This corporate "lifer" is building a rich legacy that's going to be hard to beat, but she's committed to helping others follow her playbook.

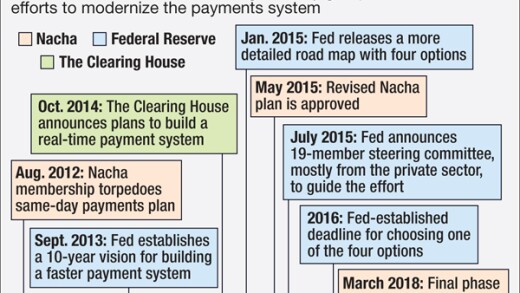

A task force convened by the Federal Reserve has made substantial progress in its first few months, but the path to real-time payment in the U.S. is still littered with challenges.

-

Zelle owner Early Warning Services has completed a test of its digital wallet, which it sees as a tool to streamline payments and combat the rising tide of fraud schemes, including those driven by generative AI.

-

Real-time payments and a potential central bank digital currency are different initiatives, but many bank customers get them mixed up. To promote acceptance of FedNow, banks must distinguish between these new technologies as well as dispel the myths and fears linked to CBDCs.

-

How the next generation of payments technology is being developed in fields such as public transit, sports and long-haul trucking.

Federal Reserve Vice Chair Philip Jefferson said in a speech Friday that long-term productivity gains brought on by artificial intelligence could compel the central bank to maintain higher rates to keep prices stable.

The first-quarter increase involved commercial real estate loans, including some problematic multifamily loans and an office credit, but none of the criticized loans were to consumers, officials at the Dallas company say. Further CRE deterioration is anticipated.

The chairman of the financial institutions panel of the House Financial Services Committee said his newly reintroduced bill has a considerable chance of passing with Republicans in control of both chambers of Congress and the White House.

-

Because lending to the fossil fuel industry is risky, unbiased rules are needed to ensure financial institutions properly manage these concerns.

-

Regulators must be cognizant of any threat that could harm the financial sector while resisting the urge to overstep their authority to set policy that should be decided by Congress.

-

Proactively checking in on your customers lets them know who is on their side.

-

Fintechs are rolling out business financing tools that are packaged as buy now/pay later and earned wage access in the hopes of capturing momentum from the budding consumer finance industries.

-

Both Fannie Mae and Freddie Mac made similar changes to their policy when it comes to disclosures and retention rules for an appeal of a valuation.

-

Organizers of the planned Portrait Bank say they're well ahead of initial capital-raising goals as they near completion on leasing a property to serve as headquarters

-

The payment company is incenting users to adopt Perplexity's Comet Browser, automating subscription management and shopping as card networks and other payment companies ramp up use of generative artificial intelligence.

-

The wireless service plans join a variety of banking and payment products offered by OnePay, a fintech company backed by the big-box retailer Walmart.

-

Credit Union of Colorado is using Scienaptic AI to make about 60% of consumer loan decisions.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Farmers National Banc Corp. in Ohio plans to acquire in-state rival Middlefield Banc Corp. in a deal that will deepen the buyer's footprint in Columbus.

Leading a regulated entity during the best of times is complicated. But adapting your leadership strategy when you face a confluence of factors—

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsored by S&P Global

- Sponsored by S&P Global

- Partner Insights from Copado