-

Federal regulators are moving forward with plans to finalize one of the last significant Obama-era rules governing long-term bank liquidity despite widespread expectations by banks that the proposal was all but dead.

October 19 -

Regulators usually avoid the public fights that define other realms of the polarized Washington landscape, but the recent tiff over the arbitration rule is an exception.

October 18 -

The Minneapolis company is considering re-entering a business it exited under pressure from its regulator in 2014.

October 18 -

Under a joint order, lenders still have to document the value of properties in storm-affected regions, but they will not have to depend on appraisers.

October 17 -

Six Democratic senators want the Treasury Department’s independent watchdog to investigate whether acting Comptroller of the Currency Keith Noreika is still allowed to be in that role.

October 16 -

The Office of the Comptroller of the Currency used "flawed statistics" and misstated the effects of the Consumer Financial Protection Bureau's arbitration rule on community banks, Director Richard Cordray said Friday.

October 13 -

In an op-ed, acting Comptroller of the Currency Keith Noreika argued that allowing consumers to sue financial institutions in class actions would raise credit costs and harm small banks.

October 13 -

Amy Friend, who helped implement the Dodd-Frank Act while at the OCC, will retire from government service on Nov. 11, the OCC said Wednesday.

October 11 -

The world of short-term lending was shaken up Thursday as one regulator issued a rule cracking down on payday loans while another made it easier for banks to offer an alternative product.

October 5 -

Acting Comptroller of the Currency Keith Noreika on Thursday called for steps to ease the asset thresholds that determine whether banks are subject to certain provisions of the Dodd-Frank Act.

October 5 -

Industry observers are skeptical of acting Comptroller Keith Noreika's claims that his agency could grant a fintech charter to a commercial firm like Amazon or Google, arguing that such a move could become "Walmart 2.0."

October 3 -

Leslie Ireland, a former assistant secretary for intelligence and analysis at the Treasury Department, was also elected to the bank's board.

October 2 -

Meetings between bank regulators and technology giants like Amazon and PayPal underscore Silicon Valley's growing involvement in the financial services arena, and may presage pursuit of a bank charter.

September 29 -

Washington Federal is the latest bank to pull an application after being flagged for insufficient Bank Secrecy Act compliance.

September 29 -

Acting Comptroller of the Currency Keith Noreika affirmed Thursday that the agency’s fintech charter, if implemented, could be granted to commercial firms like Walmart or Google.

September 28 -

The proposal is aimed at a simpler capital regime particularly for community banks, but some industry representatives and regulators themselves questioned whether the plan went far enough.

September 27 -

How most banks obtain deposits has changed radically over the past 30 years, thanks in part to innovation. It is time for regulators to rethink their notion of what constitutes a quality deposit portfolio.

September 27 MainStreet Bank

MainStreet Bank -

Acting Comptroller of the Currency Keith Noreika on Monday gave a ringing endorsement to online lenders seeking to expand into banking, suggesting they should consider taking deposits and seek out national bank charters as they mature.

September 25 -

Readers chime in on debates about ILCs, the CFPB’s arbitration rule, the financial services ambitions of tech firms and more.

September 22 -

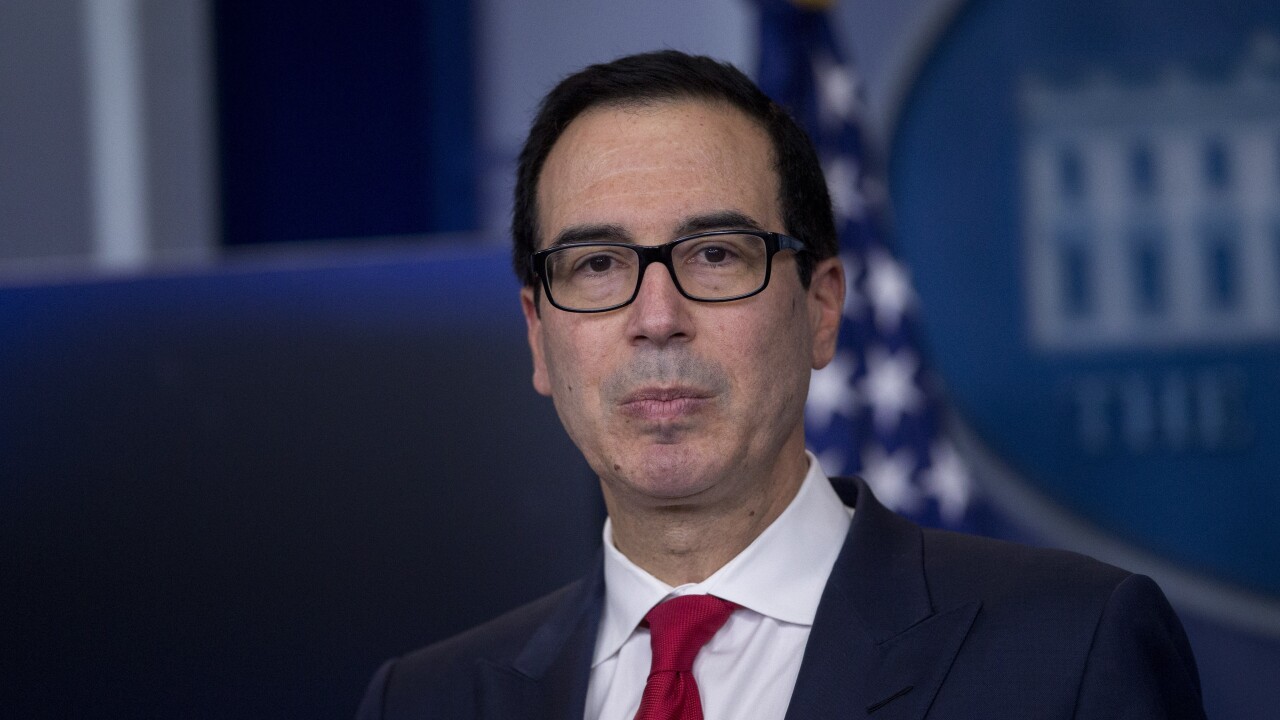

The Trump administration is prepping recommendations to address shortcomings in the capital markets in a report to be released next month, a top Treasury Department official said Monday.

September 18