-

The North Carolina bank is the latest regional to experience a widespread outage.

February 23 -

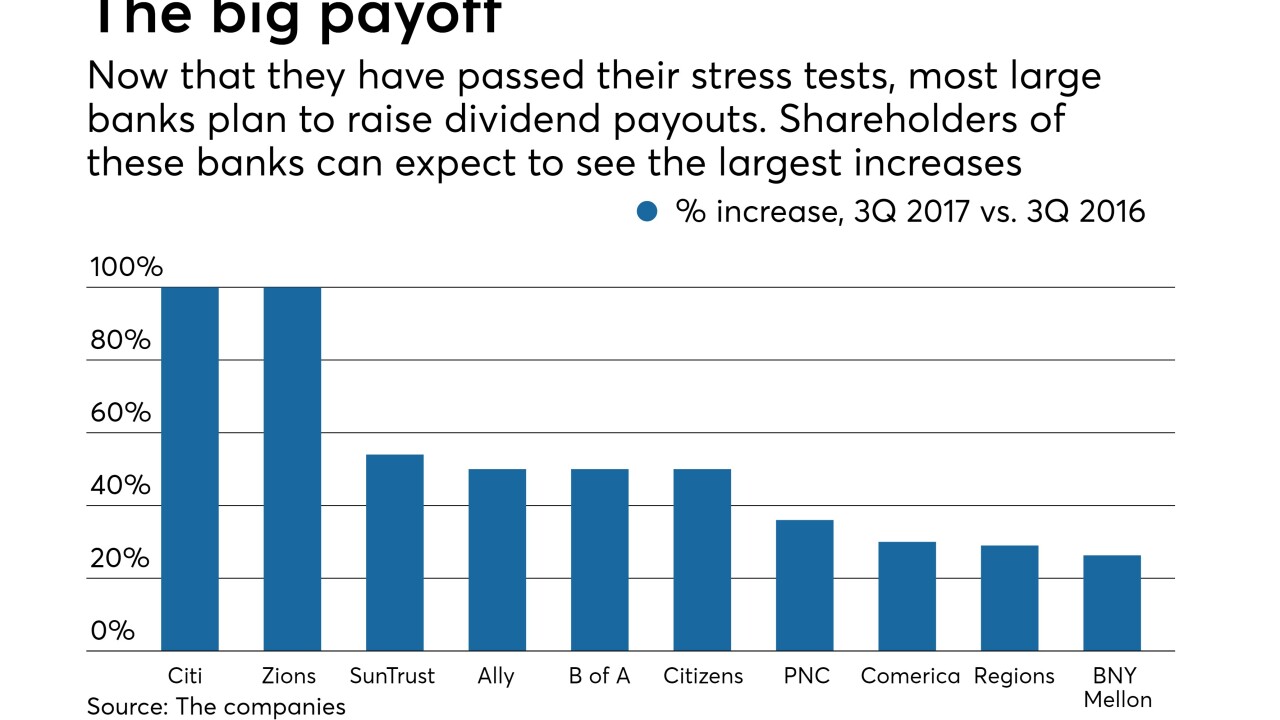

Banks may start paying special dividends now that capital levels have improved.

February 23 -

Look for banks to boost dividend payouts, expand into new markets, increase their tech spending and, eventually, ramp up their C&I lending. But don't expect much in the way of M&A.

January 21 -

The move comes at a time when banks are becoming more aggressive in acquiring or investing in financial technology companies.

January 17 -

After a six-month transition period, Mark Midkiff will succeed Bill Hartmann later this year.

January 3 -

It’s only early December, but bank CEOs’ comments this week about tax reform, their thirst for deposits, consumer lending initiatives, and challenges in commercial lending offer a sneak peek at what’s coming when earnings season begins next month.

December 7 -

New York Fed chief cautions against taking “meat cleaver” to Dodd-Frank; Stephanie Cohen, one of the highest-ranking women at the bank, will try finding new sources of revenue.

November 7 -

Flush with capital and facing stiff competition for customers, many regional banks appear to be mulling acquisitions to accelerate growth.

October 20 -

Dramatic changes in the way banking services are delivered combined with slow economic growth has resulted in too many banks chasing too little business, said BB&T's CEO.

October 19 -

Chenault to leave credit card giant helm after 16 years, vice chairman will take his place; Brett Redfearn named the agency’s director of trading and markets.

October 19 -

Total loans fell 1.6% at the North Carolina-based regional bank, which has been scaling back in key segments such as residential mortgages and auto. Wider margins offset that reduction, but earnings were flat and revenue growth small.

October 19 -

Flush with cash, many commercial firms are also opting to pay down debt rather than take on new loans, and those seeking financing aren’t always turning to banks to meet their needs.

September 15 -

Credit card issuers have been trying to outdo each other to offer the best rewards program. And it shows, as customer satisfaction rates with many (but not all) of their banks have never been higher in a yearly J.D. Power study. But they may not last forever.

August 17 -

As much as $2.5 trillion, or nearly half of bank deposit growth since the crisis, may be attributable to the central bank's quantitative easing. If investors start drawing down on their accounts to buy back assets from the Fed, the trend could dampen liquidity at certain banks, add upward pressure on deposit prices and reshape M&A.

July 31 -

The regional bank reported an 8% gain in fee income and trimmed costs amid 1% loan growth.

July 20 -

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29 -

Following are notable cases where banks were tripped up by the Fed's stress tests either by flunking the numbers (or quantitative) part of the test or raising red flags on a qualitative basis.

June 19 -

With the first half of 2017 drawing to a close, bank executives gathered this week at the Morgan Stanley Financial Services conference to discuss their companies’ performance thus far and, more important, outline their priorities for the rest of the year and beyond. Here are some of the highlights.

June 15 -

CEO Kelly King also did not rule out a return to bank M&A now that BB&T has completed the integration of Susquehanna Bancshares and National Penn Bancshares.

June 13 -

Attractive demographics, a large supply of startups that appeared built to sell and a surplus of smaller banks struggling with high expenses have combined to make the Mid-Atlantic one of the most active regions for mergers and acquisitions.

May 17