-

The Department of Financial Services and Attorney General Eric Schneiderman are both inquiring.

August 2 -

Wells Fargo & Co. customers accused the bank in a lawsuit of forcing them to pay for unnecessary auto insurance that drove some of them so far into a financial spiral that their vehicles were repossessed.

July 31 -

The bank forced hundreds of thousands of auto loan borrowers to take out insurance they didn't need, putting some into delinquency; a Russian man is arrested and charged in $4 billion money laundering scheme.

July 28 -

Wells Fargo's campaign to rebuild customer and shareholder trust just hit another bump, as the bank said it may have pushed thousands of car buyers into loan defaults and repossessions by charging them for unwanted insurance.

July 28 -

Valley National's latest acquisition would make it a much bigger player in Florida and provide a platform to write more auto loans. Both markets present attractive returns but high risks.

July 27 -

The Detroit company is capitalizing on other banks' retreat from the auto sector.

July 27 -

TCF executives were peppered with questions about the quality of $345 million in auto loans recategorized as held for investment in the second quarter, as a result of the company’s recent move away from loan sales and securitizations.

July 24 -

Double-digit growth in loan volume offset a decline in fee income at the Honolulu company.

July 24 -

Net interest income rose 7% and margins widened 17 basis points at the Wayzata, Minn., company.

July 24 -

Auto risks mounting. Mortgage market tightening. Are there any good risks these days in consumer lending? Regional bank executives insist partnerships with online lenders, unsecured personal loans and other niche efforts can work if done properly.

July 21 -

The McLean, Va., lender, which has substantial exposure to subprime consumer loans, also added to its provision for credit losses.

July 20 -

LendKey, whose software helps financial institutions make student, auto and home improvement loans, closed a Series C round led by a fund whose investors include more than a dozen banks.

July 20 -

Declines in commercial products and mortgage banking fees at the Minneapolis company offset some of the benefits of higher interest rates.

July 19 -

Wells Fargo's new car loans dropped by almost half in the second quarter, while its automotive portfolio fell to the lowest level in two years after the San Francisco-based company tightened underwriting standards.

July 14 -

Banco Santander plans to go ahead with a proposal to increase control of its U.S. subprime auto loan unit, after the business passed the Fed's stress test last month, according to people familiar with the matter.

July 10 -

AutoGravity of Irvine, Calif., has received $30 million in equity financing from VW Credit, according to a source familiar with the matter.

July 6 -

A new report from the American Bankers Association reinforces existing concerns about the ability of U.S. consumers to manage all of their debts.

July 6 -

Millennials already comprise a growing part of the auto market, and they'll gain significant ground by the end of the decade. Is your credit union prepared?

June 22 EFG Companies

EFG Companies -

James Clinger is currently general counsel to the House finance panel; CFPB director refutes House panel claims he didn’t do his job in Wells Fargo investigation.

June 19 -

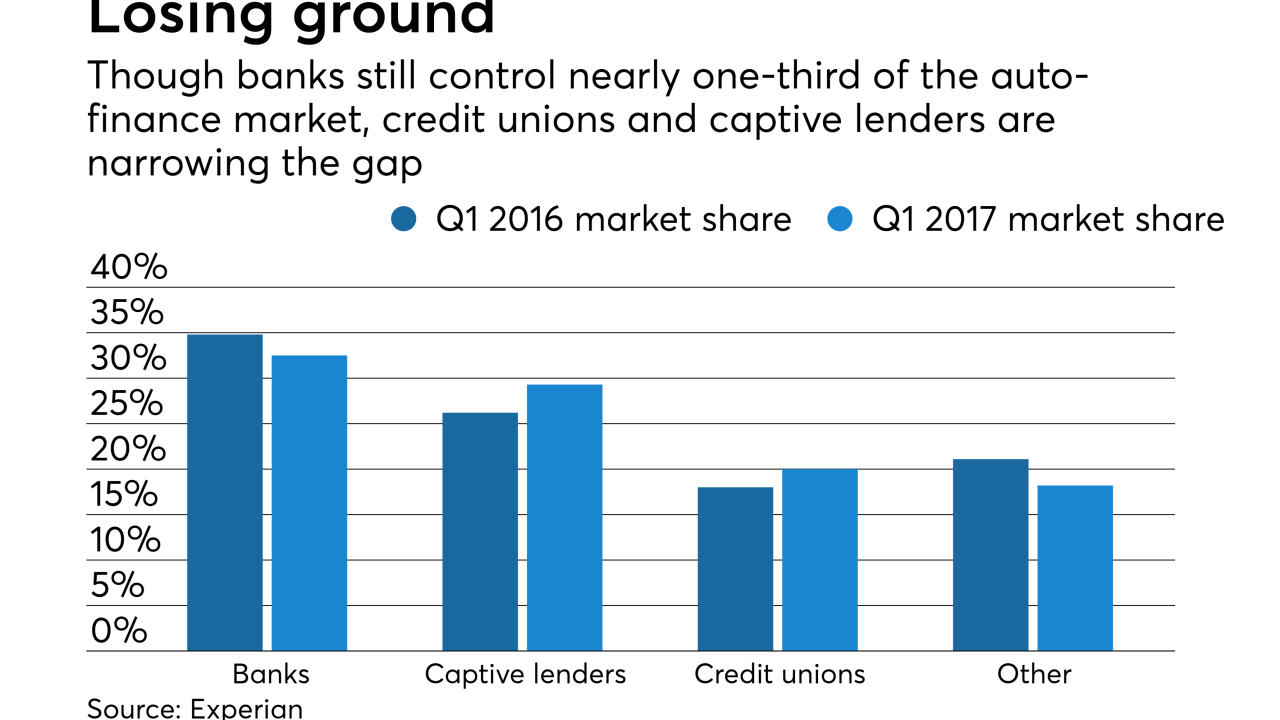

Large banks have scaled back lending as competition has intensified and credit unions and financing arms of car manufacturers are picking up the slack.

June 8