Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Sen. Elizabeth Warren, D-Mass., asked Federal Reserve Chair Janet Yellen on Monday to remove 12 Wells Fargo board members because of the fake-accounts scandal.

June 19 -

U.S. C&I loan growth has dropped below that of the eurozone for the first time in six years; bank employee says Chase discriminates against fathers when it comes to family leave.

June 16 -

The most innovative projects shared at Digital Banking 2017 involve embedding banking in popular devices and apps like Facebook Messenger and Amazon Echo.

June 15 -

While the courts have affirmed cities’ right to file predatory lending suits, they are also now holding them to a much higher standard in proving that banks knowingly steered minority borrowers into high-cost home loans.

June 14 -

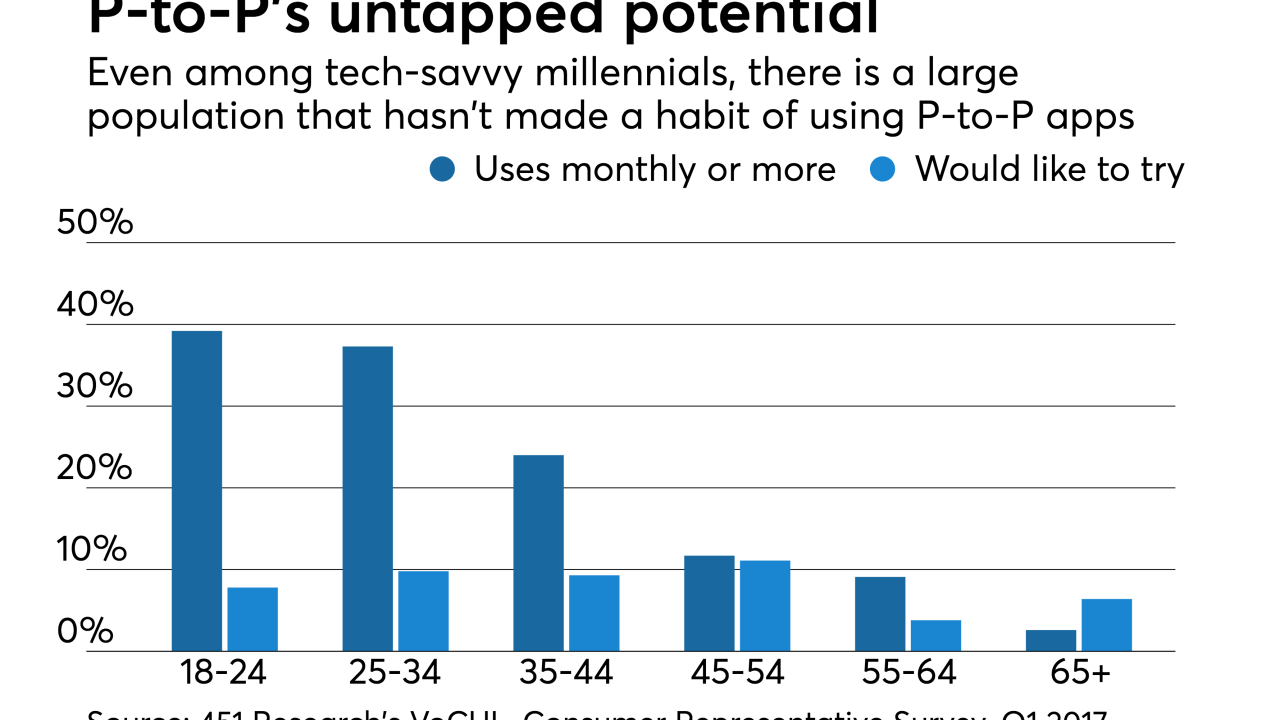

The financial institution-owned person-to-person network formally went live Monday, enabling direct transfer of funds across 30 U.S. FIs. There are a lot of questions around whether it can compete with the current kings of P-to-P — Venmo and PayPal — but Zelle may not be aiming to take them head-on just yet.

June 12 -

Wells Fargo, which is expanding its investment banking unit, has hired Mike Mayo to oversee U.S. large-cap bank research.

June 12 -

The bank-owned person-to-person network formally went live Monday, enabling direct transfer of funds across 30 U.S. financial institutions. There are a lot of questions around whether it can compete with the current kings of P-to-P — Venmo and PayPal — but Zelle may not be aiming to take them head-on just yet.

June 12 -

The San Francisco company is combining its regional and area president positions into a single role called region bank president.

June 9 -

The following is a recap of the 2017 slate of honorees picked by the tech journalists at American Banker, led by Digital Banker of the Year Michelle Moore of Bank of America and including four finalists.

June 8 -

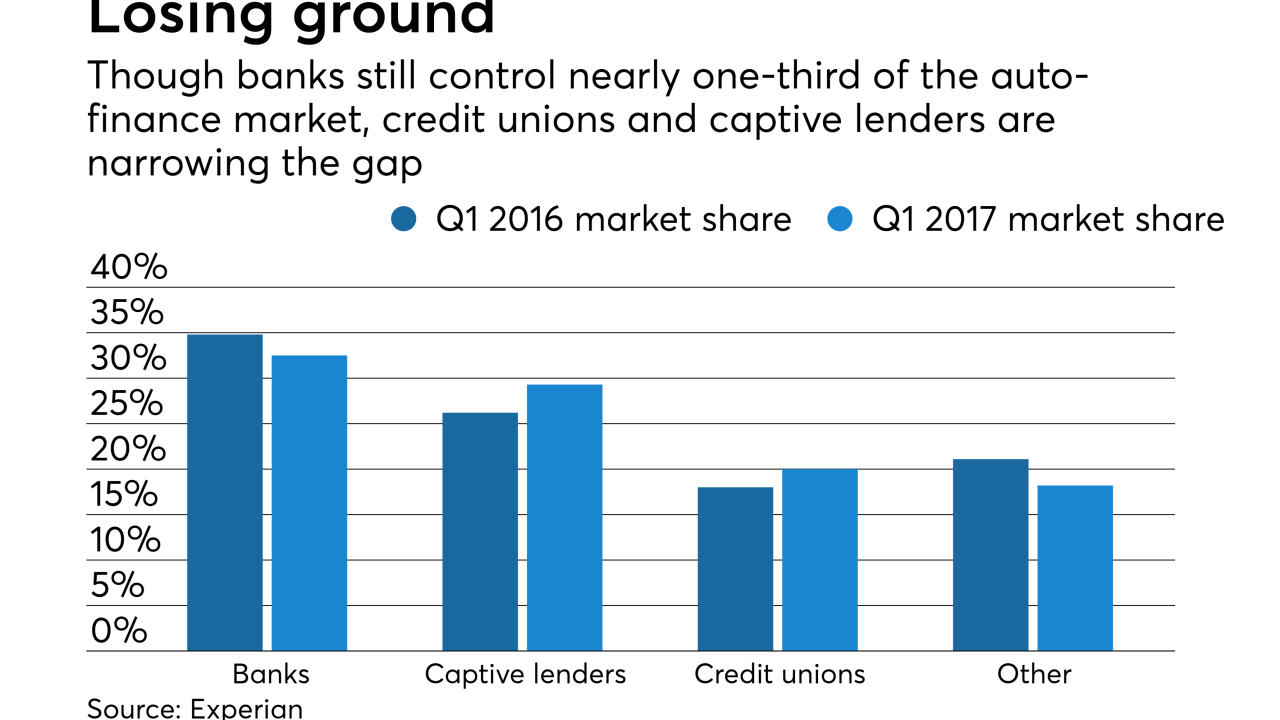

Large banks have scaled back lending as competition has intensified and credit unions and financing arms of car manufacturers are picking up the slack.

June 8 -

Bill would replace much of Dodd-Frank but is unlikely to become law; online retailer is expected to expand Amazon Lending program to small businesses in the U.S., U.K. and Japan.

June 8 -

By making it easier and safer to share data with third parties, Wells Fargo's Brett Pitts says he is strengthening the bank's relationships with customers.

June 7 -

Large banks have scaled back lending as competition has intensified and credit unions and financing arms of car manufacturers are picking up the slack.

June 7 -

Spain's largest bank to pay a little over a dollar to save troubled domestic rival Banco Popular; House finance committee says CFPB director dragged his feet on Wells phony accounts scandal.

June 7 -

President to name former One West lieutenant to Treasury Secretary Steven Mnuchin to head OCC; Wells plunges to number 100 from seventh in Barron's rankings of most respected public companies.

June 6 -

Executives at Wells Fargo, SunTrust and PNC insist that credit cards, mortgages and other consumer lines can help pick up the slack as commercial borrowers remain cautious.

June 1 -

Wells Fargo's David Carroll, who had pay clawed back after the bank's fake-accounts scandal, will retire and be succeeded by Jonathan Weiss as wealth and investment management chief.

June 1 -

Stocks in big banks have fallen by double-digit percentages since early March amid "fading hopes" of stimulus; Wells won't be able to manage municipal bond deals in New York for at least a year.

June 1 -

New York Mayor Bill de Blasio and Comptroller Scott Stringer are pushing to prevent the city from hiring Wells Fargo to lead bond sales or handle other banking business until it improves its track record of lending in poor communities.

May 31 -

Wells Fargo streamlines Western unit, shifts executives as post-scandal overhaul continues; Goldman Sachs gets grief for "cynical" purchase of Venezuelan bonds at deep discount.

May 31