-

Down payment standards should be relaxed to just 10% to spur homebuying among millennials, Bank of America CEO Brian Moynihan said this week.

May 19 -

State regulators felt they were strung along by the mortgage servicing giant Ocwen Financial after years of promises that were never fulfilled, resulting in successive enforcement actions against the company.

May 17 -

In an attempt to show it went all out to help struggling homeowners, the embattled mortgage servicer Ocwen Financial provided an unusual level of detail about foreclosures it says regulators have deemed "inappropriate."

May 3 -

In an echo of the rescue deals of 2007 and 2008, New Residential's CEO framed the transaction as something undertaken to benefit the entire industry.

May 1 -

Years after the worst of the housing crisis, states still dealing with high foreclosure activity are weighing laws to speed the process on vacant or abandoned properties.

April 28 -

The onslaught of regulatory actions against Ocwen may open the door for Nationstar to pick up a massive subservicing portfolio from the beleaguered servicer.

April 27 -

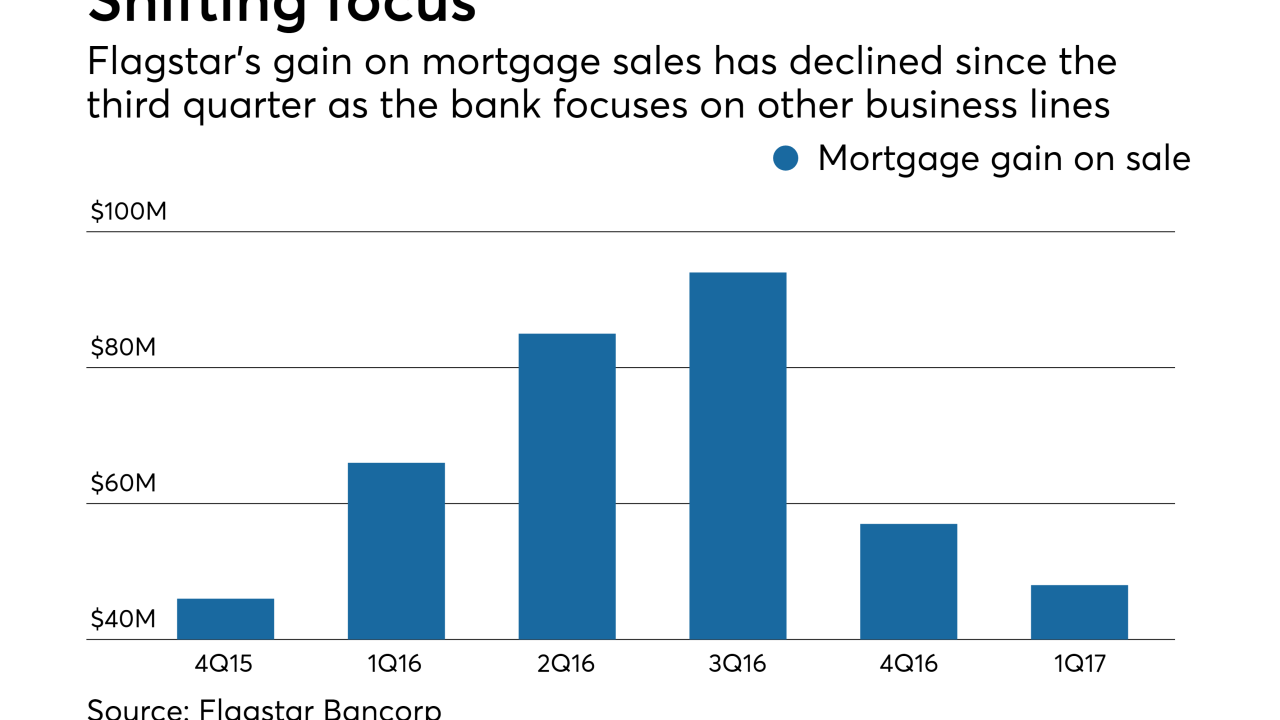

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25 -

Citi has named David Chubak as head of global retail banking and mortgage for the global consumer bank, replacing Jonathan Larsen, who

resigned late last year .April 20 -

Ocwen Financial and its subsidiaries faced a slew of accusations from federal and state regulators on Thursday, which raised questions about whether the firm could survive.

April 20 -

Speaking at a town hall event in Washington, JPMorgan Chase CEO Jamie Dimon said that post-crisis regulations have made mortgages too costly for consumers — and made homeownership unattainable for borrowers with low incomes or blemished credit histories.

April 4 -

New research from the New York Fed confirms a lingering worry for the banking industry: More prime-age, college-educated borrowers are delaying the decision to take out their first mortgage as they focus instead on paying off their student loans.

April 3 -

Ocwen Financial is a step closer to the day when it can resume purchases of mortgage servicing rights.

March 28 -

While there are inherent differences between student loan and mortgage servicing, recent claims against the largest student loan servicer echo the mortgage debacle.

March 22 Davis & Gilbert LLP

Davis & Gilbert LLP -

Industry critics argue the Invitation Homes deal will create new risks for Fannie Mae and remove affordable inventory from homebuyers.

March 15 -

A Long Island, N.Y., man was sentenced to prison time and ordered to pay $2.5 million after pleading guilty in June to ripping off distressed homeowners, said Christy Romero, the Tarp special inspector general.

March 7 -

Rising interest rates have slowed a recent run of unexpectedly high prepayments of government-insured mortgages, making servicing rights for loans held in Ginnie Mae securities more attractive to investors.

March 6 -

Caliber will also buy about $36 million of mortgage servicing rights in a deal that is expected to close at the end of March.

March 3 -

The mortgage servicer will pay at least $25 million in cash and provide some $200 million in debt relief to borrowers to resolve a range of alleged violations. But Ocwen will also be allowed to resume acquiring servicing rights in the nation's largest state.

February 17 -

Citigroup's plan to sell a $97 billion mortgage servicing portfolio and subservice its remaining accounts highlights the growing prevalence of nondepository servicers and raises questions about how much capacity exists for these institutions to absorb more large deals.

January 30 -

Citigroup's decision to exit mortgage servicing by the end of 2018 is part of a long-term strategy to increase returns and sharpen the bank's focus on its core retail customers.

January 30