Credit cards

Credit cards

-

Rising losses and chargeoffs at JPMorgan Chase and Citigroup could be an indication of future trouble at other banks. Still, executives are bullish on cards and argue that the loss rates are logical consequences of rate hikes and attempts to expand card business.

October 12 -

On Jun. 30, 2017. Dollars in thousands.

October 10 -

At 1.56%, the delinquency rate on consumer loans remains well below historic averages, the American Bankers Association said Thursday.

October 5 -

Verba's two-decade career at one of the East Coast's fastest-growing banks began with an old-fashioned letter to a local bank when she was in her late 40s and an epiphany about work-life balance.

October 4 -

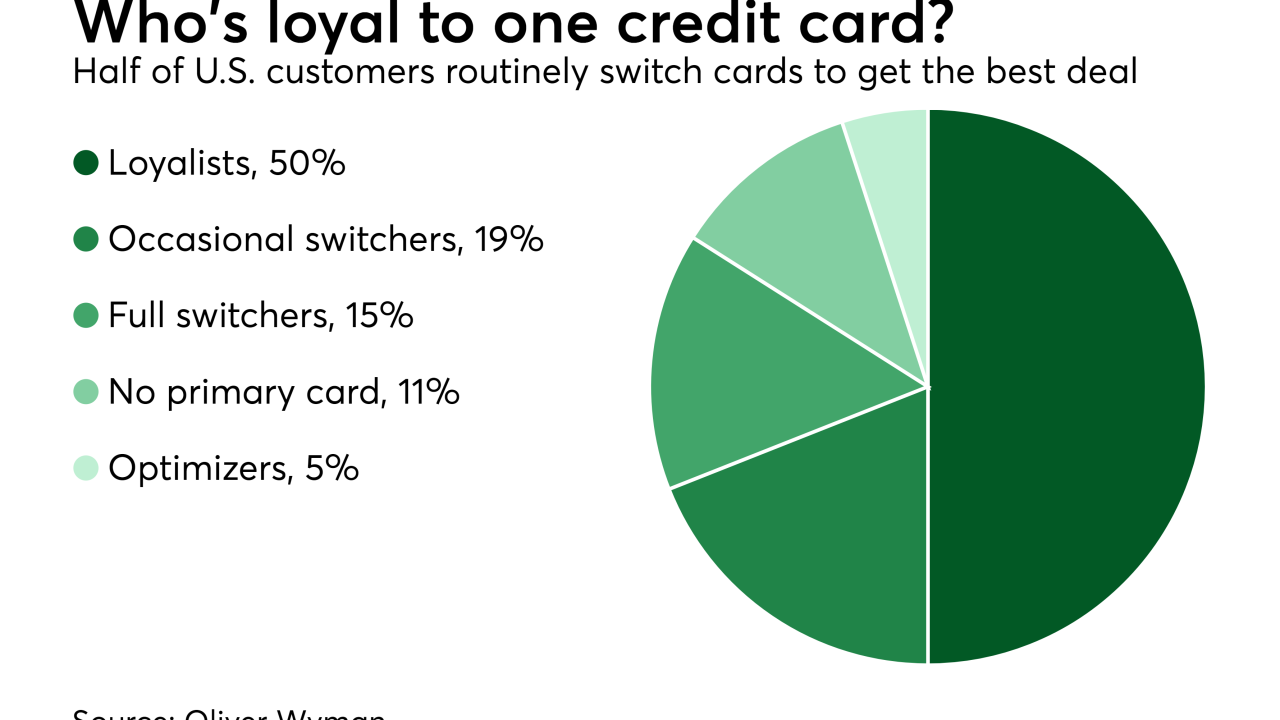

When it comes to credit card profitability, consumer loyalty to a single card may not be such a virtue after all, according to a new study by Oliver Wyman.

October 3 -

The company would not say where the jobs are based or how many positions are being eliminated. The layoffs come as Capital One's investments in digital technology are yielding efficiency gains.

September 29 -

Under Diane Morais, Ally Bank is growing deposits at a rate four times faster than the industry average.

September 25 -

An internal CFPB memo says it was considering a $10 billion fine before settling on $100 million; state suit against credit bureau is likely to be the first of many.

September 20 -

Normally tight-lipped about security moves, bankers tell how they are re-examining their systems for Equifax-like flaws and providing new cards, fresh accounts and reassuring advice for anxious customers.

September 19 -

Credit card benefits aren't worth much to a consumer who has no idea what the card offers, or has forgotten about them over time and simply never uses them.

September 12 -

Citigroup’s struggles with collections on certain types of retail credit card accounts have persisted in the third quarter, but it hopes to contain chargeoffs.

September 11 -

Petal is using machine learning in its new card program to make the most of the scant financial data available from young consumers.

September 8 -

The Wall Street giant on Wednesday played up its customer service skills, saying that representatives of its Marcus personal-loan unit answer calls within 10 seconds.

September 6 -

The 3-year-old order was related to Discover Bank’s programs for combating money laundering. A related agreement with the Federal Reserve Bank of Chicago remains in effect.

August 30 -

The Pay It Plan It feature allows customers to create payment plans for individual purchases, similar to personal loans. The plans include a fixed fee and no interest.

August 30 -

PayPal Holdings Inc. is turning to its old nemesis, plastic, to help it expand beyond the digital realm.

August 30 -

Beverly Anderson, who had held the job on an interim basis since March, leads a unit that has been roiled by the bank's unauthorized-accounts scandal.

August 24 -

American Express charged higher interest rates and annual fees to cardholders in Puerto Rico, the U.S. Virgin Islands and other U.S. territories than in the U.S., the CFPB said Wednesday.

August 23 -

On March 31, 2017. Dollars in thousands

August 18 -

Credit card issuers have been trying to outdo each other to offer the best rewards program. And it shows, as customer satisfaction rates with many (but not all) of their banks have never been higher in a yearly J.D. Power study. But they may not last forever.

August 17