-

The Louisiana company's board has made it clear that independence is "not a God-given right" and wants new management to address energy loan issues, underwriting, capital and expenses.

June 2 -

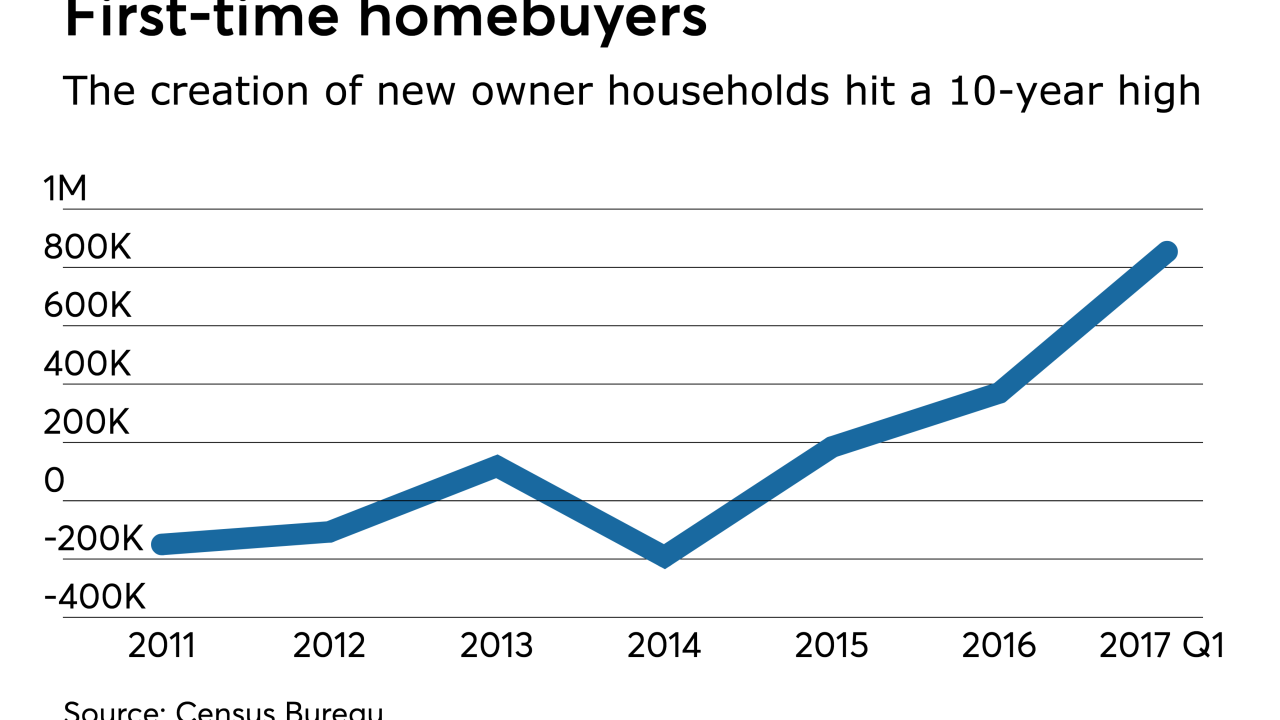

For the first time in a decade, new-owner households created in the first quarter were higher than the creation of renter households.

June 2 -

A new tariff on Canadian lumber threatens to further disrupt homebuilding at a time when lenders are increasingly concerned about a purchase mortgage resurgence that has failed to materialize.

June 1 -

KeyCorp is acquiring HelloWallet, a personal financial management product it has offered its bank customers since 2015, from the investment research firm Morningstar.

May 31 -

Wells Fargo streamlines Western unit, shifts executives as post-scandal overhaul continues; Goldman Sachs gets grief for "cynical" purchase of Venezuelan bonds at deep discount.

May 31 -

Aggressive restructuring moves and stock buybacks are giving CIT time to remold itself, but it will need to show core-banking growth to stave off calls for the company to sell itself.

May 30 -

A new survey finds that 14% of small and medium-size businesses switched banks last year and 18% are considering switching this year. Doug Brown senior vice president of FIS, explains why, and what banks should do about this.

May 30 -

Canada's big banks are pursuing wholesale banking, capital markets and select M&A opportunities across the border to hedge against a slowing mortgage market and other economic concerns on the home front.

May 26 -

The 'revolution' in auto financing, communication tips and the keys to member engagement were all topics of focus during the second day of CU Direct's annual DRIVE conference in Las Vegas.

May 26 -

Today’s primitive question-and-answer programs will mature into sophisticated conversational agents, which will help customers transact and may even be capable of understanding emotional cues, experts say.

May 26 -

Thanks to the Federal Reserve's unwinding of post-crisis policies, the next wave of mergers will be driven in part by a drop in deposits.

May 26 Adjoint

Adjoint -

Amid all the bad news this year among taxi-medallion lenders, banks are trying to renegotiate loan terms behind the scenes, and regulatory changes could prop up collateral values and the competitiveness of taxis.

May 25 -

Credit unions in Alabama and Louisiana announce conversion to first-ever core system designed specifically for CDFIs.

May 25 -

The Toronto bank said increases in deposits and loans spurred a 20% rise in profit at its U.S. retail bank from a year earlier.

May 25 -

As the annual DRIVE conference kicked off in Las Vegas, credit union leaders gathered for wide-ranging discussions on the future of auto lending.

May 25 -

New mothers were bailing out from the Cincinnati bank at twice the rate of other women employees, so it decided to offer a maternity concierge service that would help them with stressful chores.

May 24 -

Bay Area CU launches Business Banking Division to increase, diversify loan portfolio.

May 24 -

The rising regional player has also appointed new chairs for four board committees as it prepares for the retirement of several long-serving directors.

May 23 -

Regulators have hinted that they're warming up to the idea of startups, but industry veteran George Groves is raising money to buy an existing bank because he fears the approval process would take too long.

May 23 -

Bank of the West is using alternative data and the international expertise of its parent company to tap into the lucrative but difficult to underwrite market of middle- and upper-class immigrant mortgage borrowers.

May 23