-

Total loans fell 1.6% at the North Carolina-based regional bank, which has been scaling back in key segments such as residential mortgages and auto. Wider margins offset that reduction, but earnings were flat and revenue growth small.

October 19 -

Flush with cash, many commercial firms are also opting to pay down debt rather than take on new loans, and those seeking financing aren’t always turning to banks to meet their needs.

September 15 -

Credit card issuers have been trying to outdo each other to offer the best rewards program. And it shows, as customer satisfaction rates with many (but not all) of their banks have never been higher in a yearly J.D. Power study. But they may not last forever.

August 17 -

As much as $2.5 trillion, or nearly half of bank deposit growth since the crisis, may be attributable to the central bank's quantitative easing. If investors start drawing down on their accounts to buy back assets from the Fed, the trend could dampen liquidity at certain banks, add upward pressure on deposit prices and reshape M&A.

July 31 -

The regional bank reported an 8% gain in fee income and trimmed costs amid 1% loan growth.

July 20 -

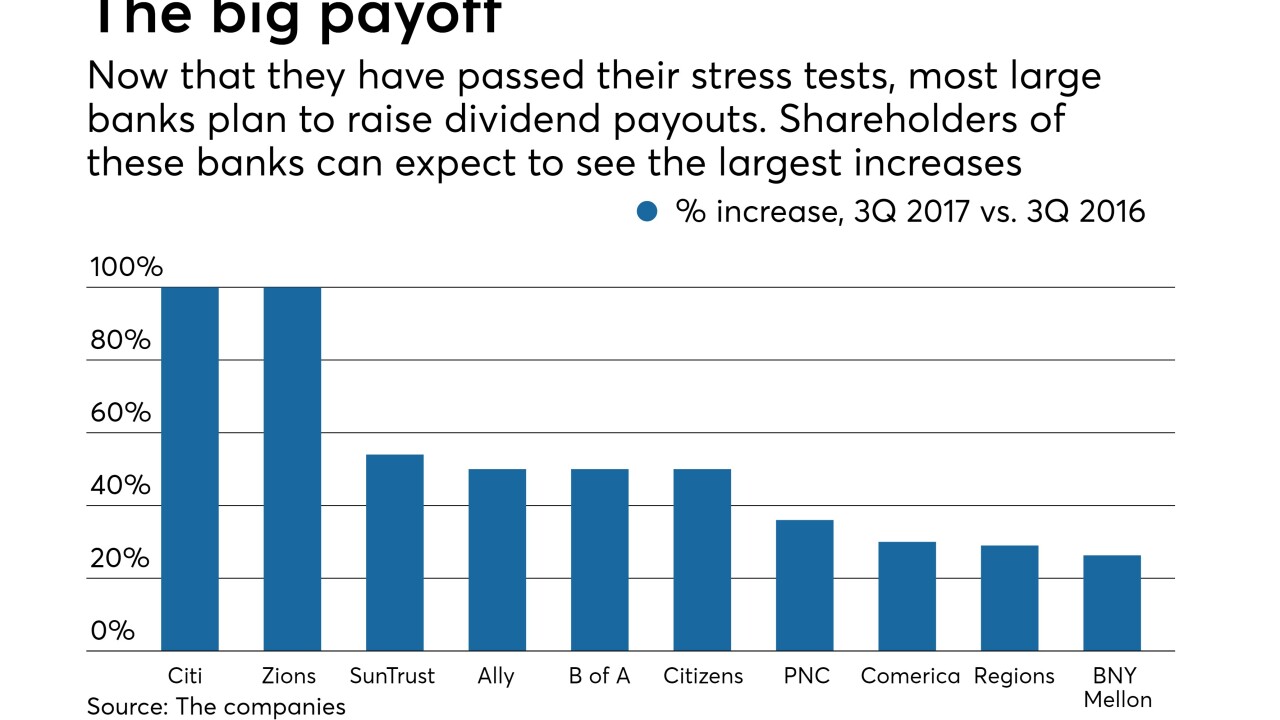

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29 -

Following are notable cases where banks were tripped up by the Fed's stress tests either by flunking the numbers (or quantitative) part of the test or raising red flags on a qualitative basis.

June 19 -

With the first half of 2017 drawing to a close, bank executives gathered this week at the Morgan Stanley Financial Services conference to discuss their companies’ performance thus far and, more important, outline their priorities for the rest of the year and beyond. Here are some of the highlights.

June 15 -

CEO Kelly King also did not rule out a return to bank M&A now that BB&T has completed the integration of Susquehanna Bancshares and National Penn Bancshares.

June 13 -

Attractive demographics, a large supply of startups that appeared built to sell and a surplus of smaller banks struggling with high expenses have combined to make the Mid-Atlantic one of the most active regions for mergers and acquisitions.

May 17 -

Executives at BB&T, KeyCorp and Citizens are milking commercial lending niches and balancing cost control with new investments while waiting for more rate hikes to fatten margins.

April 20 -

The North Carolina company reported lower net income from a year earlier after extinguishing nearly $3 billion in Federal Home Loan bank advances. BB&T also reported more regulatory charges as it deals with a consent order.

April 20 -

Business confidence remains high, but Fed data shows commercial borrowing actually decelerated during the first quarter. Fortunately for banks, rate hikes have fattened margins.

April 7 -

Community banks, big commercial banks and Wall Street investment houses are finding common ground in small-business loan funds that help Main Street, minimize potential losses on credit extended to young companies and sometimes lead to new business prospects.

March 27 -

So-called performance-share units are pushing aside stock options as the preferred long-term incentive pay for bank executives. Many investors and regulators fear that options can encourage reckless conduct and have other shortcomings, though options still have supporters.

March 21 -

More and more banks are using advanced geographic information systems to help make decisions around branch consolidation, lending in low-income communities, monitoring fraud and even deploying talent.

February 14 -

Regional banks don’t pose risks to the financial system that have caused concern among policymakers, executives of 18 banks told top Republican and Democratic lawmakers in Congress.

February 13 -

Federal and state regulators on Friday announced that BB&T has agreed to a consent order over weaknesses in its Bank Secrecy Act and anti-money-laundering program.

January 27 -

Profit surged at BB&T in Winston-Salem, N.C., during the fourth quarter, driven by various acquisitions and growth in business lending.

January 19