-

U.S. payments consultancy FIME has added Discover's payment application specification (D-PAS) accreditation to the Pulse ATM network, allowing it to provide guidance and support services on EMV chip technology for acquirers and issuers unfamiliar with D-PAS.

November 29 -

Jane Fraser, chief executive of Citigroup Latin America, explains how changes the company has made to its business model in that region are working so far.

November 28 -

The Michigan company, which lost more than $1.4 billion in the aftermath of the financial crisis, is trying to become more of a commercial lender. Its recent agreement to buy a deposit-rich franchise in California could help it get there.

November 21 -

The Tennessee branches are being sold as part of First Horizon's deal to buy Capital.

November 20 -

While technology will let many banks cut staff and reduce the size of branches, factors such as geography, customer demographics and strategic direction will ultimately shape the look and feel of future offices.

November 16 -

The company, which had launched an at-the-market offering in late May, plans to use the proceeds for organic growth.

November 16 -

Bridge Bancorp, which plans to rebrand is bank as BNB Bank, also plans to boost 2018 profit by $3.3 million by closing 14% of its branches.

November 16 -

The planned sale will also include $70 million of loans in southern California.

November 13 -

Most of Sterling Bancorp's operations are in San Francisco and Los Angeles. The company plans to use some of the $93 million it will raise to expand in New York and Seattle.

November 9 -

Pat Hickman, CEO of Happy State Bank, wants his institution to remain viable in the face of stifling regulation. As for selling? That'll happen over his dead body, he says.

November 9 -

Rather than pull up stakes and leave two low-income Mississippi towns at the mercy of payday lenders, Regions Bank donated the branches to a local credit union and kicked in another $500,000 for operating costs.

November 7 -

Community banks are spending on technology to expand without having to build new branches.

November 3 -

Focus on ensuring your teams know why you make changes, and they will be far more likely to make those changes work for you.

November 1

-

It's been a decent year for banks, especially given the industry's return on assets hit a 10-year high. But there are signs it might not last. With Halloween near, here is a look at some potentially frightening developments that could keep bankers up at night.

October 29 -

Cort O’Haver, the successor to Ray Davis at Umpqua, has a plan to preserve human relationships in mobile and online banking.

October 25 -

Dramatic changes in the way banking services are delivered combined with slow economic growth has resulted in too many banks chasing too little business, said BB&T's CEO.

October 19 -

Diebold Nixdorf is a well-known provider of ATMs, but in an increasingly cashless economy it needs to apply its expertise in new ways.

October 19 -

"I’m not going to step aside because I’m an asset for this company," Tim Sloan said Wednesday, rejecting arguments by some Senate Democrats that he is too tied to the phony-accounts scandal.

October 18 -

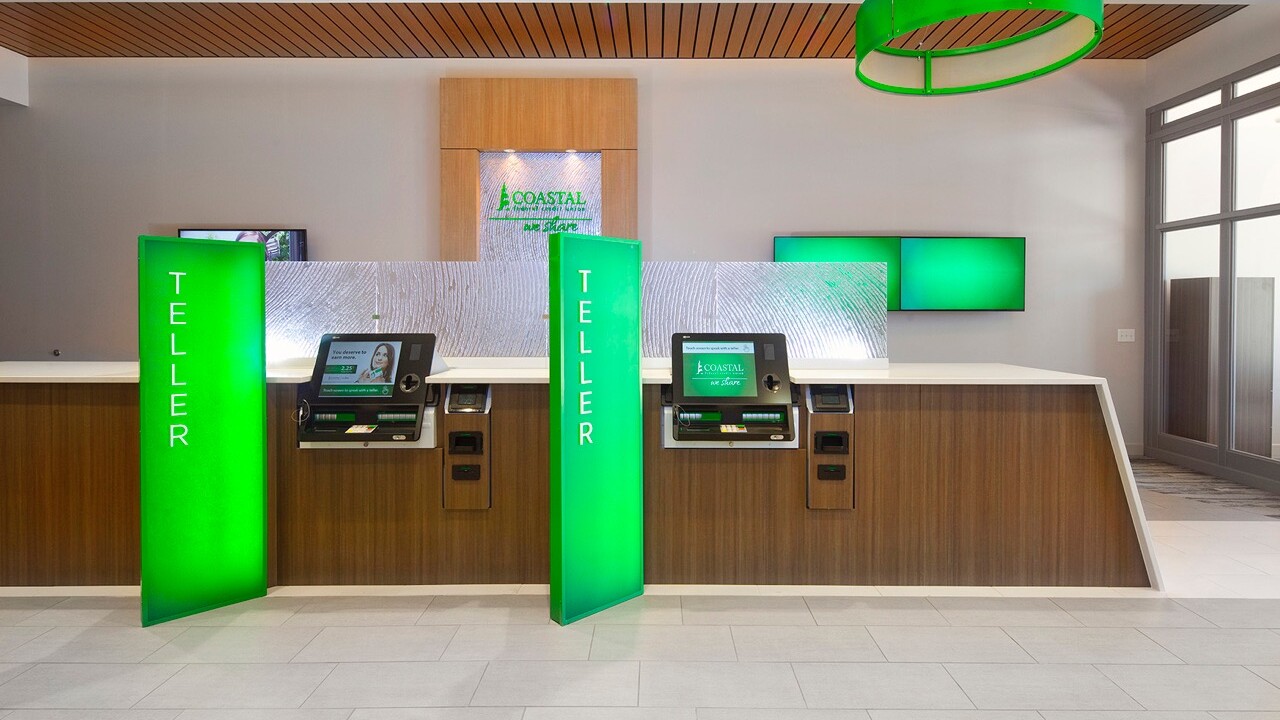

CU Journal's annual awards recognize new innovations that have demonstrated concrete results, giving readers a host of great ideas to use.

October 16 Credit Union Journal

Credit Union Journal -

Along with increased efficiencies, one branch has seen membership nearly quadruple in less than a year.

October 16