Huntington Bancshares

Huntington Bancshares

Huntington Bancshares is a regional bank holding company headquartered in Columbus, Ohio. The bank has a network of branches and ATMs across eight Midwestern states.

-

Banks that scored high in customer-satisfaction ratings did so for their front-line service, not their tech capabilities, a study finds.

March 30 -

Some top bank executives — at big and regional institutions alike — enjoy premium perks, including personal travel on corporate aircraft and minimal wait times for fancy medical exams. Here’s an overview of the special items disclosed to investors so far this year.

March 21 -

Many of the industry’s top executives — at big and regional banks alike — enjoy premium perks, including personal travel on corporate aircraft and minimal wait times for fancy medical exams. Here’s an overview of the special items disclosed to investors so far this year.

March 21 -

Huntington executives are surprised that chargeoffs are still so low and say they're prepared for things to get worse, yet they remain aggressive in auto and other categories. The juxtaposition is a sign of the times for lenders.

October 25 -

Efforts to make it easier for small businesses to apply for SBA loans, coupled with key community banks' outreach initiatives, contributed to the third consecutive record for 7(a) lending, but credit union participation is still lagging.

October 13 -

What's more important than which job you take? Which company you work for. That is one of the lessons Huntington’s Mary Navarro learned in her 42 years in banking.

October 12 -

Efforts to make it easier for smaller businesses to apply for SBA loans, coupled by concerted expansion efforts among key regional and community banks, contributed to the third consecutive record for 7(a) lending.

October 11 -

The financial crisis gave Mary Navarro an unprecedented opportunity to change banking for the better — and she delivered.

October 5 -

As Huntington's chief regulatory liaison, Helga Houston deserves much of the credit for the fact that the Fed approved the FirstMerit acquisition in just 185 days.

September 25 -

Sandy Pierce's myriad responsibilities include managing Huntington’s 18 regional bank presidents, overseeing its private bank and leading all activities in Michigan.

September 25 -

The tie-up comes as banks put more resources into helping customers manage their finances digitally.

August 3 -

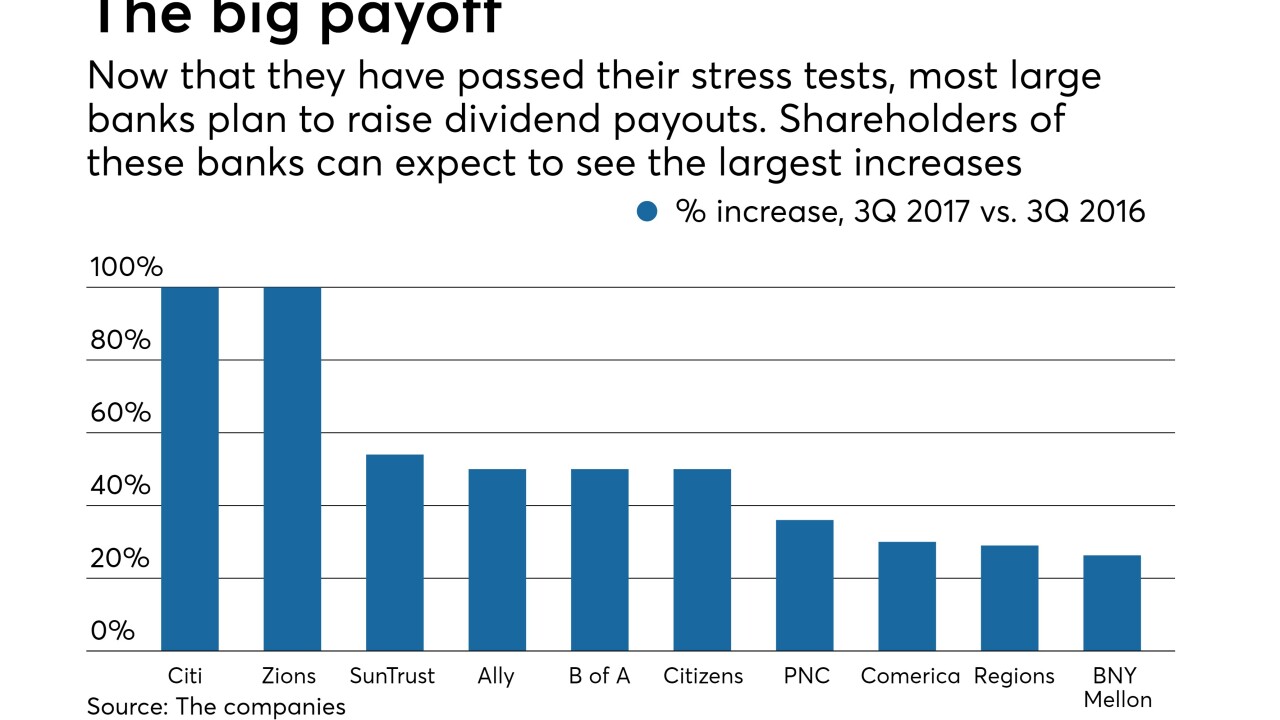

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29 -

The largest banks announced plans to distribute capital back to shareholders after the Fed gave passing grades to everyone following this year’s CCAR stress tests.

June 28 -

Even with card defaults ticking up slightly, regional banks remain committed to pursuing more credit card business as they look to both diversify their balance sheets and deepen relationships with customers.

June 27 -

Fifth Third, Huntington Bancshares and KeyCorp are among the companies backing an effort to bring startups to the Buckeye State.

May 9 -

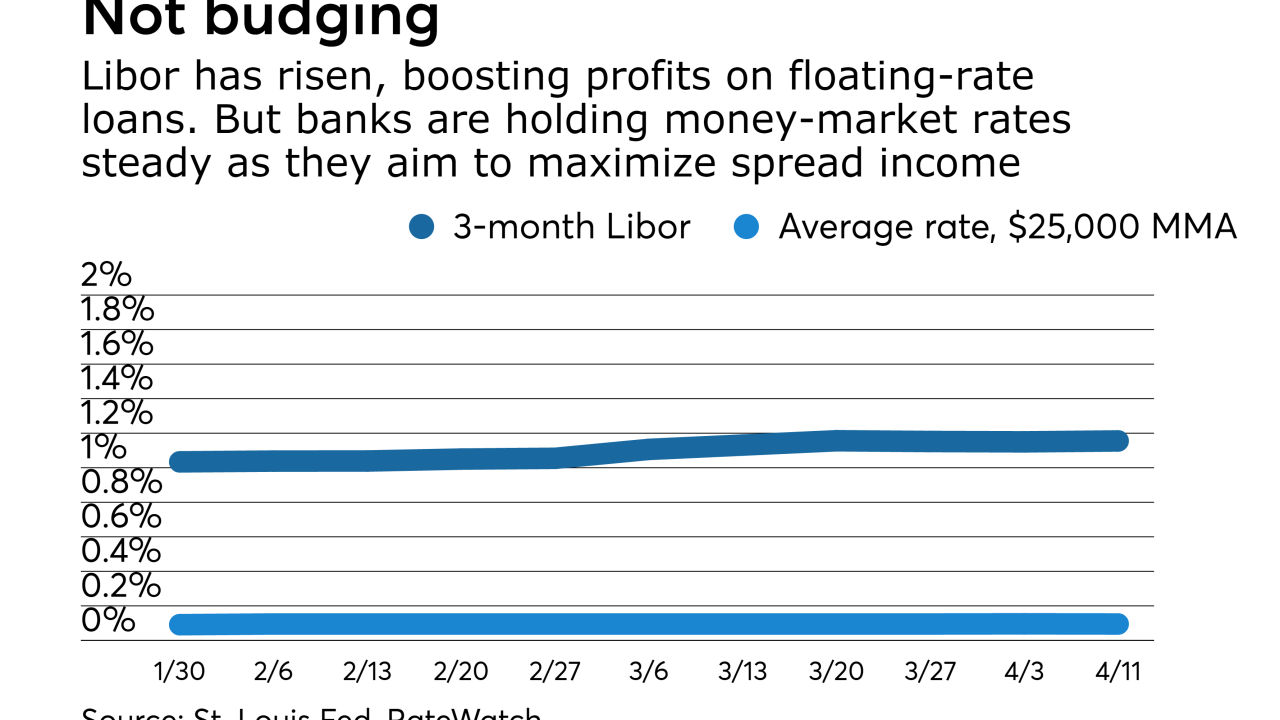

Even with net interest margins improving, banks are reluctant to raise rates on deposits until more floating-rate loans reprice. But how long can they wait before depositors start demanding higher yields?

April 24 -

Huntington, Wintrust and Eagle reported extremely low quarterly chargeoff ratios, and their CEOs say they remain confident about the future. But, as one observer says, "ultimately some sector is going to get overextended."

April 19 -

Opus Bank has added Paul Greig, who was CEO of FirstMerit until its sale in July, as a director.

April 11 -

Andy Harmening will succeed longtime retail banking chief Mary Navarro, who is retiring in June.

March 23 -

Huntington Bancshares says it is especially well positioned to benefit from a commercial lending boom that could accompany a revival of U.S. heavy industry, but other lenders also say they are upbeat.

January 25