-

These execs say they are finding ways to reduce fixed costs in areas such as branching and personnel, offer appealing tech, yet provide in-person services when customers have concerns.

April 11 -

The Little Rock, Ark., bank said first-quarter profits rose slightly and that it plans to dissolve its holding company to trim regulatory costs.

April 11 -

The cuts punctuate the end to a rapid expansion period at the company, which now seems to be prioritizing profitability over growth.

March 14 -

The company also seems to be shifting the narrative to operational performance after addressing claims of questionable insider dealings.

March 8 -

Cache Valley Bank in Utah agreed to buy Proficio's deposits and most of its assets.

March 3 -

The executive, who was also M&T's chief operating officer, died on Sunday after an extended illness.

February 27 -

Hadley Robbins succeeded Melanie Dressel, who died unexpectedly on Sunday. Columbia will begin a search for a permanent CEO.

February 23 -

Kirk Wycoff of Patriot Financial Partners will soon join PL Capital's Richard Lashley on the company's board.

February 10 -

James Lally will succeed Peter Benoist as CEO of the $4.1 billion-asset company at its annual meeting this spring.

February 10 -

The company, which provided few details about the possible fraud, plans to hold a conference call Friday.

February 9 -

The announcement comes a day after the company's board announced a series of corporate-governance improvements.

February 9 -

Royal Bancshares in Pa. made tough choices to avoid collapse during the financial crisis

January 31 -

The Livingston, N.J., company took a big hit in the fourth quarter as it continued to divest certain business lines and restructure its operations.

January 31 -

Quarterly profit fell at SunTrust Banks in Atlanta as noninterest expense rose 8.4% and its loan-loss provision increased.

January 20 -

The Minneapolis company reported gains in lending and fee income, but merit-pay increases and compliance-related spending contributed to higher noninterest expenses.

January 18 -

The San Francisco private bank reported double-digit gains in originations and noninterest income that led to a nearly 30% increase in profits last quarter.

January 13 -

JPMorgan Chase said profit rose 24% as bond-trading revenue climbed more than analysts estimated and expenses fell.

January 13 -

PNC’s fourth-quarter profit improved on higher lending to corporate customers for real estate and other loans.

January 13 -

Larry Mazza, MVB’s chief executive, joined the board at BillGO.

January 11 -

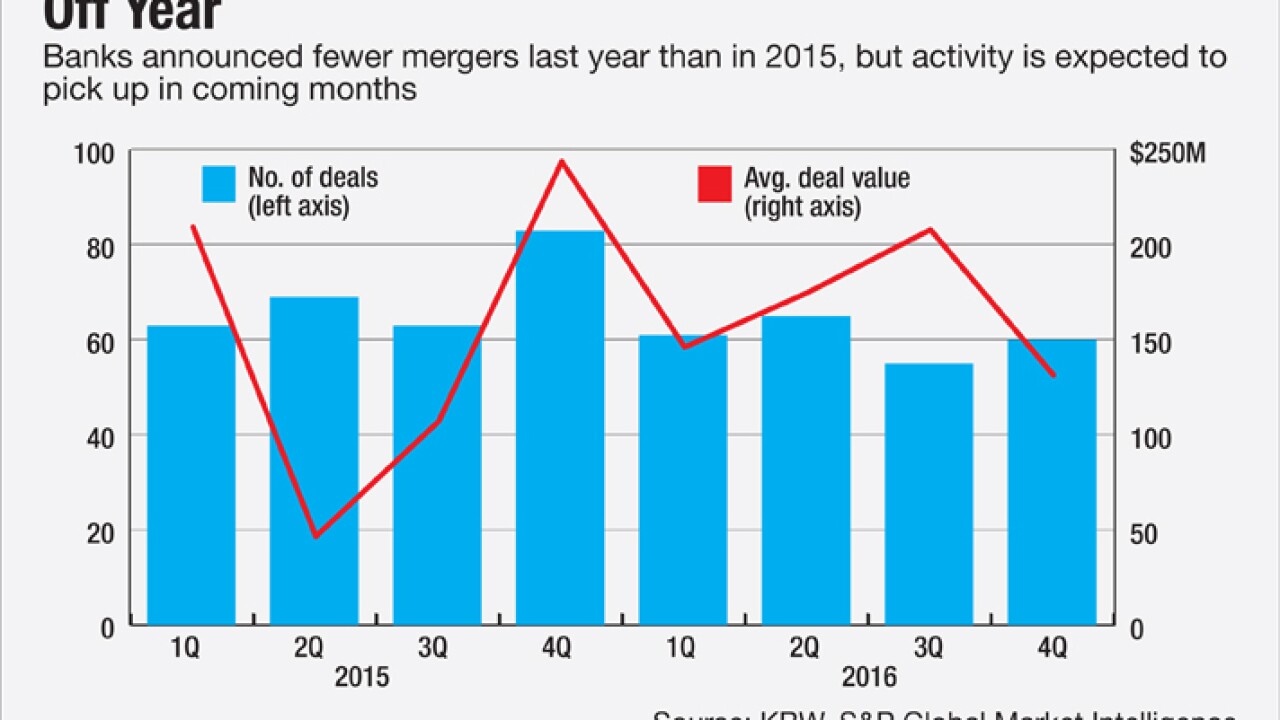

There is optimism that consolidation could bounce back from a lackluster 2016 as bank stocks rally. At the same time, expectations of regulatory easing and tax reform could entice more banks to stay independent, at least in the short term.

January 11