While the Office of the Comptroller of the Currency's recently published stablecoin rule bars stablecoin issuers from offering yield on holdings, there is enough wiggle room in the proposal — and unfinished business in Congress and the courts — for rewards to ultimately be accepted.

Fintech lenders are positioned to help businesses navigate the latest round of global tariffs announced by President Trump, even as the volatility causes overall decreases in loans.

-

Noelle Acheson points out that a wander through stablecoin history highlights an overlooked use case likely to be of interest to financial services providers.

-

By acquiring the ATM firm, Brink's hopes to expand in retail commerce. Plus, Revolut issues a card to compete with Amex; Standard Chartered has a new payments chief; and more in American Banker's global payments and fintech roundup.

-

The blockchain technology firm has added new processing tools for digital assets and traditional money, pitching itself as a destination for crypto-curious banks.

Cybersecurity stocks tumbled after Anthropic unveiled a new vulnerability scanner, prompting vendors to defend their runtime protection platforms.

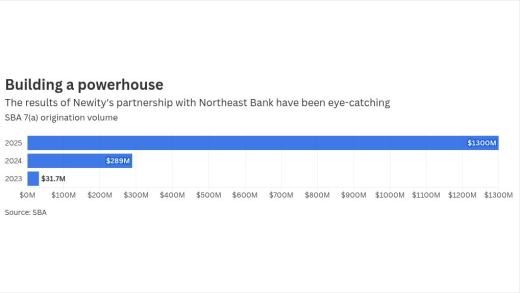

The Chicago-based lender service provider, which has helped build Northeast Bank in Maine into an SBA powerhouse, has expanded its capacity with an AI-driven technology upgrade.

Sens. Tim Scott, R-S.C., and Elizabeth Warren, D-Mass., released new legislative language Monday night that includes a ban on institutional investors' purchase of single family homes and a temporary ban on the Federal Reserve issuing a Central Bank Digital Currency.

-

The Financial Crimes Enforcement Network's expectations of banks that file suspicious activity reports have changed. Some banking clients may soon discover that they are less appealing customers than they used to be.

-

Sanctions forced Iran to build its own financial network, but technology allows it to take the war anywhere

-

The Block CEO said companies will need fundamentally fewer workers in the AI age. The question is, how many fewer?

-

Traditional banks warn the Fed's decision to grant Kraken a limited-purpose master account introduces systemic risks before final rules are even in place.

-

Fifty years of sanctions has forced the Middle Eastern country to develop its own isolated financial system. But money has still found a way to move in and out of the country.

-

The Supreme Court slammed the door on CashCall's final appeal, cementing a massive win for the Consumer Financial Protection Bureau after a 12-year legal marathon.

-

U.S. banks are bracing for retaliatory cyberattacks following military strikes in Iran that killed Ayatollah Ali Khamenei.

-

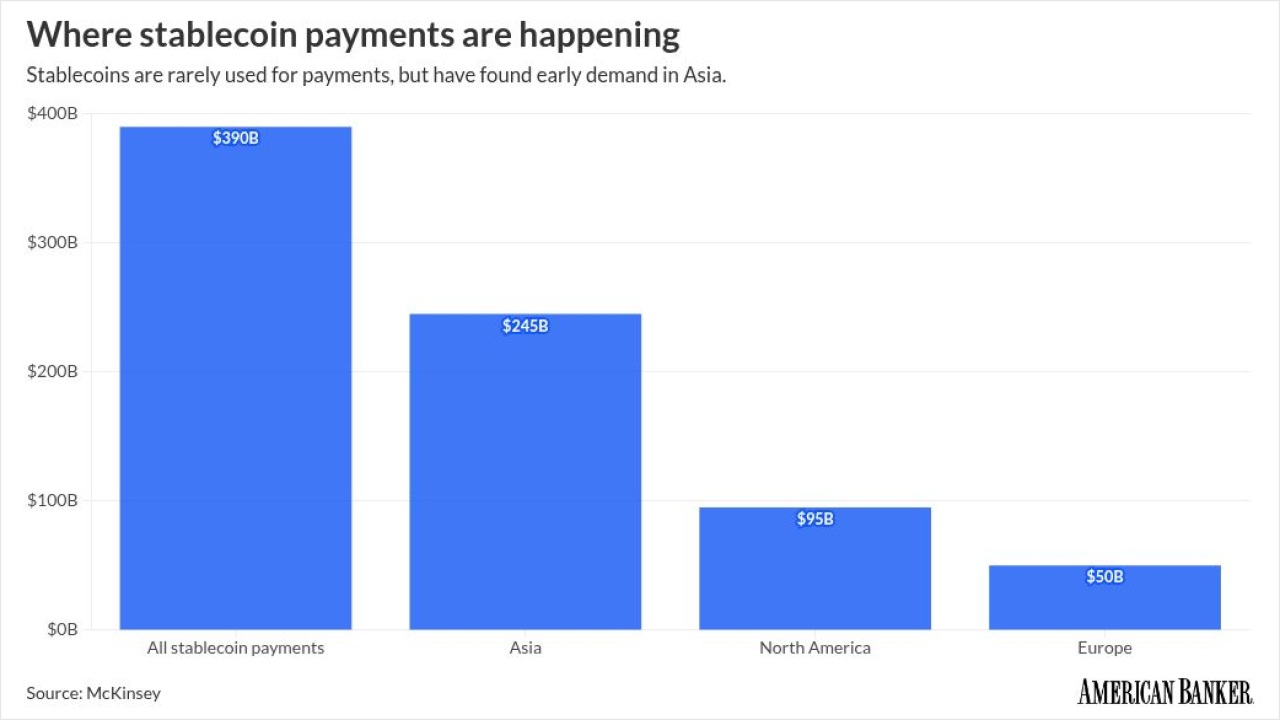

In separate arrangements, Mastercard is working with SoFi and Visa is working with Bridge to build scale in anticipation of greater demand for the digital asset.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

-

The annual rankings honor the notable performances of individuals in banking and finance and as teams.

-

Call for submissions for women 40 years and younger who are rising leaders at their bank or financial institution.

-

Think your credit union has one of the best workplaces in the country? Here's how to apply for American Banker's ranking of the Best Credit Unions to Work For.

The 23rd annual ranking of women leaders in the banking industry.