The 50 companies that made American Banker's annual list share insights into what makes their workplace culture enticing for potential new hires and current staff members.

The fintech topped American Banker's annual list this year. CEO Dave Buerger attributed the company's hands-off management style as one reason that draws in and keeps workers around.

Forty companies made the 2024 edition of American Banker's annual list of enviable workplace cultures in the financial technology space. Here is a look at some of what makes these firms employers of choice.

The core banking provider was No. 1 on American Banker's ranking of the Best Places to Work in Fintech this year. The company attributes this success to encouraging employees to hash out solutions to challenges.

The company has changed the dynamics of its meetings, created diversity metrics and deployed software to make job descriptions gender-neutral.

The company, which provides workplace investing programs to banks, is giving employees a say in some decisions and working with partners to recruit women and people of color.

The Texas fintech embraces a progressive culture and has taken steps during the pandemic to maintain a spirited vibe even as employees work remotely.

Top executives from the 49 companies that earned a spot in this year's ranking of the Best Fintechs to Work For cite the need for nimble shifts in business strategy, leadership style and recruiting tactics among the lessons they took away from the challenges of the coronavirus crisis.

Small, often intangible quality-of-life perks are a big part of what makes some fintechs the best ones to work for.

The Utah fintech encourages a playful attitude by devoting the first floor of its offices to entertainment and comfort with video games, Ping- Pong, a pool table and a lounge area.

Without its funhouse office, annual trips or volunteering events, the executive found ways to engage his staff virtually.

-

Onboarding technology isn't enough if the account opening process is too cumbersome, a J.D. Power survey finds.

May 4 -

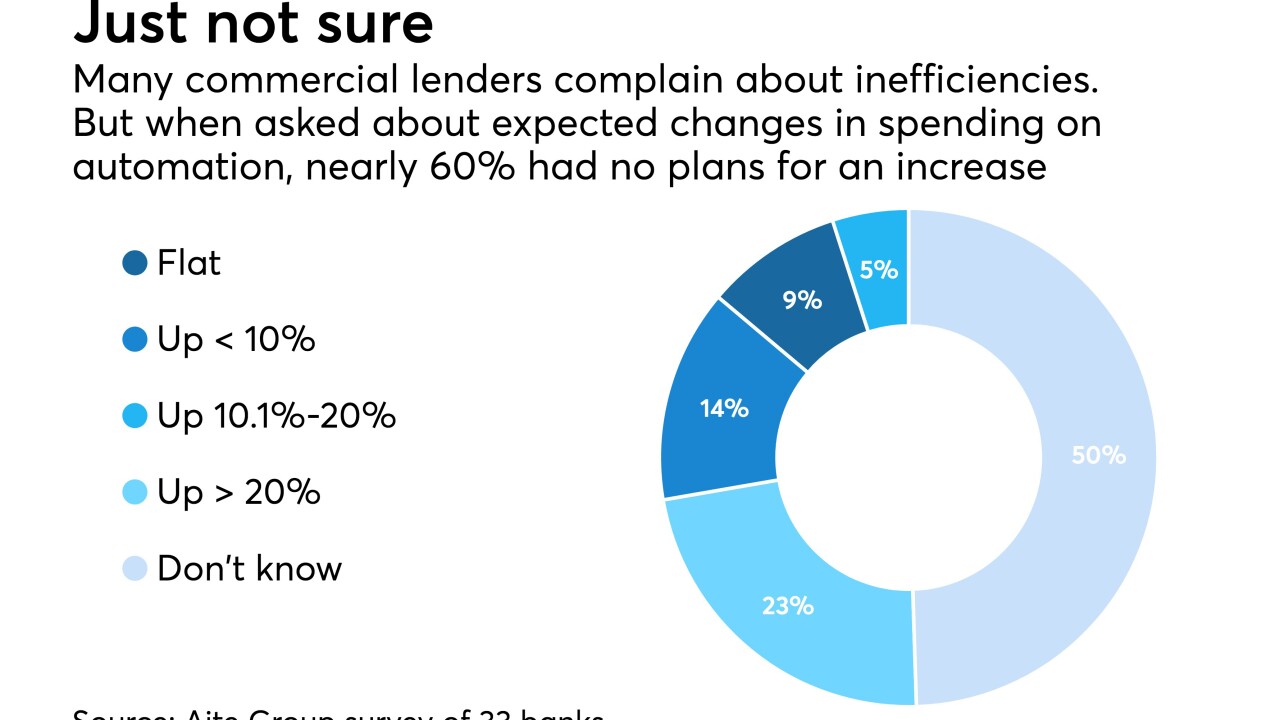

A bank that can deliver a loan decision a little faster, or ask a client to input information just once, could get a leg up on the competition. But some executives are skeptical of software sales pitches and fear overpaying.

May 3 -

Leader Bank says it can land property managers as commercial clients by helping them handle tenant deposits — and possibly create opportunities to boost CRE lending.

May 3 -

Although there's often a tension between regulation and innovation, the sandbox concept can help startups, regulators and incumbent banks better navigate experimental financial technologies.

May 3 FinTech Forge

FinTech Forge -

The fintech wants to facilitate loans for elective surgeries, auto repairs and jewelry purchases, but regulatory uncertainty — at the state and federal levels — casts a cloud over its business model.

May 2 -

The Michigan bank hopes conversational technology can get customers to talk more freely about their financial health.

May 1 -

Judge Dabney Friedrich ruled that the case could not proceed because the OCC has not actually granted the fintech charter to any firm.

May 1