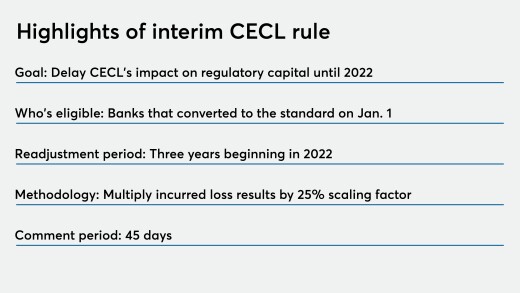

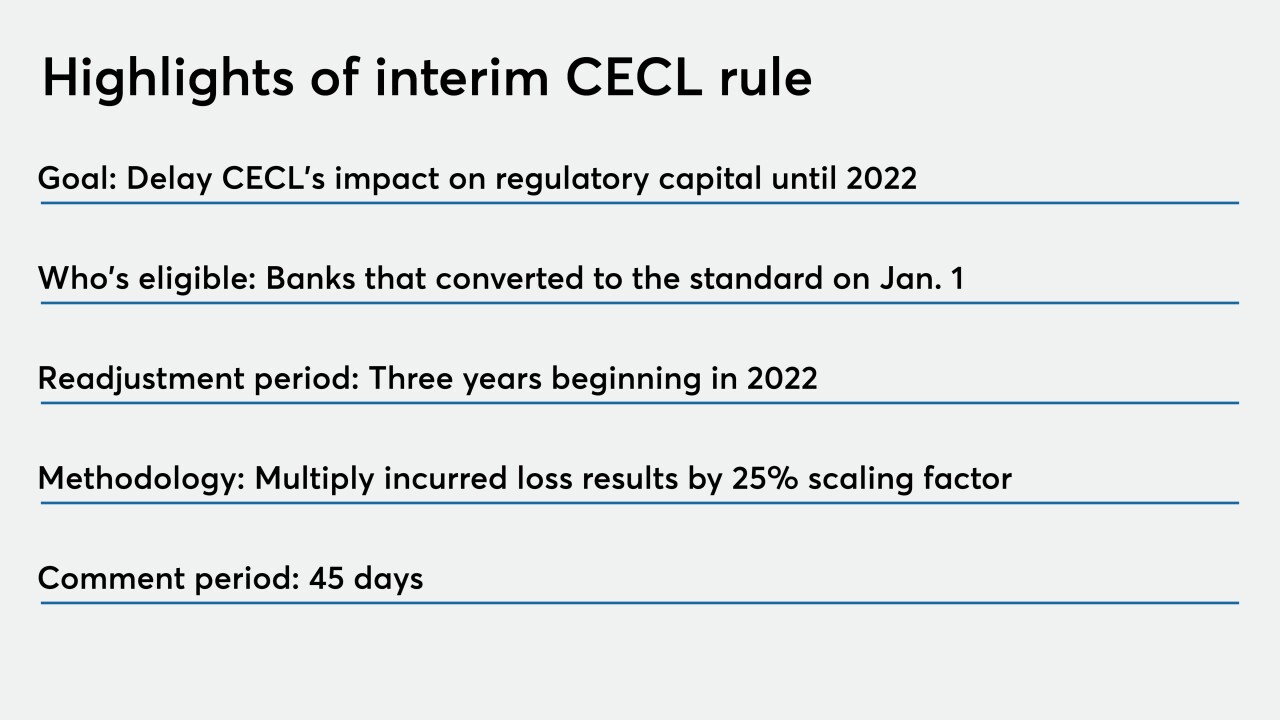

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

What banks need to know about the coronavirus stimulus package; tech vendor Finastra hit with ransomware attack; bank CIOs confront challenge of so many employees working at home; and more from this week's most-read stories.

Many argue the economic turmoil from the pandemic makes the Comprehensive Capital Analysis and Review irrelevant this year, while others say testing banks’ capital strength is crucial now more than ever.

In contrast, grocery stores and pharmacies saw a jump in spending during the coronavrius outbreak, according to credit union member data examined by the CUSO.

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

CEO Brian Moynihan also said in an interview that the bank is helping clients affected by the coronavirus pandemic through increased commercial lending to companies and expanded forbearance for Main Street customers.

The coronavirus pandemic has forced foreign exchange money agent Travelex to close all of its U.K. offices for the next eight weeks.

The U.S. government will shortly funnel trillions of dollars into the economy to soften the coronavirus’ impact on a variety of industries and small businesses. Payment companies that are also lenders will soon find out if it’s enough to save the market.

-

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

March 27 -

What banks need to know about the coronavirus stimulus package; tech vendor Finastra hit with ransomware attack; bank CIOs confront challenge of so many employees working at home; and more from this week's most-read stories.

March 27 -

Many argue the economic turmoil from the pandemic makes the Comprehensive Capital Analysis and Review irrelevant this year, while others say testing banks’ capital strength is crucial now more than ever.

March 27 -

In contrast, grocery stores and pharmacies saw a jump in spending during the coronavrius outbreak, according to credit union member data examined by the CUSO.

March 27 -

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

March 27 -

CEO Brian Moynihan also said in an interview that the bank is helping clients affected by the coronavirus pandemic through increased commercial lending to companies and expanded forbearance for Main Street customers.

March 27 -

The coronavirus pandemic has forced foreign exchange money agent Travelex to close all of its U.K. offices for the next eight weeks.

March 27