-

The Pittsburgh company benefited from loan growth and higher interest rates, though fee income fell and expense rose in the third quarter.

October 13 -

Total revenue rose less than 1% to $21.8 billion, but expenses declined 2.5% to $13.1 billion. That computed to the highest profit at Bank of America in six years.

October 13 -

An increase in corporate loans, the highest lending margin in four and a half years and record profit in asset management helped the lender top analysts’ estimates and offset trading and other challenges.

October 12 -

Profits rose 20% at the Texas bank, but net interest margin growth last quarter, and the bank’s margin outlook for the rest of this year, disappointed analysts and investors.

July 27 -

Just as pre-crisis success was illusory, so too might be expectations that banks could ever regain that type of profit growth again.

July 25

-

Net interest income rose 7% and margins widened 17 basis points at the Wayzata, Minn., company.

July 24 -

The Rhode Island bank plans to build out its fee income capabilities, expand C&I lending in the Southeast, renegotiate vendor contracts and take other steps to produce expense cuts and revenue enhancements of at least $90 million.

July 21 -

The Cincinnati company reaped the benefit of the latest round of interest rate hikes, as a higher net interest margin and lower costs helped overcome the drop in lending.

July 21 -

The regional bank reported an 8% gain in fee income and trimmed costs amid 1% loan growth.

July 20 -

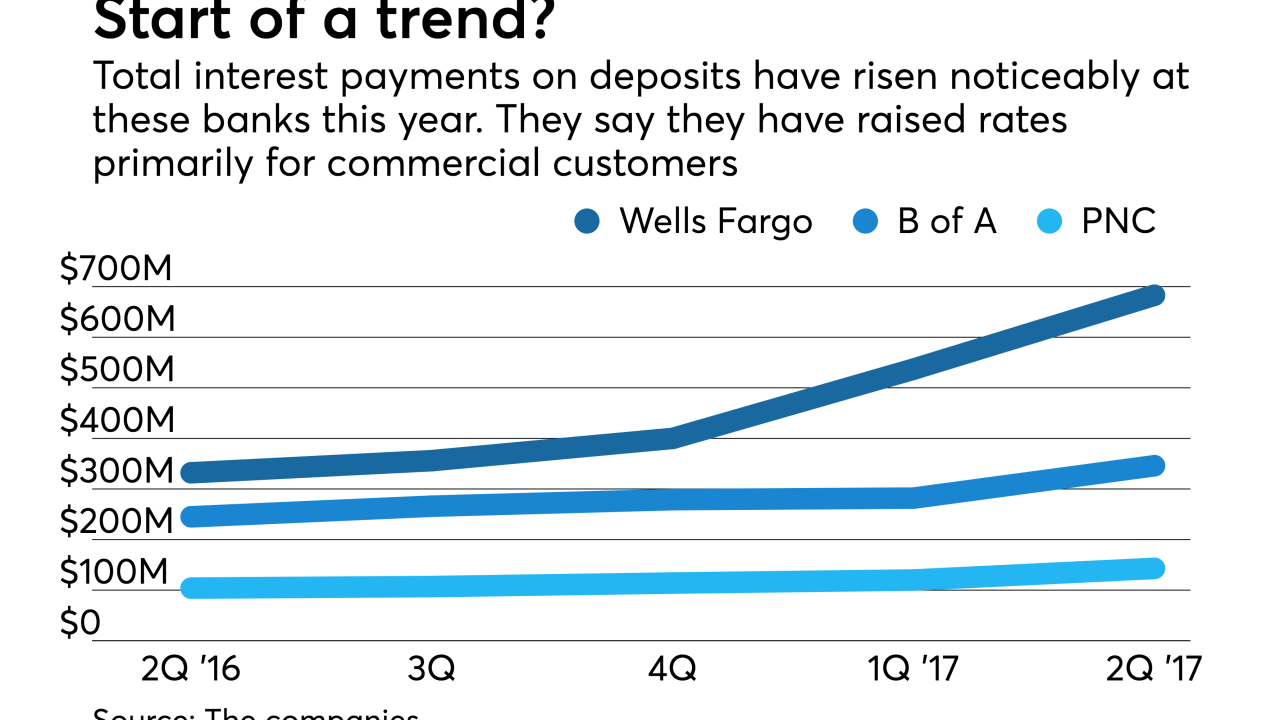

In a sign of broader competition ahead, bigger banks are raising the interest they pay on deposits held by business customers. The big question is how hard will it be for banks to maintain margins and to stave off consumer demands for better rates.

July 18 -

Net interest margins are on the rise and banks have the green light to return more capital to shareholders, but commercial lending and consumer credit quality remain trouble spots.

July 3 -

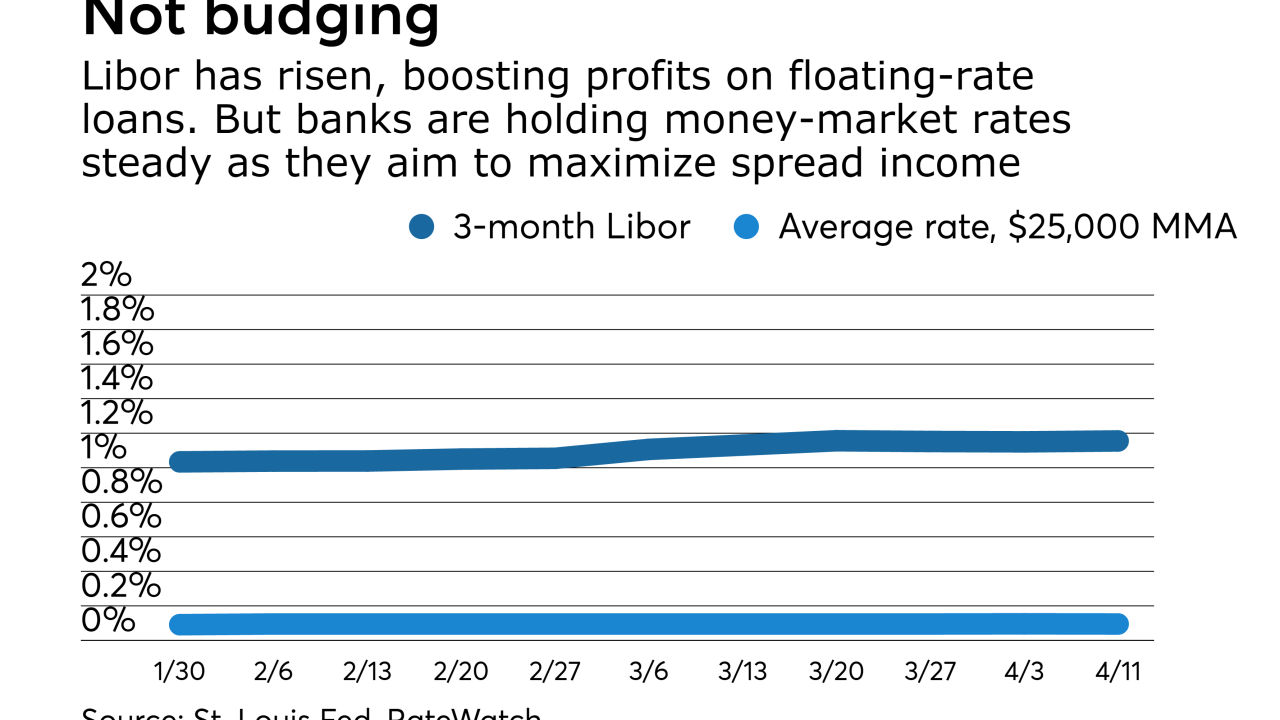

Even with net interest margins improving, banks are reluctant to raise rates on deposits until more floating-rate loans reprice. But how long can they wait before depositors start demanding higher yields?

April 24 -

The Atlanta company's profits rose on stronger net interest income and investment banking income as well as a tax maneuver.

April 21 -

Executives at BB&T, KeyCorp and Citizens are milking commercial lending niches and balancing cost control with new investments while waiting for more rate hikes to fatten margins.

April 20 -

First-quarter earnings at the Providence, R.I., company jumped 45% thanks partly to improvements in its net interest margin, 7% loan growth and stronger card and other noninterest income.

April 20 -

Bank of America beat expectations in several categories, including earnings per share, revenue and net interest margin.

April 18 -

A new accounting policy and improved profit margins fueled M&T Bank’s double-digit profit growth in the first quarter.

April 17 -

Earnings season kicked off with some banks capitalizing better than others on higher rates and still-low deposit costs. Banks will have to keep working on that balance as they contend with rising credit card losses, slower commercial lending and other issues.

April 13 -

A 9% increase in net interest income more than offset rising expenses at the Kansas City, Mo., company.

April 13 -

Business confidence remains high, but Fed data shows commercial borrowing actually decelerated during the first quarter. Fortunately for banks, rate hikes have fattened margins.

April 7