-

Industry observers are skeptical of acting Comptroller Keith Noreika's claims that his agency could grant a fintech charter to a commercial firm like Amazon or Google, arguing that such a move could become "Walmart 2.0."

October 3 -

Leslie Ireland, a former assistant secretary for intelligence and analysis at the Treasury Department, was also elected to the bank's board.

October 2 -

Meetings between bank regulators and technology giants like Amazon and PayPal underscore Silicon Valley's growing involvement in the financial services arena, and may presage pursuit of a bank charter.

September 29 -

Washington Federal is the latest bank to pull an application after being flagged for insufficient Bank Secrecy Act compliance.

September 29 -

Acting Comptroller of the Currency Keith Noreika affirmed Thursday that the agency’s fintech charter, if implemented, could be granted to commercial firms like Walmart or Google.

September 28 -

The proposal is aimed at a simpler capital regime particularly for community banks, but some industry representatives and regulators themselves questioned whether the plan went far enough.

September 27 -

How most banks obtain deposits has changed radically over the past 30 years, thanks in part to innovation. It is time for regulators to rethink their notion of what constitutes a quality deposit portfolio.

September 27 MainStreet Bank

MainStreet Bank -

Acting Comptroller of the Currency Keith Noreika on Monday gave a ringing endorsement to online lenders seeking to expand into banking, suggesting they should consider taking deposits and seek out national bank charters as they mature.

September 25 -

Readers chime in on debates about ILCs, the CFPB’s arbitration rule, the financial services ambitions of tech firms and more.

September 22 -

The Trump administration is prepping recommendations to address shortcomings in the capital markets in a report to be released next month, a top Treasury Department official said Monday.

September 18 -

David Dotherow, CEO of the newly formed Winter Park National Bank, stresses the need for strong management and a straightforward business plan when applying for a charter.

September 15 -

Few lawmakers have stated positions on fintech applications for industrial loan company charters. It may not stay that way.

September 13 -

Square became the third fintech firm in recent months to seek out a bank charter. Others are likely to follow.

September 11 -

The nominations of Randal Quarles as Federal Reserve Board vice chairman and Joseph Otting as comptroller of the currency will now head to the full Senate.

September 7 -

The debate over the separation of banking and commerce has come roaring back, but instead of Walmart in a spotlight role, many banks have centered on a player they see as the new villain: fintech.

September 5 -

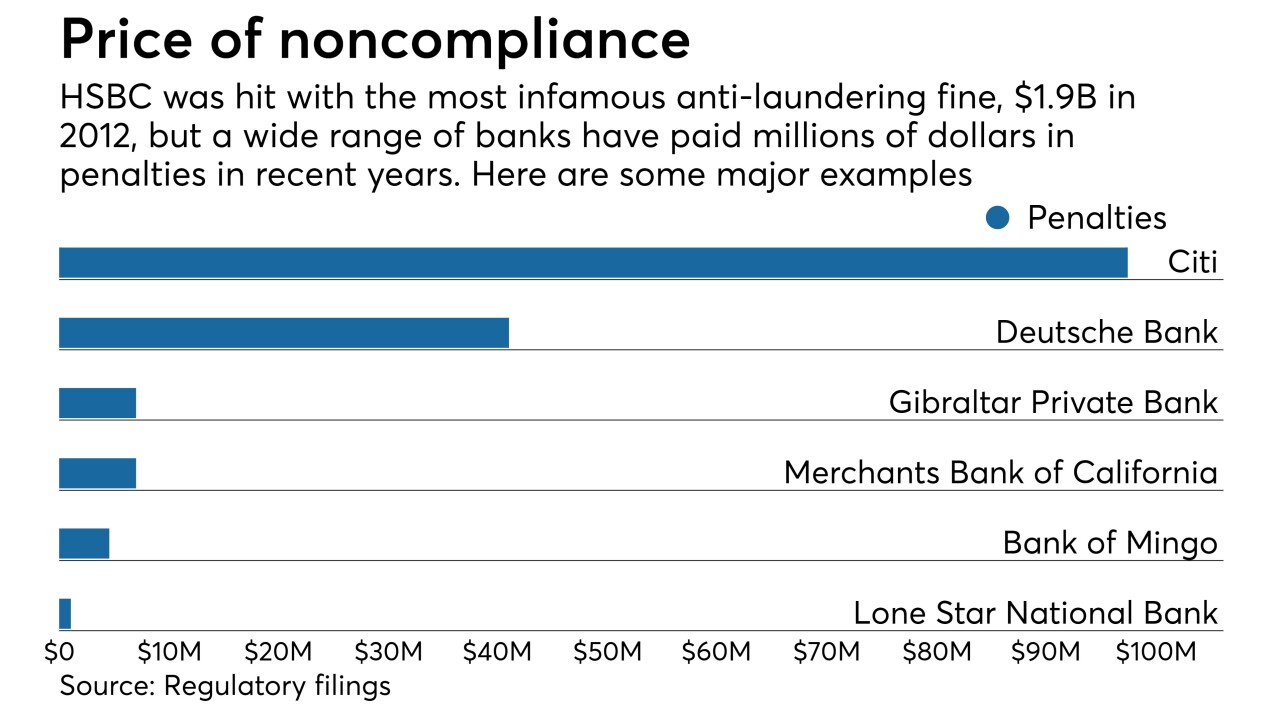

Nothing like revelations of a client’s Ponzi scheme that lead to your bank paying $4 million in anti-money-laundering fines. That’s what happened at Gibraltar Private Bank & Trust, but its CEO argues its compliance overhaul has given the bank a competitive advantage in cosmopolitan New York and South Florida.

September 5 -

The Office of the Comptroller of the Currency and Federal Deposit Insurance Corp. have signed off on an abbreviation of the settlement cycle for securities to two days from three days.

September 1 -

The rule limiting the largest U.S. banks’ ability to enter into contracts with early termination clauses is intended to forestall a liquidity crunch if the bank is under stress.

September 1 -

The Fed's order noted that Sterling had clarified errors in its Community Reinvestment Act data before receiving a "satisfactory" rating from the OCC.

-

Acting Comptroller of the Currency Keith Noreika is questioning the sincerity of recent steps by the FDIC to encourage de novo applications.

August 25