-

Ocwen Financial reached a settlement with 10 states under which it can't acquire servicing rights for eight months but will not face any financial penalties.

September 29 -

The Consumer Financial Protection Bureau may face an unsteady political environment, but a new report on CFPB supervisory priorities has experts warning financial institutions not to rest on their laurels.

September 14 -

The Consumer Financial Protection Bureau may face an unsteady political environment, but a new report on CFPB supervisory priorities has experts warning banks not to rest on their laurels.

September 14 -

The portfolio of conforming loans is currently being subserviced by Nationstar Mortgage Holdings on behalf of Seneca Mortgage Investments.

September 7 -

The bank agrees to pay $6 million to a California couple a judge said was illegally foreclosed on; do rewards programs help or hurt card issuers?

August 18 -

Picking a new benchmark for adjustable-rate mortgages is the easy part. Industrywide implementation is where things get tricky.

August 10 -

Jerome Powell says it's “now or never” to cut the government’s role in mortgage finance; Justice Department is monitoring eight banks for suspected money laundering.

July 7 -

The Trump administration's Justice Department was expected to be less aggressive in its pursuit of False Claims Act cases against the mortgage industry. Instead, its focus has shifted to Federal Housing Administration-insured reverse mortgages.

July 3 -

Seeking to stay below $50 billion, the regional is selling its origination and servicing businesses.

June 27 -

Auditors performing a review of Ocwen Financial padded time sheets and claimed excessive and improper expenses, including lengthy travel and meals at strip clubs and casinos, according to a lawsuit filed against Fidelity Information Services.

May 30 -

Down payment standards should be relaxed to just 10% to spur homebuying among millennials, Bank of America CEO Brian Moynihan said this week.

May 19 -

State regulators felt they were strung along by the mortgage servicing giant Ocwen Financial after years of promises that were never fulfilled, resulting in successive enforcement actions against the company.

May 17 -

In an attempt to show it went all out to help struggling homeowners, the embattled mortgage servicer Ocwen Financial provided an unusual level of detail about foreclosures it says regulators have deemed "inappropriate."

May 3 -

In an echo of the rescue deals of 2007 and 2008, New Residential's CEO framed the transaction as something undertaken to benefit the entire industry.

May 1 -

Years after the worst of the housing crisis, states still dealing with high foreclosure activity are weighing laws to speed the process on vacant or abandoned properties.

April 28 -

The onslaught of regulatory actions against Ocwen may open the door for Nationstar to pick up a massive subservicing portfolio from the beleaguered servicer.

April 27 -

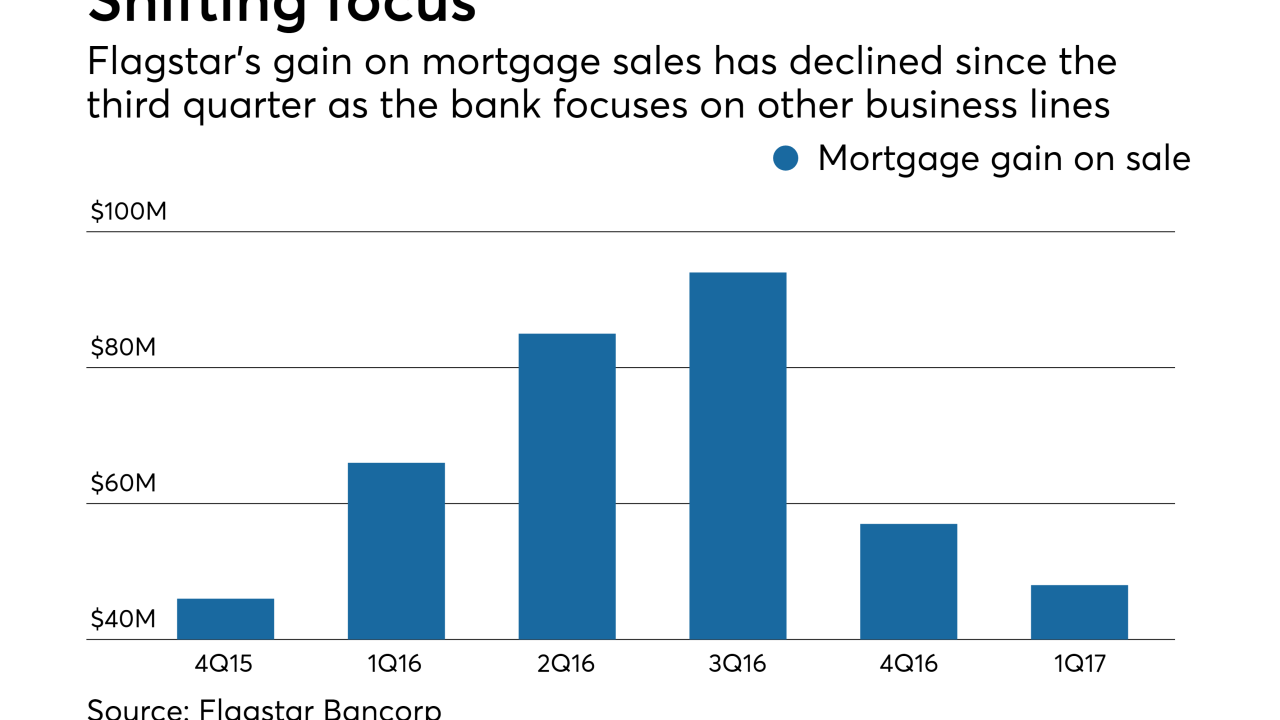

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25 -

Citi has named David Chubak as head of global retail banking and mortgage for the global consumer bank, replacing Jonathan Larsen, who

resigned late last year .April 20 -

Ocwen Financial and its subsidiaries faced a slew of accusations from federal and state regulators on Thursday, which raised questions about whether the firm could survive.

April 20 -

Speaking at a town hall event in Washington, JPMorgan Chase CEO Jamie Dimon said that post-crisis regulations have made mortgages too costly for consumers — and made homeownership unattainable for borrowers with low incomes or blemished credit histories.

April 4