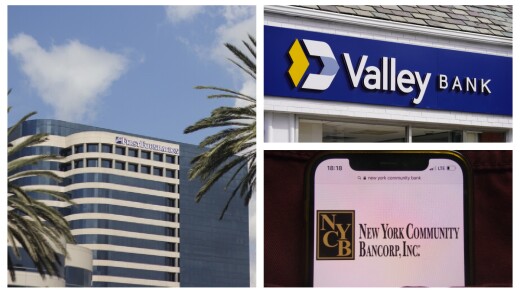

The stock prices of banks that have large exposure to commercial real estate loans surged after comments from Federal Reserve Chair Jerome Powell. His remarks could be a sign that relief is coming on both sides of those banks' balance sheets.

Three Democratic senators joined Republican colleagues to confirm the businessman, who previously voiced his support for easing government regulations.

-

The real-time payments system from the Federal Reserve will spur an increase in payments innovations and drive prices lower for existing products.

-

There are existing ways to authenticate third-party permissioned data access that don't involve screen-scraping or expensive token-based systems.

-

At best, artificial intelligence will be a tool that helps good bankers be better at their jobs. It won't replace them.

-

BayFirst Financial in St. Petersburg shuttered a national small-dollar 7(a) loan program in August. Now the $2.4 billion institution, which has been one of the nation's most active SBA lenders over the past decade, is making a clean break from the business.

-

A bipartisan bill offered Monday by Senate Banking Committee member Katie Britt, R-Ala., and Andy Kim, D-N.J., would force the Securities and Exchange Commission to update a 25-year-old threshold that holds small financial firms to higher regulatory standards.

-

The Treasury Department's Financial Crimes Enforcement Network is seeking public comment on a survey of anti-money-laundering compliance costs from a variety of nonbanks, including casinos, insurers, lenders and other nonbanks, a possible precursor to deregulatory proposals down the road.

-

Vis Raghavan's arrival last year has energized Citigroup's investment banking division, pushing his team to relentlessly pursue deals while cutting underperformers to make way for marquee hires.

-

After a slump of several years, there's been a renewal of payment and financial tech firms going public.

-

Senate Banking Committee ranking member Elizabeth Warren, D-Mass., led a group of congressional Democrats in a letter to bank regulators telling them that loosening capital rules wouldn't improve the Treasury market's functioning.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Federal Reserve Board Gov. Stephen Miran said the growth of stablecoins and cryptocurrencies will likely impact monetary policy and could lead to lower interest rates.

Existing law already provides the tools that would allow an across-the-board upgrade in digital identity verification, with benefits to banks and consumers alike. Regulators are the roadblock.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsor Content from Qlik

-

- Sponsor Content from iProov

- Sponsor Content from Early Warning®