President Trump in Davos, Switzerland, talked about his call for lower credit card interest rates and more affordable housing in a lengthy speech that mostly focused on his plan to take over Greenland.

-

The payments fintech recently introduced AI agents to its lineup of products banks and credit unions can pick from and add to their existing technology stacks.

-

The payments company is expanding the transfer app in an effort to entice more consumers to use the service as their primary banking relationship

-

ICBA argues Bridge's stablecoin model pushes the trust charter beyond its intended fiduciary scope.

First-party fraud — customers claiming they never made a transaction when they know full well they did — is a growing problem for banks. An emerging host of vendors including Socure are offering machine learning models that detect this.

The Missouri-based community bank secured the top spot on American Banker's 2025 Best Banks to Work For list. Its mission and business strategy is all about love, executives say.

The payments company submitted applications to the Utah Department of Financial Institutions and the Federal Deposit Insurance Corp. to create PayPal Bank. If approved, Mara McNeill, the former president and CEO of Toyota Financial Savings Bank, will serve as PayPal Bank's president.

-

The arguments banking trade groups are raising against granting charters to digital asset firms are the same scare tactics they used against money market funds, online brokers and fintech lenders.

-

As state-level regulators rush in to fill the gap left by a shrinking Consumer Financial Protection Bureau, bank products will have to comply with dozens of potentially conflicting state requirements.

-

Rent-seeking banks looking to profit from their monopoly on access to customer data can't be allowed to stymie the development of open banking in the U.S.

-

Merchant groups are not taking a position on President Donald Trump's threats to cap interest rates, but they are bullish on the president's endorsement of the Credit Card Competition Act.

-

Federal Reserve Vice Chair for Supervision Michelle Bowman warned that labor market conditions could weaken further and said the central bank should avoid signaling a pause in monetary policy.

-

Community Financial in Syracuse has agreed to purchase a small bank that's built its business model around end-of-life planning.

-

Bilt's new card caps interest rates at 10% for one year and Affirm is adding BNPL for rent as analysts predict the political environment will benefit fintechs.

-

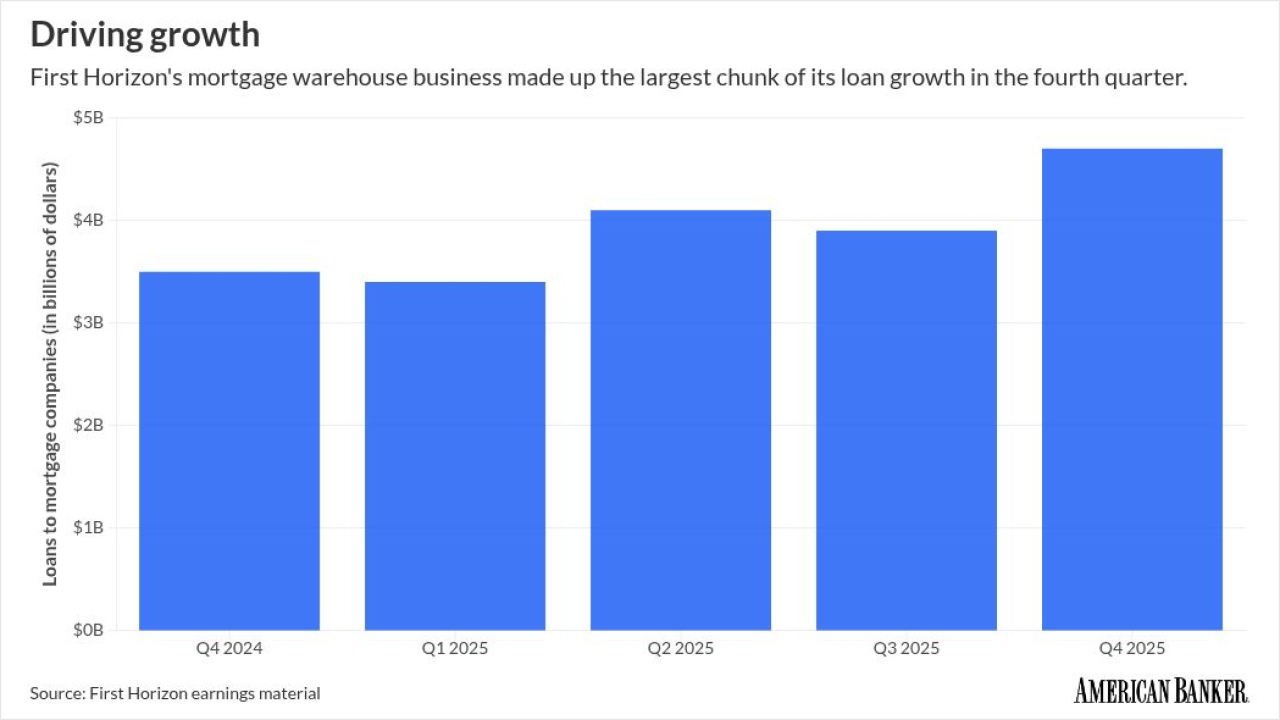

First Horizon's loans to mortgage companies in the fourth quarter rose at the fastest clip in more than two years, as the housing market showed small signs of revival.

-

The fintech investment firm Portage is now managing a $280 million portfolio acquired from the venture arm of Mets owner Steven Cohen's firm Point72.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

CEO Gunjan Kedia joined nearly 70 chief executives of Minnesota-based companies in calling for "an immediate de-escalation of tensions" in Minneapolis, where a second resident was fatally shot by federal immigration agents on Saturday.

Brent McIntosh is Citi's chief legal officer and corporate secretary. Brent leads Citi's Global Legal Affairs & Compliance organization, which includes the Legal Department, Independent Compliance Risk Management, Citi Security and Investigative Services and Citi's Regulatory Strategy and Policy function. He is a member of Citi's Executive Management Team.

Brent served as under secretary of the Treasury for international affairs from 2019 to 2021. From 2017 to 2019, Brent served as Treasury's general counsel. Prior to that, he was a partner in the law firm of Sullivan & Cromwell.

Brent served in the White House from 2006 until 2009, first as associate counsel to the president and then as deputy assistant to the president and deputy staff secretary. Before that, he was a deputy assistant attorney general at the Justice Department.

The 23rd annual ranking of women leaders in the banking industry.