A commonly used standard for property and casualty insurance will offer a carve-out for generative AI liability starting in January. Startups like Testudo, Vouch and Armilla AI stand by to scoop up that business.

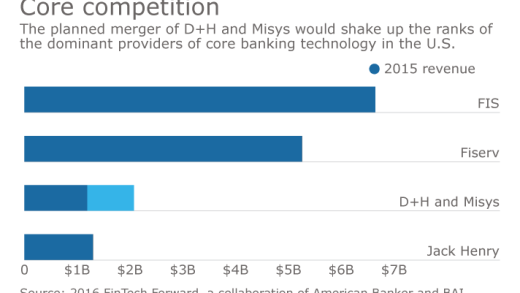

The private-equity firm Vista Equity Partners will acquire D+H in a deal valued at $3.57 billion.

-

Shares of PSQ Holdings nearly quadrupled as Wall Street reacted to the fledgling payment company's appointment.

-

As 2024 comes to a close, trends such as open banking, fights over credit card fees and the future of faster payments are still in flux.

-

Buy now/pay later firms launched new products and announced new operational strategies this week as they prepare for an expected increase in demand this holiday shopping season, while Revolut's CEO laid out plans for 2025.

Flybits is building a marketplace to connect banks with third parties that might want to share data across channels.

The bank is "very optimistic" that Trump will appoint financial regulators who are "more balanced" than current agency heads, CFO Daryl Bible said.

The regulator says its prior amicus brief, which cited the Fair Debt Collection Practices Act and sided with borrowers, was no longer valid.

-

The proposed implementing rule will squeeze credit for entrepreneurs and small businesses, adding more barriers to their success in an already-tight lending environment.

-

The global debt crisis requires sustained attention from leaders and institutions in the U.S. Failure to address it will doom untold millions of people to suffering.

-

When the 2018 Dodd-Frank reform bill lifted the asset bar for enhanced prudential standards for banks from $50 billion to $100 billion, few thought it was controversial. Recent turmoil among regional banks suggests the change may have created as many problems as it solved.

-

The challenger bank in the third quarter launched Cash Coach, an AI-powered customer insights engine that helps consumers optimize earned interest in deposit accounts and minimize interest charges on credit cards. SoFi plans to roll out a "more comprehensive" SoFi Coach that incorporates all areas of financial services as part of its strategy to rival banks.

-

FirstSun Capital Bancorp plans to buy First Foundation in an effort to accelerate its Southern California growth. The $785 million transaction follows FirstSun's failed takeover of Seattle-based HomeStreet.

-

The acquisition of the prime-focused U.S. fintech is expected to boost Barclays' return on tangible equity and digital capabilities starting in 2027.

-

The payment company launched new tools for merchants and entered artificial intelligence collaborations with OpenAI and Mastercard ahead of the company's second quarter earnings, which beat analyst expectations.

-

A proposal from the Office of the Comptroller of the Currency would roll back Biden-era recovery planning rules for banks, leaving them with broad discretion to determine their own recovery protocols.

-

Capital One, PNC, Truist and, U.S. Bancorp are urging regulators to cut duplicative calculations and align U.S. rules with global standards, a longstanding preference for banks but one that will likely find a warm reception from a deregulation-focused Trump administration.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The card network is making a digital wallet push following the Digital Markets Act, which dilutes Apple's control over mobile payments technology.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsored by S&P Global

- Sponsored by S&P Global

- Sponsored by S&P Global

- Sponsor Content from FintechOS