-

Want to make your bank a top performer? Spending can be a more effective strategy for success than cost cuts, if done smartly. That’s the lesson from banks with $2 billion to $10 billion of assets. ranked here by three-year average returns on equity.

May 31 -

The company will record a $300 million charge to cover the elimination of three data centers and book $125 million in broader severance costs.

May 31 -

First Savings Financial in Indiana and Dime Community in New York are keen on making more SBA loans as a way to diversify revenue and generate fees through loan sales.

May 19 -

The Minnesota company recently announced that it would stop selling auto loans since credit quality concerns have slowed investor demand, but it is unclear whether its plan to keep all its car loans on its books is less risky.

May 15 -

Executives at the embattled bank made clear Thursday that they are not discarding its long-standing strategy of selling additional products to existing customers.

May 11 -

Wells said slowing loan growth had hurt its aggressive efforts to lower its efficiency ratio, so it is doubling the expenses it aims to cut by 2019.

May 11 -

The recent earnings season shined a light on community bankers’ tactical moves. Here’s a look at what some institutions are planning in coming months.

May 10 -

After a bogus-accounts scandal spooked new clients and crimped profitability, Wells Fargo may eliminate more branches and dismiss staff.

May 10 -

Once focused mainly on growth, the New York-based small-business lender said it will lay off employees and cut other expenses in an effort to become profitable. The moves are a sign of waning patience among investors in the once-frothy sector.

May 8 -

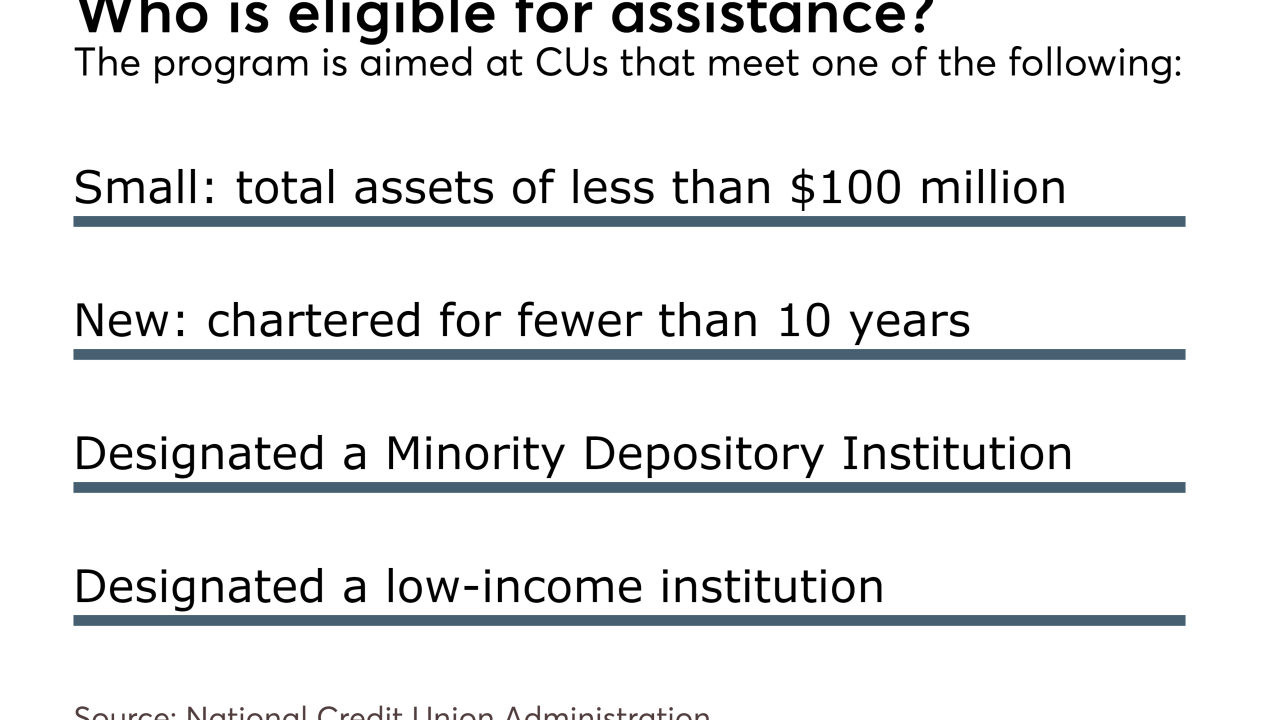

Applications for the regulator's consulting services are due May 31.

May 3 -

The New Jersey company's profit growth was constrained by an 11% increase in compensation and benefits and an 85% jump in consulting fees tied to compliance and other issues.

April 28 -

The credit union is the tenth largest in Pennsylvania, serving more than 80,000 members.

April 28 -

The Cincinnati bank's profit-improvement plan is as detailed as it gets, but there is an argument to be made it is heavy on metrics and light on vision.

April 27 -

Merger-related expenses cut into the Pittsburgh company's earnings, though management is excited about growth opportunities in North Carolina.

April 25 -

The Cincinnati company’s 1Q profits were hurt as it scaled back in key consumer and commercial credits, paid higher severance and saw fee income fall.

April 25 -

Executives at BB&T, KeyCorp and Citizens are milking commercial lending niches and balancing cost control with new investments while waiting for more rate hikes to fatten margins.

April 20 -

Delorier is a former chief marketing officer and head of consumer channels at SunTrust Banks.

April 20 -

New boss Andy Cecere's first year on the job will likely be defined by how he tackles the challenges in front of him, including keeping the company’s highly watched efficiency ratio in check and managing pitfalls in auto-lease financing.

April 19 -

Wintrust’s mortgage revenues fell in the first quarter, but net interest income picked up the slack.

April 19 -

Barbara Yastine, who stepped down as head of Ally’s banking unit two years ago, has become a director of Zions in Salt Lake City.

April 12