Challenger bank OakNorth plans to kick its marketing into higher gear. Its desired endgame in the U.S. is a banking charter and it's open to an acquisition to help get it there.

Some traditional bankers are unsettled by the wave of crypto and fintech banks getting bank charters. This Nashville bank CEO sees opportunity.

-

On Sep. 30, 2019. Dollars in thousands.

-

Banks, especially smaller ones, are more worried about the competitive inroads that Apple Pay, Venmo and others have made than they are about tech companies' incursions into other financial segments, according to a new survey by Promontory Interfinancial Network.

-

The Exton, Pa.-based credit union grew its commercial real estate and credit card lending in 2019 from a year earlier.

CEO Max Levchin said the lender is testing technology that allows merchants to perform more advanced testing of promotional financing offers.

It includes simpler Paycheck Protection Program forgiveness and a consistent approach from federal regulators to reforming the Community Reinvestment Act, says Bank of America's Christine Channels, who chairs the Consumer Bankers Association's board.

The Biden administration's decision to bar oil and gas imports from Russia could increase domestic production and energy lending yet impede overall growth and demand for credit.

-

This trend will continue until banks have addressed key vulnerabilities, according to John Gunn and David Vergara of VASCO Data Security.

-

In the wake of President Trump’s tax cut, banks would be wise to take the time to explore investment opportunities before returning increased profits to shareholders.

-

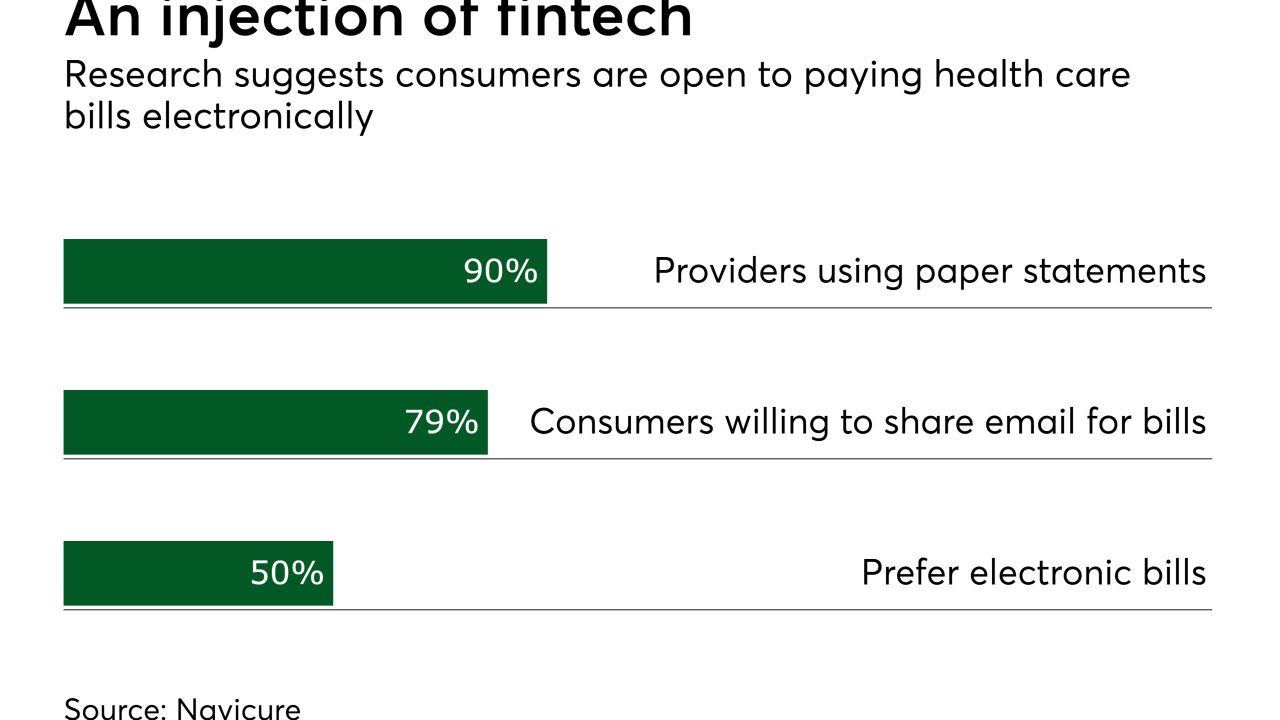

The fintech revolution is now touching almost every market in the payments space. Some are still further ahead than others, so expect 2018 to be a year of consolidation in more mature sectors, but one of rapid change in those with some catching up to do, writes David Yohe, vice president of marketing at BillingTree.

-

The buy now/pay later company beat analysts' expectations on revenue, net income and earnings per share as it issued new guidance for the end of its next fiscal year. Its stock was up as much as 31%.

-

Canadian Imperial Bank of Commerce and Royal Bank of Canada both set aside much less money than expected last quarter to cover loan losses.

-

Tech companies and banks are trying to shrink the carbon footprints of the large language models they create, host and deploy. Can they move fast enough?

-

Bridgewater Bancshares agreed to acquire First Minnetonka Bancorp. in an all-cash transaction slated to close in the fourth quarter. It would create a nearly $5 billion-asset bank.

-

Payment experts say keeping customers happy is the key to maintaining partnerships Here's what J.D. Power has to say about user satisfaction.

-

The indictment of Telegram's CEO has added scrutiny to the ways in which messaging apps are facilitating check fraud — and what banks can do to stop them.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsored by S&P Global

- Sponsored by S&P Global

- Partner Insights from Copado