-

Longtime CEO John Radebaugh will retire July 1, at which time EVP/COO Dan Schline will take the helm.

February 16 -

The South Carolina company also provided a timeline for heightened regulation tied to crossing the $10 billion asset threshold.

January 23 -

The company agreed to pay $18 million for Atlantic Bancshares in a deal that will increase its operations along South Carolina's coast.

December 13 -

John Kimberly, who was CEO of a bank that CAB bought in 2014, is set to take the helm on Jan. 1.

December 12 -

First Reliance in South Carolina, which recently announced its first bank acquisition, is angling to take advantage of disruption caused by bigger mergers in the Carolinas.

October 19 -

The company, which agreed to buy Independence Bancshares, also brought in $25 million by selling common and preferred stock.

September 26 -

Monday’s eclipse is an astronomer’s dream, but CUs’ responses range from trying to make hay while the sun isn’t shining to preparing for potential disaster.

August 18 -

Lynn Harton was finally named CEO of United Community Bank after a five-year apprenticeship, though Jimmy Tallent remains CEO of the parent company. The executives have long touted an ability to bounce ideas off each other as a reason for United's success.

August 17 -

The credit union’s new name and imagery are intended to represent financial empowerment for consumers.

June 27 -

Beacon Community Bank seeks to become the first new bank in South Carolina in roughly a decade.

June 19 -

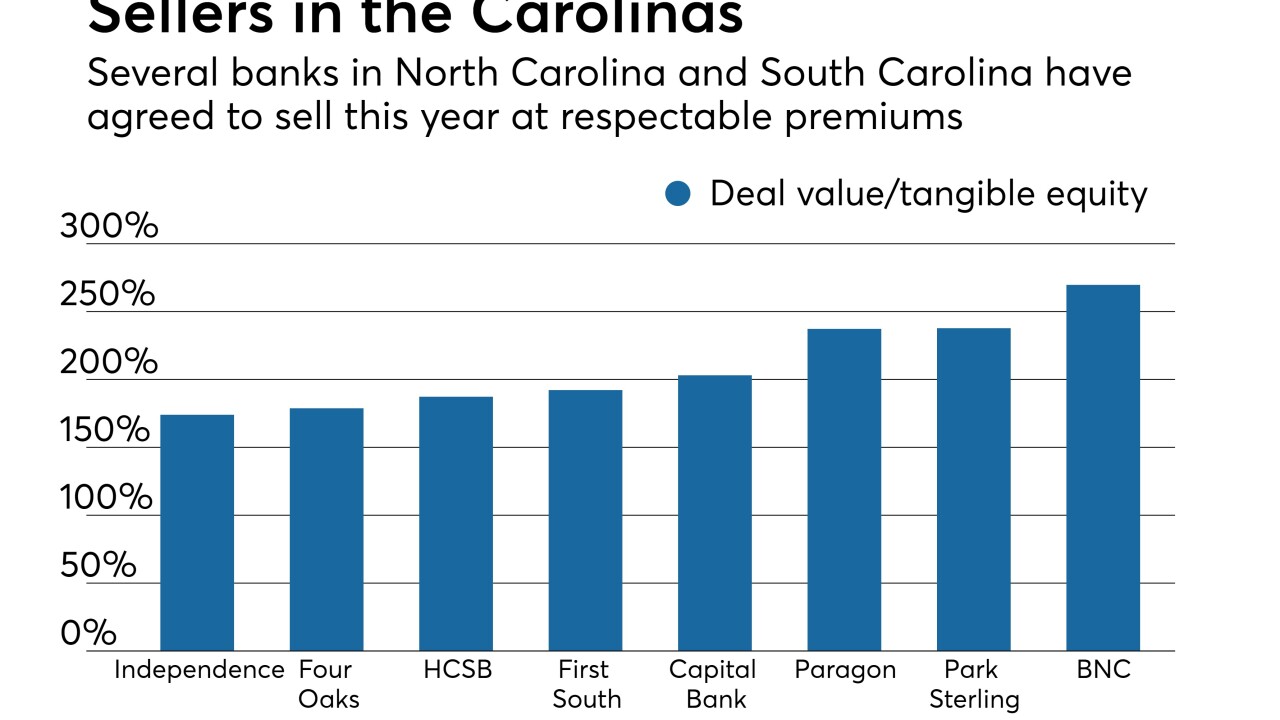

The company agreed to pay $162 million to buy First South Bancorp in Washington, N.C. It is the fifth time this year that a bank in North Carolina has agreed to be sold to a buyer from another state.

June 12 -

Beacon Community Bank aims to become the first bank to open in Charleston, S.C., in a decade.

June 8 -

The Palmetto State joins Alabama, Florida, Texas and other states to provide greater interstate branching access to members.

June 8 -

GrandSouth Bancorp's issues with floor-plan loans to car dealers serve as a reminder of another pitfall in auto lending besides consumer loans.

May 31 -

His decades-long career in credit unions spans three different state leagues and was proceeded by 21 years of military service.

May 24 -

The Georgia company invested in HCSB Financial's recapitalization a year before agreeing to buy the coastal South Carolina bank. Doing so allowed United to stay to close to HCSB and its board, which helped when the time came to discuss a deal.

April 25 -

The deal is the latest coastal acquisition for United Community. For HCSB, the sale is the final chapter in a turnaround that began 13 months earlier.

April 20 -

The deal, which is expected to close in the fourth quarter, values Cornerstone at $25.8 million.

April 12 -

The founders of the South Carolina bank, which liquidated after lavish spending and losses depleted its capital, paid a total of $55,000 in fines and face restrictions on future employment.

February 24 -

While most ads for the big game are shrouded in secrecy, the credit union unveiled three spots and asked the public to choose which one should run Sunday.

February 3