The New York megabank, which completed the sale of a 25% equity stake in its Mexico retail business, has been exiting certain international markets as part of CEO Jane Fraser's focus on being a simpler, smaller bank.

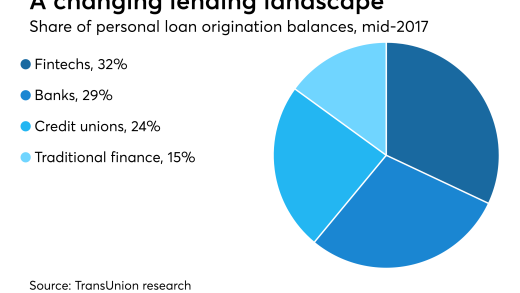

The pioneering brand re-enters a market where fintechs now account for over 30% of personal loan originations.

-

Comerica and U.S. Bank are applying new tools that attempt to take the worry out of real-time transactions made on behalf of third parties. Comerica payments exec Allysun Fleming spoke about the bank's plans.

-

The volunteer firefighting crew in Kerr County was the target of impersonation scams on the digital payments platform for donations to relief efforts.

-

Research from Cornell University suggests that people assign different levels of social status to others depending on how they choose to pay for goods and services.

The New York megabank is working to deploy artificial intelligence as it seeks to make its own operations more efficient. Solomon also sees an "unprecedented" opportunity in financing clients' needs as they invest in AI.

Dime Community Bancshares, which has added dozens of bankers over the past two years, is now ready to consider expanding its geography.

Acting CFPB Director Russ Vought has managed to neuter the Consumer Financial Protection Bureau through a series of actions. Senate Banking Committee Chairman Tim Scott, R-S.C., played a major role by cutting funding in half.

-

Since the pandemic, financial scams have surged dramatically. The solutions to rampant fraud are clear; what's missing is the urgency.

-

To effectively reduce fraud, banks must transition to proactive, integrated strategies encompassing robust risk management and asset liability management.

-

Women in the payments industry are using the advent of real-time payment networks to help underserved women around the world gain access to vital financial services.

-

Rohit Chopra is named senior advisor to the Democratic Attorneys General Association's working group on consumer protection and affordability; Flagstar Bank adds additional wealth-planning capabilities to its private banking division; Chime promotes three members of its executive leadership team; and more in this week's banking news roundup.

-

The Office of the Comptroller of the Currency Friday approved national trust charter applications for five crypto firms, affirming the administration's push to allow crypto companies the ability to take deposits.

-

Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee said in statements Friday that their dissents from this week's interest rate decision were spurred by inflation concerns and a lack of sufficient economic data.

-

As shoppers embrace new forms of AI, crypto and alternative financing, payment experts say financial institutions will need to reassess traditional payment products.

-

Leading Democrats on the Senate Banking Committee sent a letter to Chair Tim Scott, R-S.C., pointing out the as-yet unsatisfied legal requirement for prudential regulators to appear in Congress semiannually.

-

Treasury Secretary Bessent said FSOC is readjusting its approach to avoid stifling growth in moves with implications for capital, technology and mortgages.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

As the Senate Banking Committee stands poised to mark up crypto market legislation within days, banks are focused on blocking crypto exchanges from offering rewards on stablecoins, which they fear could siphon deposits away from community banks.

First Federal Bank stretched its retail mortgage operations into Louisiana and Mississippi, following its expansion into the Midwest and Arizona in 2023.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsored by S&P Global

- Sponsored by S&P Global

-

- Sponsor Content From Refine Intelligence