The digital bank added two new board members and raised $123.9 million as it continues to manage regulatory costs amid its push for profitability.

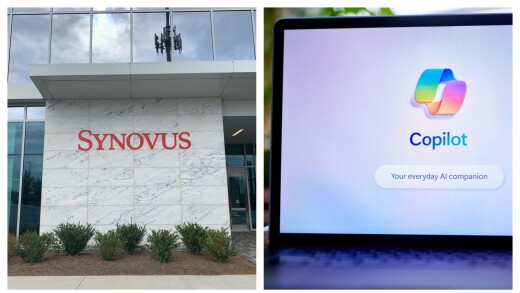

Synovus Financial demonstrated at an industry conference how it is using Microsoft's Copilot to help its staff address customers' concerns.

-

White House National Economic Council Director Kevin Hassett said Friday that the administration expects banks to voluntarily issue "Trump cards" with 10% rate caps, a move that could quell Congress' moves to impose a cap through legislation — but that's no guarantee.

-

Merchant groups are not taking a position on President Donald Trump's threats to cap interest rates, but they are bullish on the president's endorsement of the Credit Card Competition Act.

-

Bilt's new card caps interest rates at 10% for one year and Affirm is adding BNPL for rent as analysts predict the political environment will benefit fintechs.

Employees throughout the company can use generative AI to query data from sales calls, email, invoices and a host of other information sources.

The Huntsville, Alabama-based regional bank is well positioned to defend its Southeast footprint, according to CEO John Turner. It's hiring more bankers in growth markets, it has strong brand recognition and it has a long history in its core markets, he said.

Observers said the Supreme Court likely will allow Federal Reserve Gov. Lisa Cook to remain at her post while she challenges her purported removal by President Donald Trump. But her continued presence would slow, rather than stop, the president's quest for a voting majority on the central bank board.

-

Federal regulators' plan to dial back supervision of community banks is coming at a dangerous time. Rising climate risk creates unique vulnerabilities for small banks that regulators should be tracking.

-

Passkey technology offers a superior method of authenticating customer identification, both in terms of convenience and security. It's time for banks to finally make the transition.

-

Two former chairmen of the Independent Community Bankers of America take issue with the trade group's decision to support legislation that would dramatically increase federal deposit insurance levels.

-

Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said.

-

The president has called for a 10% interest rate cap and endorsed the Credit Card Competition Act. Michael Miebach expressed strong opposition to the CCCA while expressing concern about a cap's potential impact on access to credit.

-

A one-time accounting change will boost the bank's ability to spend on marketing. Traders flinched at the change; analysts called it a buying opportunity.

-

The auto lender's earnings mostly surpassed expectations in the fourth quarter, but its financial outlook was dampened by its projection of a weaker labor market in 2026.

-

New in American Banker, readers can search news and analysis to find what they need, powered by a hybrid AI search engine.

-

A world of hundreds if not thousands of stablecoins sounds chaotic – but that's because we're still thinking of stablecoins as money. Consider their potential for strengthening customer loyalty and engagement.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Amol Dalvi is vice president of product at

Instead of fighting to keep the banking industry unchanged, perhaps it's time for banks to accept that change is inevitable and focus on adapting to remain competitive.

Under Stewart's leadership, the bank's commercial banking services gained 8% year-over-year growth in middle-market loans.

-

- Sponsored by S&P Global

- Sponsored by S&P Global

- Sponsored by S&P Global