-

Casey Crawford, head of the rapidly growing Movement Mortgage, recently recapitalized First State Bank in Danville, Va., with his own money.

June 14 -

The company agreed to pay $162 million to buy First South Bancorp in Washington, N.C. It is the fifth time this year that a bank in North Carolina has agreed to be sold to a buyer from another state.

June 12 -

His decades-long career in credit unions spans three different state leagues and was proceeded by 21 years of military service.

May 24 -

The 2015 written agreement had required Four Oaks to improve corporate governance.

May 10 -

A tech JV between Live Oak and First Data aims to do for small-business deposits what the bank previously did for lending.

May 10 -

First Horizon CEO Bryan Jordan explains why he thinks policymakers will change the $50 billion asset cutoff and justify the regional bank's big acquisition.

May 4 -

The acquisition will make the Tennessee company one of the biggest banks in the Southeast, with assets of more than $40 billion.

May 4 -

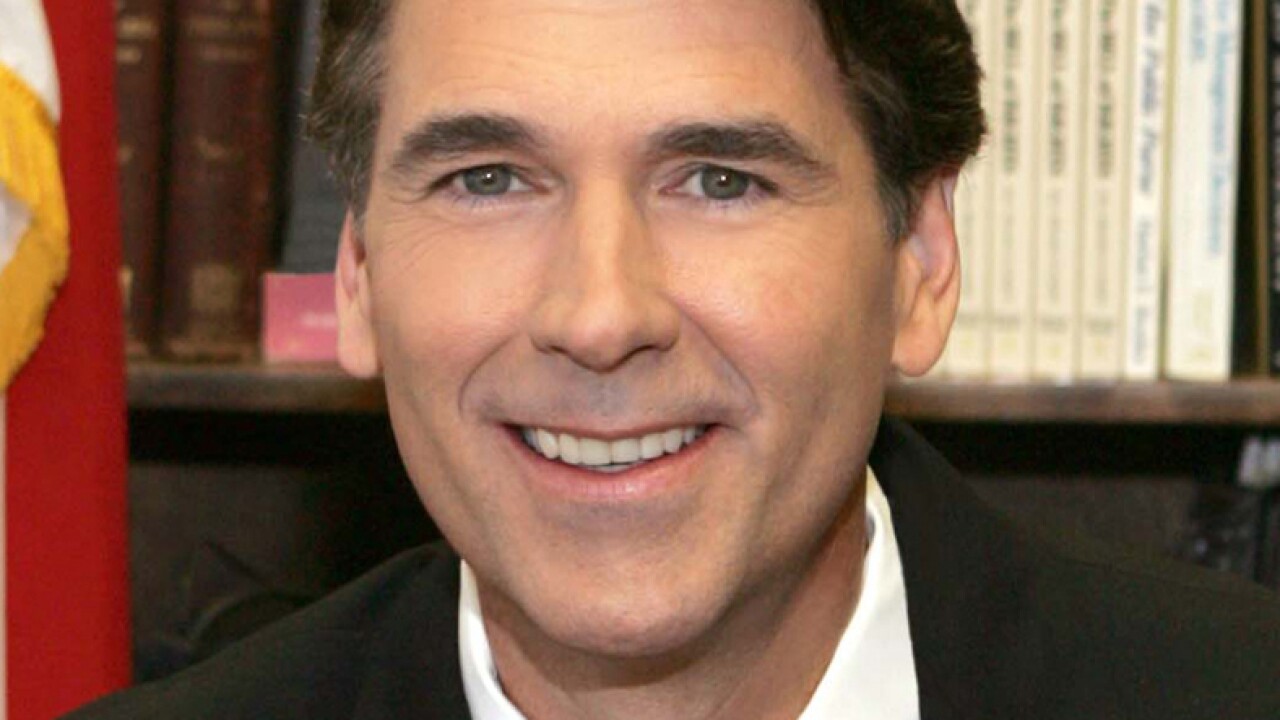

Richard Moore, CEO of First Bancorp in North Carolina, believes he can unlock more shareholder value through acquisitions and by taking advantage of disruption elsewhere.

May 3 -

Entegra Financial disclosed that it held First NBC subordinated debt. An impairment charge tied to the bank's failure will lower Entegra's first-quarter profit by $441,000.

May 3 -

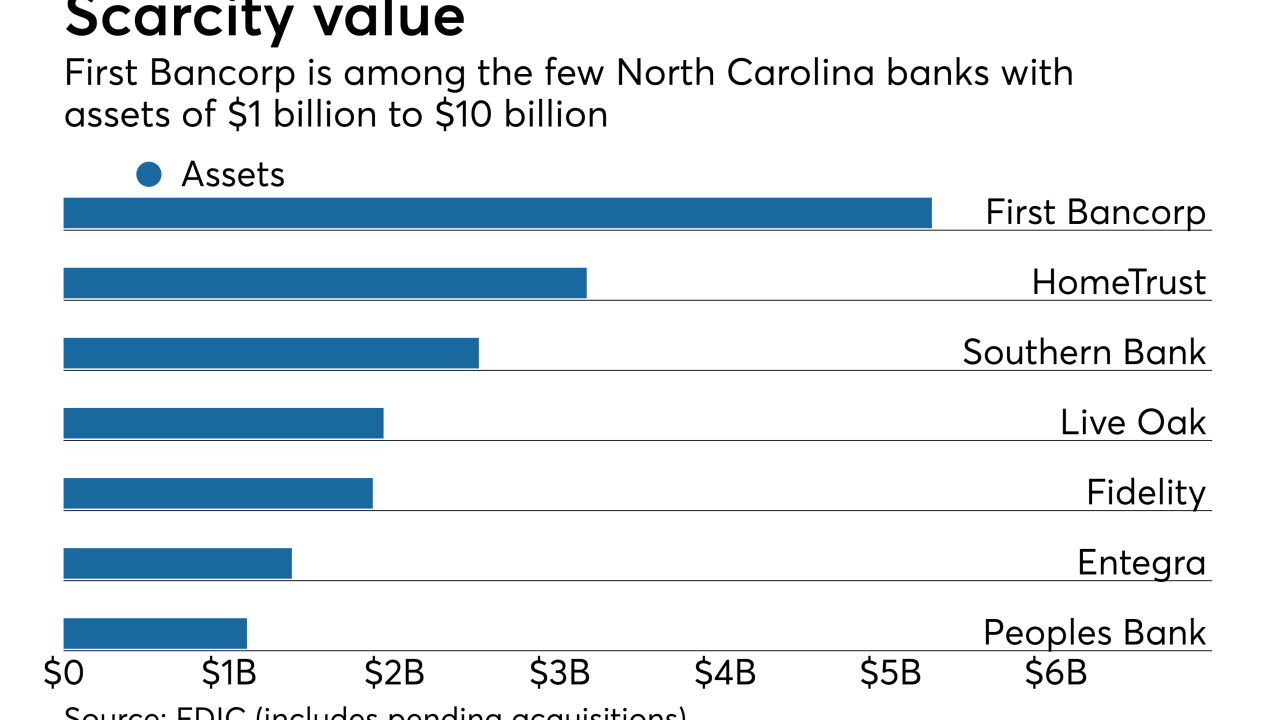

First Bancorp has emerged as one of the few consolidators in North Carolina at a time when many other banks in the state have opted to sell.

May 1 -

The acquisition will provide South State with more than $3 billion in assets and a larger operation in North Carolina.

April 27 -

TowneBank's acquisition of Paragon Commercial Bank would give it access to several North Carolina markets.

April 27 -

Merger-related expenses cut into the Pittsburgh company's earnings, though management is excited about growth opportunities in North Carolina.

April 25 -

The North Carolina company reported lower net income from a year earlier after extinguishing nearly $3 billion in Federal Home Loan bank advances. BB&T also reported more regulatory charges as it deals with a consent order.

April 20 -

Carter, who built what became Carter Bank and Trust from the ground up, was praised for his “uncanny” credit acumen, devotion to community and family, and willingness to take unconventional risks.

April 11 -

Arizona, Nevada, Florida and North Carolina have lost more banks than other states, based on the percentage decline since 2010. Each has a unique set of reasons that goes beyond regulation and a dearth of de novo activity.

April 5 -

Live Oak Bancshares in North Carolina has hired Scott Custer to run its bank. Custer recently resigned as a consultant to F.N.B. Corp. in a move that took place days after F.N.B. bought Yadkin Financial, where he had been president and CEO.

April 3 -

Scott Custer resigned as a director and paid consultant to F.N.B. days after the Pittsburgh company bought Yadkin to enter North Carolina.

March 31 -

Capital Bank Financial in Charlotte, N.C., is working with advisers to explore a sale after receiving an unsolicited approach, people familiar with the matter said.

March 15 -

Pinnacle Financial wanted to be in high-growth markets. BNC Bancorp saw more regulatory burden looming and limited opportunities to sell itself. Those factors spurred what is currently the year's second-biggest bank deal.

March 10