Some traditional bankers are unsettled by the wave of crypto and fintech banks getting bank charters. This Nashville bank CEO sees opportunity.

-

Discover is the latest card lender to say it's reining in credit lines as the coronavirus pandemic leaves millions of Americans jobless and struggling to keep up on loans.

-

Due to the U.K.’s coronavirus lockdown, many British people are socially isolated in their homes, and rely on friends to get their groceries for them. They face the problem of how to reimburse people for their expenses, since cash is no longer acceptable.

-

For the payments companies that have and will continue to support businesses during our current phase of survival and necessity, these partnerships forged in the fires of adversity will lead to strengthened relationships and long-term loyalty during the growth phase that is yet to come, writes Wirecard's Kevin Brown.

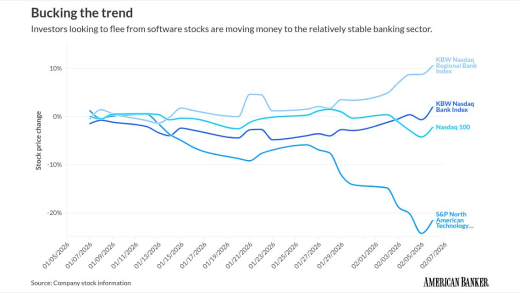

Artificial intelligence developments are stoking investor fears about software companies. Banks' limited exposure to the sector and general stability is proving attractive to investors.

By an overwhelming majority, the House approved a two-month extension of the Paycheck Protection Program, which still has almost $93 billion left to distribute.

Bank of America will pay a $10 million fine to the Consumer Financial Protection Bureau and refund fees to 3,700 customers over allegations that it processed illegal out-of-state garnishment orders.

-

The agency should consider exempting some registered cryptocurrency exchanges from state money transmission laws.

-

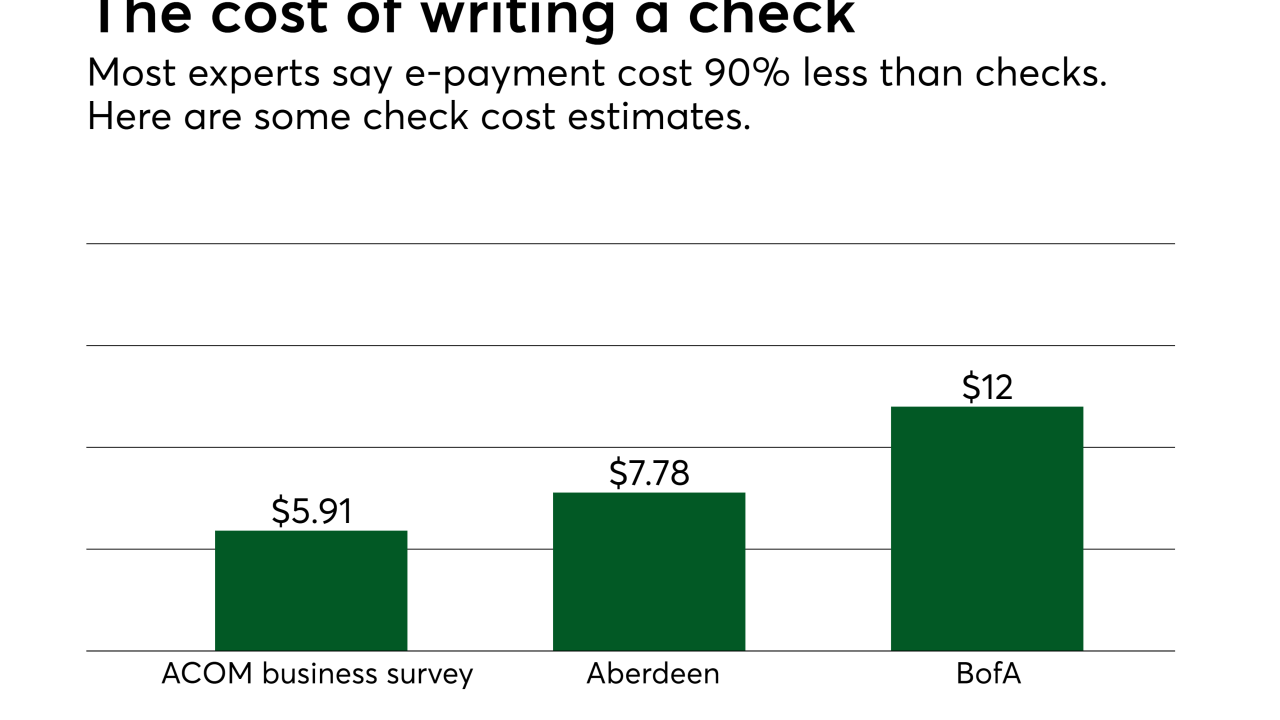

Implementing an electronic payments solution isn’t about replacing one payment method (checks) for an electronic one—as in abandoning checks for ACH, writes Ralph Perdomo, a research analyst at Nvoicepay.

-

Options include multilayered security solutions that incorporate verification via passive biometrics, without adding friction, by evaluating a consumer’s inherent behavior online during the transaction process, writes NuData Security's Lisa Baergen.

-

Some of the country's largest banks, including Bank of America, Citi and Morgan Stanley, said they support efforts to increase capacity, highlighting nuclear's role in the clean energy transition.

-

Kaplan rose though the municipal finance department to become one of the first handful of female partners at Goldman Sachs in 1990.

-

After doing "some really intensive thinking," the Buffalo-area lender said it found the partner it was looking for in the Norwich, New York-based NBT Bancorp.

-

The new bank-led digital wallet is signing up financial institutions, but payment experts say broadening its merchant base and reaching consumers will be an uphill climb.

-

The new rules on custodial account records could address the issues that the Synapse bankruptcy caused in the fintech world but also could complicate relationships between banks and fintech partners, experts say.

-

Ally customers are blaming the bank for data breaches at its vendors, arguing that basic cybersecurity measures would have prevented the thefts.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Treasury Secretary Scott Bessent and Trump's National Economic Council director, Kevin Hassett, are set to meet Tuesday with House and Senate Republican leaders and their top tax writers to try to resolve differences over the scale of cuts and ways of paying for them.

The Consumer Financial Protection Bureau has rehired more than 100 fire employees, but the union claims dozens of employees have not been reinstated in violation of a federal court order.

The 23rd annual ranking of women leaders in the banking industry.

-

-

- Sponsored by S&P Global

- Sponsored by S&P Global