Community banking

Community banking

-

With National Small Business Week set to kick off April 30, American Banker asked several community bankers to share stories of high-impact loans that made a difference in their communities and in their own enthusiasm for the work they do.

April 19 -

The Mississippi company reported loan growth but a dip in profits after a first-quarter acquisition, and it warned that it is on alert for any new “lag” in the energy sector.

April 18 -

The Trump administration's proposed budget would cut discretionary funding for the Department of Agriculture, which could affect a key agency lending program. Bankers are urging legislators to maintain, or even increase, funding.

April 17 -

From big surprises to big donations and honoring the legacy of a merged credit union, here's how CUs are giving back and paying it forward.

April 17 -

Whether with reliable programs repeated for years on end or innovative new initiatives, credit unions are finding more and more ways to give back to the communities they serve.

April 14 -

The number of U.S. banks has fallen by 24% since the end of 2010, a result of mergers, failures and a dearth of de novo activity. Here are the 10 states with the biggest declines as a percentage of total banks headquartered in the state, according to Federal Deposit Insurance Corp. data.

April 13 -

Whether donating to worthy causes or recommitting to decades-long partnerships, credit unions are putting their best face forward and showing their communities what the CU difference is all about.

April 12 -

The risks associated with a megabank collapse still pose huge problems for the industry, despite assurances from the head of the nation’s largest bank.

April 12 -

These execs say they are finding ways to reduce fixed costs in areas such as branching and personnel, offer appealing tech, yet provide in-person services when customers have concerns.

April 11 -

The Little Rock, Ark., bank said first-quarter profits rose slightly and that it plans to dissolve its holding company to trim regulatory costs.

April 11 -

Opus Bank has added Paul Greig, who was CEO of FirstMerit until its sale in July, as a director.

April 11 -

Carter, who built what became Carter Bank and Trust from the ground up, was praised for his “uncanny” credit acumen, devotion to community and family, and willingness to take unconventional risks.

April 11 -

Specialization — either in types of customers, lines of business or distinct geographies — is one of the best ways for small banks to outdo larger rivals that rely on scale to make money.

April 10 -

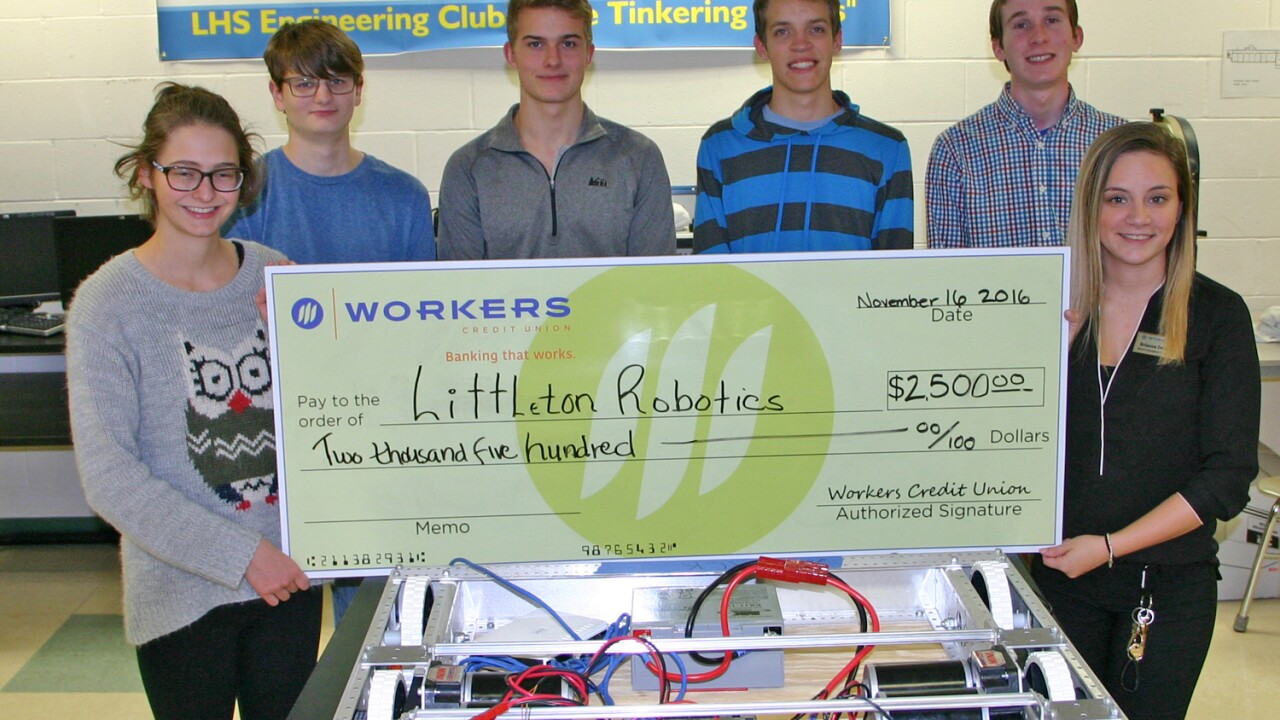

Helping students, those in need or just being a friendly face in the community, credit unions are showcasing their not-for-profit ethos by giving back to those they serve.

April 7 -

A recent survey found that a vast majority of bankers expect lawmakers to make only moderate changes to existing industry regulation.

April 6 -

Arizona, Nevada, Florida and North Carolina have lost more banks than other states, based on the percentage decline since 2010. Each has a unique set of reasons that goes beyond regulation and a dearth of de novo activity.

April 5 -

Disaster relief donations, financial literacy commitments and spreading holiday cheer are all part of the latest round-up of credit union community news.

April 5 -

Financial services was the top industry targeted by malware in 2016, so banks need to be strategic in building their defenses against attacks.

April 5 -

New branches, big donations and all kinds of ways to give back.

April 3 -

Texas Capital ties bankers’ bonuses to loan performance instead of volume. The strategy has aided recruitment and helped the bank achieve exceptional loan growth while keeping credit quality respectable.

April 3