-

There are outstanding questions about whether Elizabeth Duke, who has been on Wells Fargo's board since January 2015, is the right person to lead a culture change at a large bank mired in scandals and investigations.

August 16 -

Retiring from CUNA after 39 years, Bill Hampel looks back on how the movement has changed – and, more importantly, what hasn’t.

August 16 -

While banks know they must develop and launch new tools that are useful, convenient and intuitive, figuring out which tools meet that objective and employing them often seems out of reach.

August 16 CCG Catalyst

CCG Catalyst -

Aberdeen Proving Ground FCU taps a new chief financial officer and more new hires and promotions.

August 15 -

Duke, currently vice chairman, was rumored to be a likely contender for the chairman spot last week.

August 15 -

JPMorgan Chase Chief Executive Jamie Dimon joined U.S. corporate leaders in denouncing racial intolerance as the pressure heats up on them to challenge President Trump on social and other policy matters. However, Dimon remains on a key presidential advisory group.

August 15 -

Carmen Sylvester will take the helm at the credit union, following the departure of CEO Daniel Waltz, who is now CEO of City of Boston CU.

August 14 -

Chatbots are the next big thing in payments. But a poor in-chat commerce strategy can turn off consumers and create bad user experiences.

August 14 -

The Florida company will pay nearly $600 million to buy HCBF Holding and Sunshine Bancorp.

August 14 -

On September 13 credit union employees can dress down to raise money for Children’s Miracle Network hospitals.

August 14 -

The $2.6 trillion-asset bank's recent commitment to digital lending augurs the development of a two-tier market for borrowers who want fast access to cash.

August 11 -

Banks are being pushed into the background of popular digital experiences. But they can reappear on interfaces that customers use daily by doubling down on financial wellness efforts.

August 11

-

Chairman Stephen Sanger could step down ahead of the embattled bank's next annual meeting, according to a news report, clearing the way for the elevation of Duke, the current vice chairman and a former Fed governor and banking executive.

August 10 -

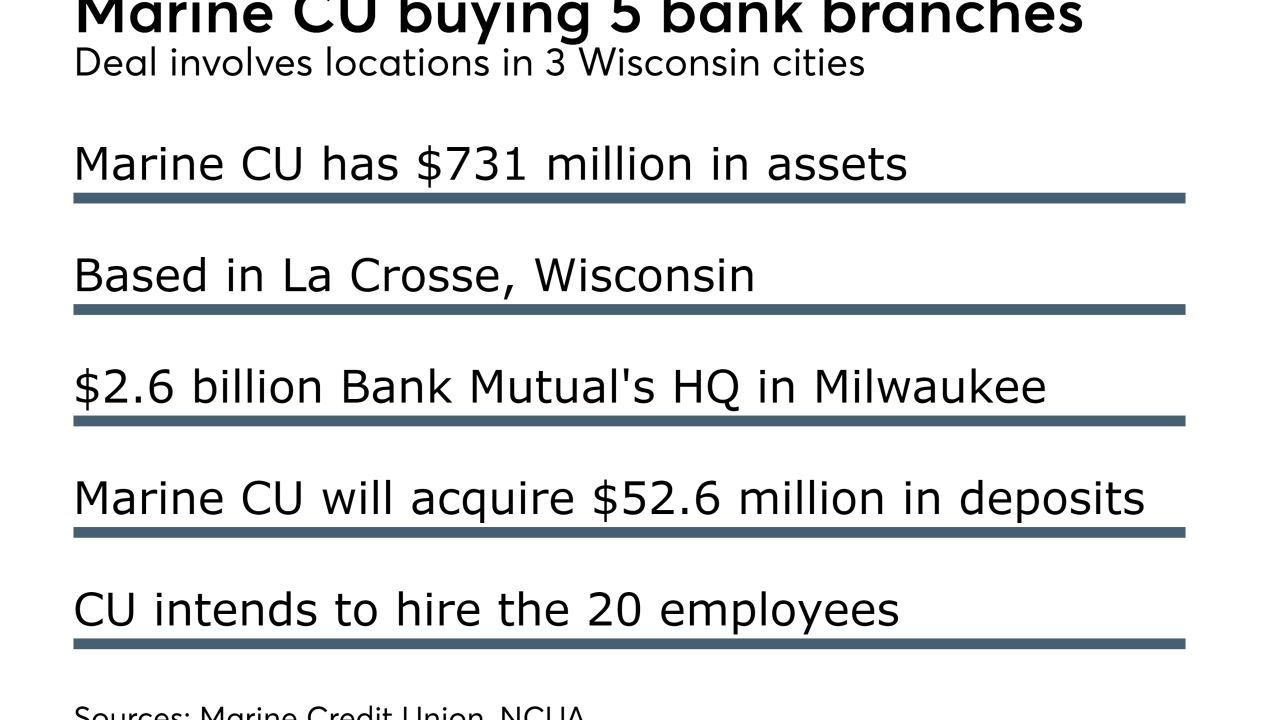

Wisconsin-based CU will acquire five Bank Mutual branches in three cities on August 25.

August 10 -

Clearer criteria of what the Federal Reserve expects from directors will improve board oversight of banks, while also cutting down on misplaced demands on boards’ time and attention.

August 10 Promontory Financial Group

Promontory Financial Group -

Triumph Bancorp in Dallas has successfully taken chances on out-of-state acquisitions, factoring and other nontraditional strategies that many of its peers have avoided.

August 9 -

The venue currently called the Verizon Center will be renamed the Capital One Arena immediately, according to its owner. The arena houses the NBA's Washington Wizards, the NHL's Capitals and the WNBA's Mystics.

August 9 -

NCUA Board Member Rick Metsger's term officially expired last week, meaning the president now has two openings to fill at the agency.

August 9 -

Hopewell is bolstering its member service with several new tellers, Suffolk announces board members and more credit union advocates in the news.

August 8 -

Current SVP Tom Davis will take over as dictated by the firm's long-time succession plan.

August 4