Community banking

Community banking

-

Buying Capital Bank puts the company on a fast track for more regulatory scrutiny. Executives are identifying ways to boost revenue and taking other measures so it can handle the change.

July 14 -

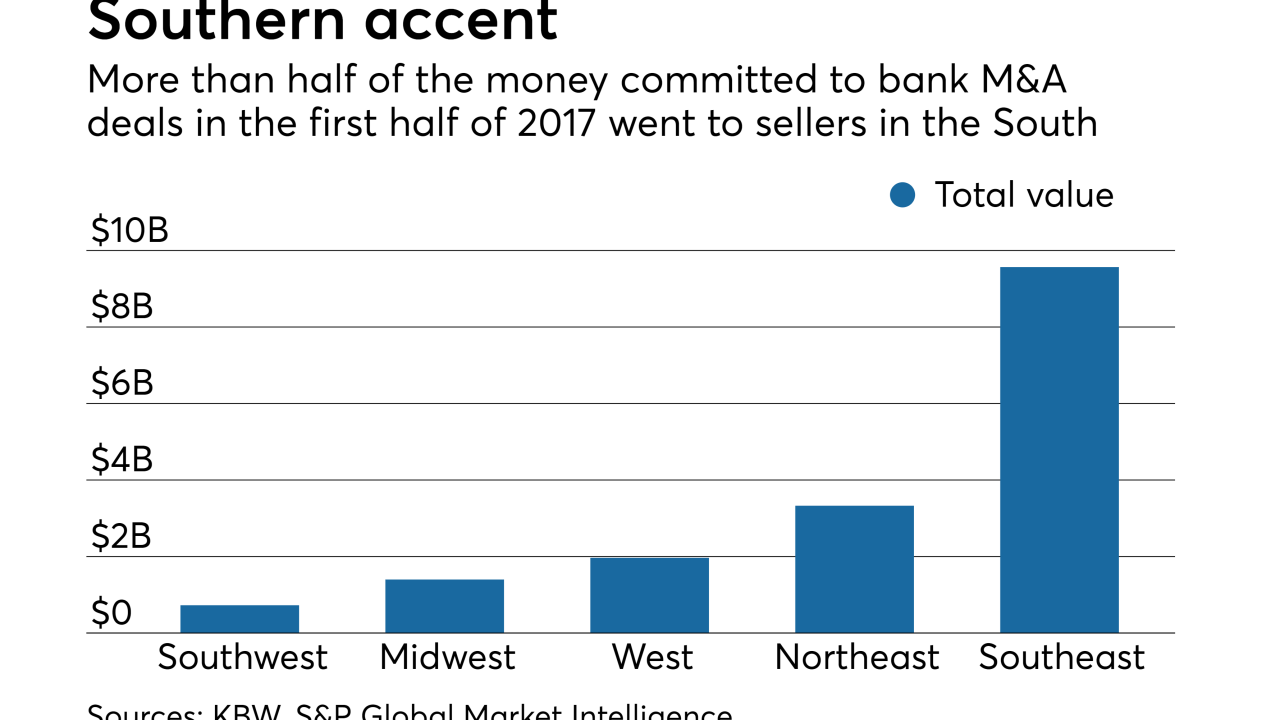

While industry consolidation remains slow compared with previous years, certain regions are humming along with strong volume and improved pricing. Here’s a look at each region based on June 30 data from KBW and S&P Global Market Intelligence.

July 14 -

Several RBB Bancorp executives and directors, including CEO Alan Thian, will also sell a significant number of shares when the Los Angeles company goes public.

July 14 -

Readers slam credit unions’ ever-inclusive membership criteria, weigh in on the OCC’s proposed fintech charter, encourage a rewrite of the CRA, and more.

July 14 -

A community bank gets taken to task by the Equal Employment Opportunity Commission. Tennis player Andy Murray makes his mom — and lots of other women — proud at Wimbledon. Also, the Bank of England's Charlotte Hogg and Morgan Stanley's Naureen Hassan.

July 13 -

First Citizens is pressuring KS Bancorp to sell even though the banks' operations overlap in many markets in eastern North Carolina.

July 13 -

Working with Sungage Financial will help NBT Bancorp diversify its consumer loan portfolio and learn from a fintech startup with a speedy credit approval process.

July 13 -

WSFS is implementing a new internal audit program and shoring up the succession planning in its risk department.

July 13 -

Stopping house fires, reducing poverty, protecting consumers and other ways credit unions are giving back.

July 13 -

The North Carolina company could issue $200 million in new securities over time to fund acquisitions and other investments.

July 13 -

Property Assessed Clean Energy loans can no longer be offered in unincorporated areas of Kern County, Calif. The controversial loans, meant to promote energy efficiency, began in California and are now offered in a number of states.

July 12 -

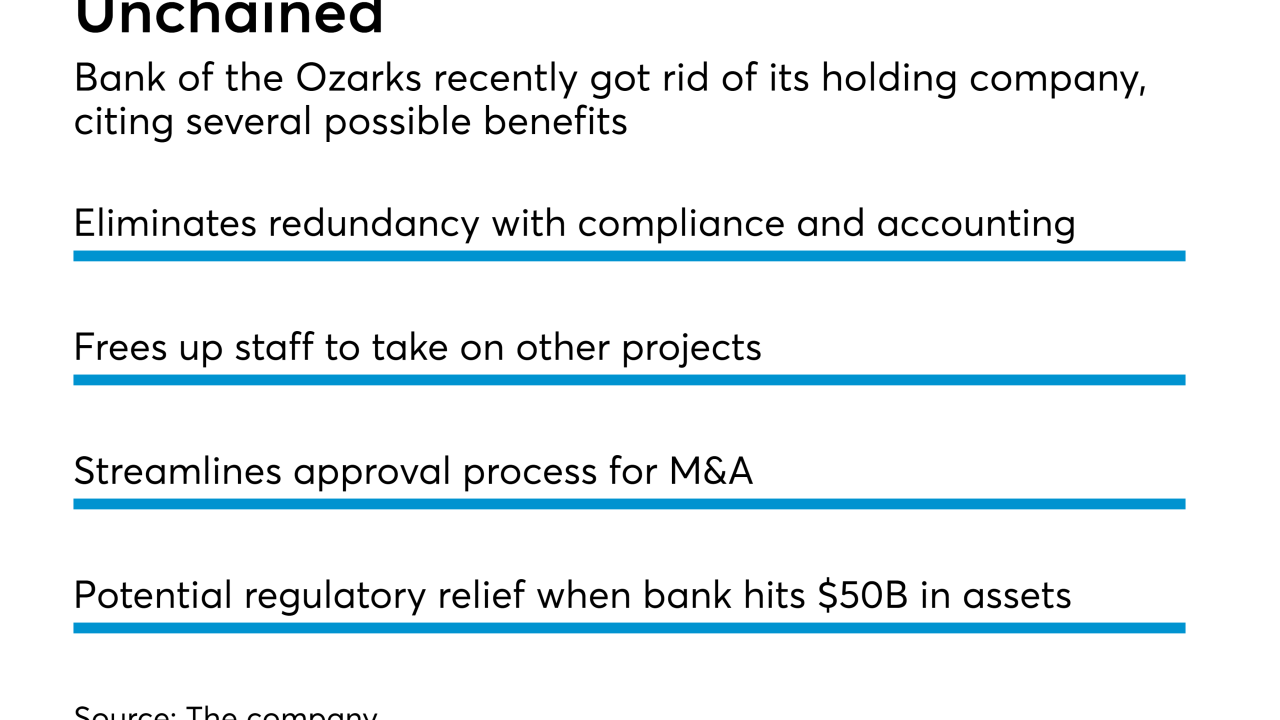

Bank of the Ozarks recently dissolved its holding company in a move that goes against modern banking strategy. There are, however, strong arguments for other institutions to follow the bank's lead.

July 12 -

The Arkansas bank bought C1 Financial in Florida and Community & Southern Holdings in Georgia last year.

July 12 -

The Treasury Department will take a huge hit when Cecil Bancorp sells its bank, while 1st Mariner Bank in Baltimore will see its equity stake completely wiped out. Cecil opted for bankruptcy court when it was unable to resolve an impasse over its trust-preferred stock.

July 11 -

The former Triumph Capital Advisors doubled its business by acquiring Doral Bank's CLO assets; Dodd-Frank’s “skin in the game” regs spurred its spinoff as a vehicle of the deep-pocketed Pine Brook.

July 11 -

Severn said it believes Mid Maryland Title Co. will complement its existing dealings in mortgages, commercial banking and commercial real estate.

July 10 -

Sponsorships, celebrations, education and other ways credit unions are giving back.

July 10 -

The region is responsible for a third of all bank sellers — and more than half of the industry's overall deal volume.

July 10 -

Expansions, donations and 500 pounds of crawfish.

July 7 -

ESSA Bank & Trust has successfully worked with a federal program that helps former prisoners in some eastern Pennsylvania towns get back into society, and it plans to expand the program to the Philadelphia market.

July 7