-

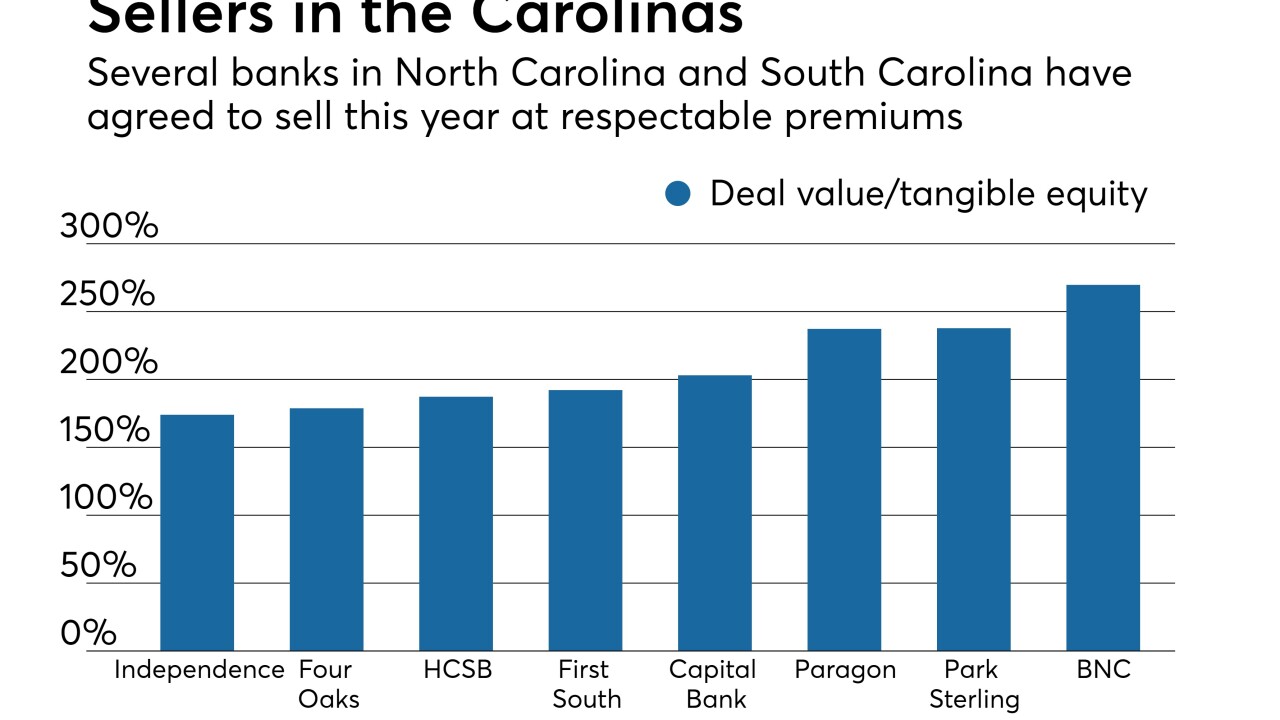

First Reliance in South Carolina, which recently announced its first bank acquisition, is angling to take advantage of disruption caused by bigger mergers in the Carolinas.

October 19 -

Navient has suspended stock buybacks to buy and expand a debt-refinancing firm that faces stiff competition from fintechs, and some shareholders aren’t happy.

October 18 -

The Illinois company, four months removed from its last bank acquisition, just announced the biggest purchase in its history. Alpine Bancorp. will add low-cost deposits and scale to Midland States' wealth management business.

October 18 -

The company agreed to buy Commercial Bancshares for $59 million in stock.

October 13 -

The company, which is still recovering from two recent hurricanes, said it will voluntary comply with several key restrictions that were in the 2010 written agreement.

October 6 -

Washington Federal has pulled its application to buy Anchor Bancorp after regulators flagged issues tied to its BSA systems and processes. The companies said they remain committed to the deal.

September 27 -

The company has agreed to buy Bay Bancorp for $129 million in stock.

September 27 -

The company, which agreed to buy Independence Bancshares, also brought in $25 million by selling common and preferred stock.

September 26 -

The company is looking to raise about $115 million. A portion of the proceeds would help pay for Merchants' pending purchase of Joy State Bank.

September 26 -

Grand Mountain Bank raised $7 million to help it exit the crisis-era capital program.

September 25 -

Brookline will pay $56 million in cash and stock for First Commons in a deal that will add $324 million in assets.

September 21 -

The cash acquisition allows First American to expand its operations in Kenosha, Wis.

September 20 -

David Dotherow, CEO of the newly formed Winter Park National Bank, stresses the need for strong management and a straightforward business plan when applying for a charter.

September 15 -

The Indiana company could also use proceeds from the planned stock sale to pay off debt.

September 15 -

CU in Vancouver announces distribution via redemption, dividend on shares.

September 12 -

The company will add $370 million in assets after buying the parent companies for First Bank & Trust and First Bank of Chandler.

September 8 -

BankGuam, which is looking to sell $20 million of common stock, warned investors that North Korea represents a unique risk to its stock price.

September 7 -

The acquisition will allow Eagle to expand into southwestern Montana.

September 6 -

The company said it could use the proceeds to fund acquisitions and to make more loans.

September 5 -

His Berkshire Hathaway exercised 6-year-old warrants to buy 700 million shares at an $11.5 billion discount.

August 29