-

Banks are undergoing a digital transformation at the same time that hacker culture has taken off, escalating the security risks. Here is one strategy for protecting data where many banks need to improve.

March 27 SAP

SAP -

The industry needs to establish a clear set of rules and standards so safe and secure financial data access and sharing continues unrestricted.

March 27Financial Data and Technology Association of North America -

The administration wants to deal with the concerns of banks of all sizes in its deregulatory efforts, Treasury Secretary Steven Mnuchin said Friday.

March 24 -

In the shift to online and mobile shopping, one group often left out is the 65 million Americans with poor or no credit. But as more retail categories like furniture move online, a growing number of e-commerce merchants is adding instant finance options for the subprime crowd.

March 23 -

Brave, founded by JavaScript creator and former Mozilla CEO Brendan Eich, intends to issue a cryptocurrency to fund the development of a new way to buy and view digital ads.

March 23 -

The Justice Department believes that Pyongyang was behind last year's New York Fed heist; Marcus Schenck, DB's CFO and deputy CEO, may be next in line to head the big German bank.

March 23 -

Malicious hackers tend to swarm around industries they perceive as vulnerable, and terminal makers are the latest to find themselves in the crosshairs.

March 23 -

As connected devices expand in use and add payment capabilities, retailers and technology companies will need to move fast to stay safe and ahead of the curve.

March 23 Intel

Intel -

Live Oak Bank, known for streamlining the lending process, has turned its attention to fixing its patchwork approach to cybersecurity.

March 22 -

Some new data rules, such as the one in New York state governing cybercrime protection, require complex technology work to remain compliant. But the rules also leave room for outside help.

March 22 EventTracker

EventTracker -

ID attacks have expanded quickly in the past year, partly due to the same kind of automation that companies use to manage a high volume of transactions.

March 21 NuData Security

NuData Security -

BloqLabs, created by the startup Bloq, wants to help developers get their projects in front of enterprise clients.

March 17 -

Cleveland-based Select Restaurants Inc., a national chain of upscale restaurants and bars, has experienced a breach exposing customers’ payment card data through point of sale technology, according to data security expert Brian Krebs.

March 17 -

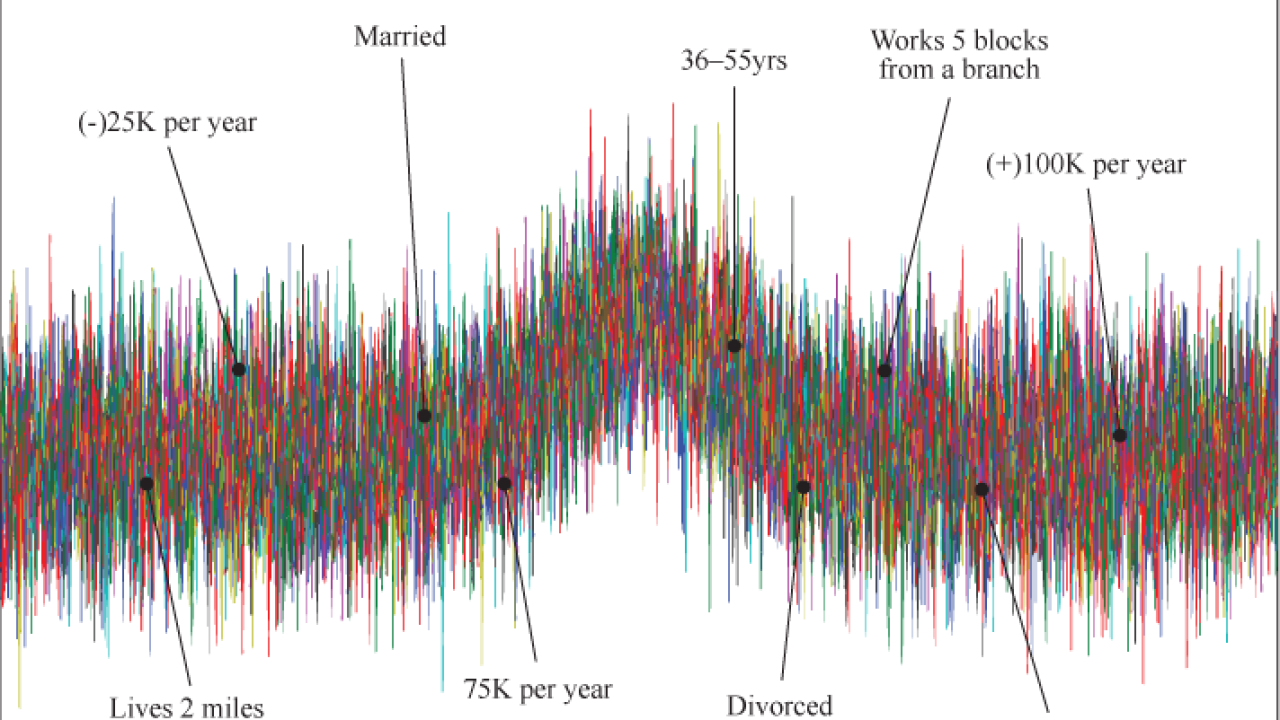

Credit unions are sitting on a wealth of data from social media channels. The trick is sifting through the noise to find it—and use it.

March 17 -

The ICO fundraising model has already yielded more than $230 million for startups.

March 16 -

Using big data can help CUs improve efficiencies and reduce costs when it comes to compliance.

March 16 LexisNexis Risk Solutions

LexisNexis Risk Solutions -

A lot of time can pass between a breach and when a company discovers the incident, creating an opportunity to damage payment systems.

March 15 Imperva

Imperva -

The venture capital firms of Goldman Sachs and Citigroup, along with the fund backed by Google’s chairman, have invested in a firm that helps banks secure their cloud technology.

March 14 -

The bank’s clients now have a simpler alternative for logging in to treasury management and other commercial accounts, part an effort by bankers to offer business customers more convenient high-tech services that are still secure.

March 14 -

If the Federal Reserve and other central banks began issuing their own digital currencies, they could benefit consumers, boost the economy and fight financial crime. But not without risks to cybersecurity, individual privacy — and possibly bank profits.

March 14