-

The Florida company, which hit an aggressive profit goal last year, is planning its first investor day later this month to outline longer-term goals.

February 13 -

Now that the holiday sales rush is over, merchants are starting to look more closely at game-changing sales models like Amazon Go as models to reinvent their own point of sale.

February 8 -

In time, more large institutions will realize that closed, centralized blockchains aren’t any better than the databases now in use.

January 31 Equibit Development Corp.

Equibit Development Corp. -

From frictionless payments to improved underwriting models, connected cars will rewrite the rules for how and where banks interact with their customers.

January 29 -

Connected cars are going to create new revenue streams, not just for automakers, but also for financial services providers.

January 29

-

Atlanta-based software provider Oversight Systems is working with Mastercard on a solution to help federal agencies ensure U.S. government spending on purchasing cards and other expenses are in compliance with policies.

January 27 -

Banks want and need to rival tech giants in their use of customer analytics. Some think artificial intelligence is the key to making it happen.

January 26 -

Artificial intelligence is moving from science fiction to practical reality fast, and it's in banks' best interest to gear up now for the changes ahead. Here are some strategies to consider.

January 8 -

State Street Corp. has named John Plansky as the new head of its Global Exchange data and analytics unit.

January 6 -

The jobs of chief investment officer departments and financial advisers are likely to change as banks and stand-alone wealth managers adopt artificial intelligence to inform the advice they give clients.

January 5 -

By using some of the sales and performance analysis associated with e-commerce, Revel says the inherent advantage that stores have in connecting with consumers can be enhanced for the next generation of retail competition.

January 4 -

The phony-accounts scandal at Wells Fargo illustrates how sales quotas can incent bad behavior. Is your bank effectively mitigating the risk of 'managing to metrics'? Or could it be in danger of becoming a 'cargo cult'?

January 2 -

Even in a digital era, human connections still matter. That is one big disadvantage for fintech startups and increasingly for banks as customers stop making regular branch visits. So it is instructive to hear SoFi's thinking on how to overcome this challenge. It is trying some unorthodox tactics to better understand the people behind the data and to create meaningful connections with them.

January 2

-

The time banks have to investigate red-flagged credit payments has shrunk from several days to a few hours and fraudsters have already taken notice.

December 29 -

Banks have used biometrics for about a decade, but there are a number of hurdles that banks, device makers and customers need to overcome before passwords are history.

December 27 -

With identity management now established as a distinct industry, it needs an organization to nurture its practitioners like those that exist for the privacy and security sectors.

December 21 Kantara Initiative

Kantara Initiative -

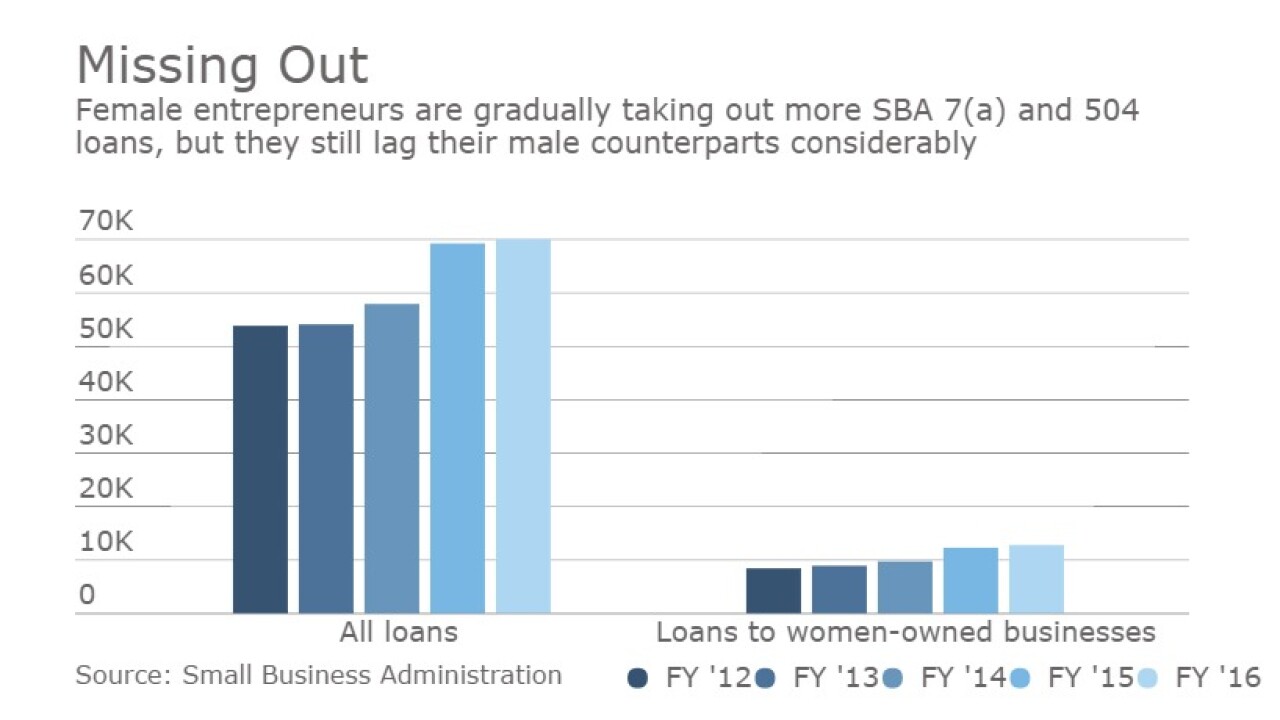

Female entrepreneurs who apply for loans online and are evaluated by an automated system get a bigger share of online credits than they do traditional in-person bank loans. It could be a sign that automated credit decisions are fairer.

December 20 -

The appeal of information pathways such as the internet were seen as possibly bringing about a "comeback" for artificial intelligence in financial services in the 1990s.

December 19

-

Banks should embrace artificial intelligence so that they can more easily navigate policy shifts that will affect their compliance resources and processes.

December 14 The Rudin Group

The Rudin Group -

The core-tech vendor Fiserv has agreed to buy Online Banking Solutions in Atlanta.

December 12