-

Wells Fargo CEO Tim Sloan has told employees that a third-party review of unauthorized accounts will be published “within a few weeks.”

August 23 -

All critical data to run the CUSO's business operations in the event of a disaster will also be backed up to a location 900 miles away from the firm's offices.

August 23 -

Bryn Mawr Bank has launched a mutual fund at a time when heightened competition and regulatory oversight are the norm.

August 22 -

Arvest agreed to pay nearly $400 million in cash for a bank with 42 branches in Arkansas, Missouri and Oklahoma.

August 22 -

The $1.5 billion-asset company agreed to buy Southern Missouri Bancshares to expand into two strategically important markets.

August 21 -

The company says the tracking devices are a way to reduce office space and know when shared workstations are free, but "hot-desking" also raises questions about whether employees are being spied on.

August 18 -

Monday’s eclipse is an astronomer’s dream, but CUs’ responses range from trying to make hay while the sun isn’t shining to preparing for potential disaster.

August 18 -

Lynn Harton was finally named CEO of United Community Bank after a five-year apprenticeship, though Jimmy Tallent remains CEO of the parent company. The executives have long touted an ability to bounce ideas off each other as a reason for United's success.

August 17 -

Baxter CU, Randolph-Brooks FCU and Coastal CU have already signed on with the service, which aims to create analytics strategies to help credit unions grow and improve service.

August 17 -

The exodus of chief executives from two of President Trump’s business advisory councils in the aftermath of the Charlottesville tragedy was a highly visible example of risk management and cultural principles in action.

August 17

-

Approval from the Federal Reserve is the last remaining hurdle for the $2.2 billion transaction.

August 16 -

In addition to typical industry challenges, family-owned banks also have to address generational leadership and estate planning at a time when an increasing number of their CEOs are looking to retire.

August 16 -

One untapped resource is appealing to investors to allocate more of their private wealth to companies with successful gender diversity programs.

August 16 The Rudin Group

The Rudin Group -

Duke, currently vice chairman, was rumored to be a likely contender for the chairman spot last week.

August 15 -

JPMorgan Chase Chief Executive Jamie Dimon joined U.S. corporate leaders in denouncing racial intolerance as the pressure heats up on them to challenge President Trump on social and other policy matters. However, Dimon remains on a key presidential advisory group.

August 15 -

The Florida company will pay nearly $600 million to buy HCBF Holding and Sunshine Bancorp.

August 14 -

Chairman Stephen Sanger could step down ahead of the embattled bank's next annual meeting, according to a news report, clearing the way for the elevation of Duke, the current vice chairman and a former Fed governor and banking executive.

August 10 -

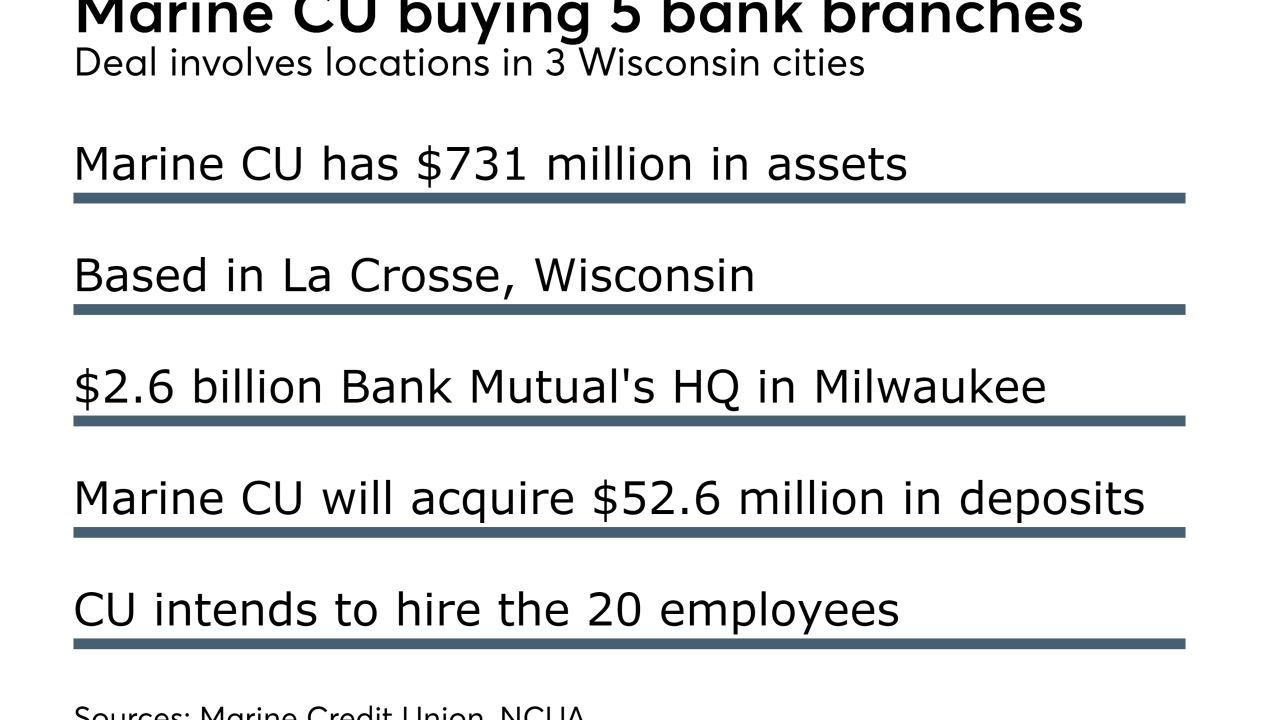

Wisconsin-based CU will acquire five Bank Mutual branches in three cities on August 25.

August 10 -

Clearer criteria of what the Federal Reserve expects from directors will improve board oversight of banks, while also cutting down on misplaced demands on boards’ time and attention.

August 10 Promontory Financial Group

Promontory Financial Group -

Triumph Bancorp in Dallas has successfully taken chances on out-of-state acquisitions, factoring and other nontraditional strategies that many of its peers have avoided.

August 9