-

House Democrats are ultimately hoping that the Deutsche investigation will provide more information about President Trump’s business dealings with Russia.

June 22 -

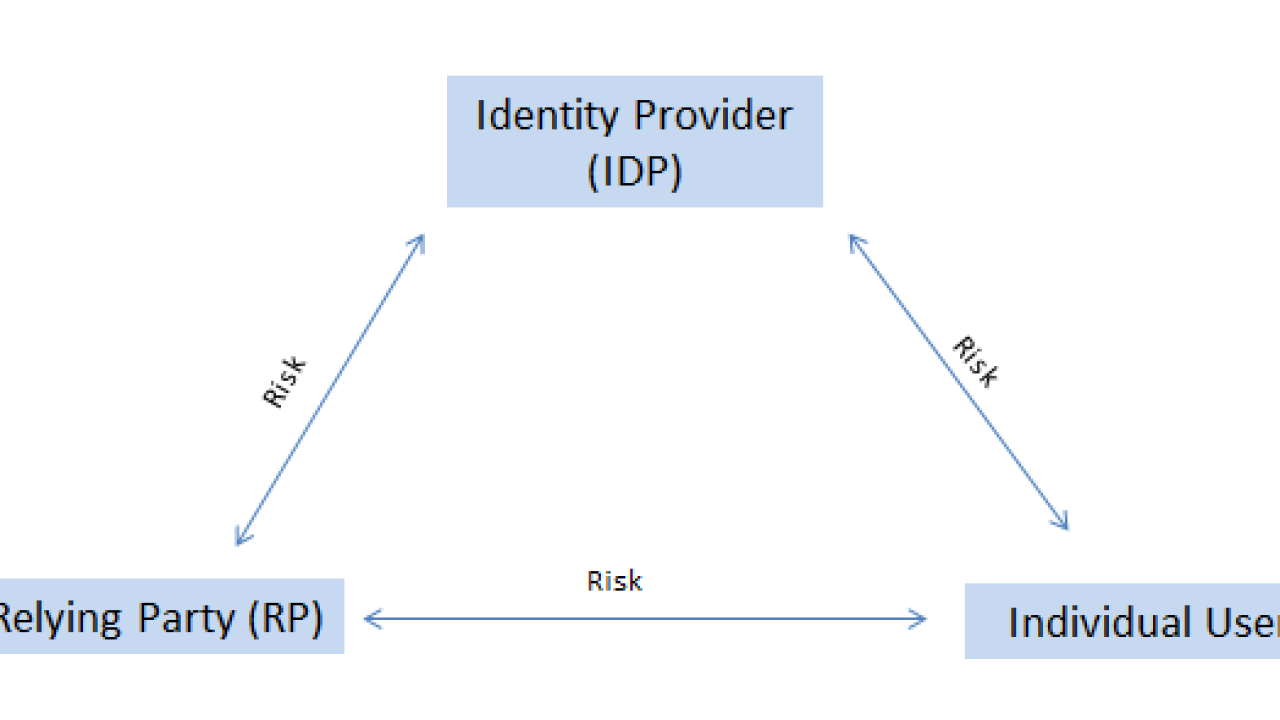

Portable digital identities could improve customer experience, cut costs and generate revenue for banks. But who’s on the hook when something goes wrong?

June 21 -

The plan places a greater burden on bank managers to stop money laundering, with board members overseeing companies caught breaching the law also facing punishment if they fail to intervene.

June 21 -

The Financial Crimes Enforcement Network thanked the $22.4 billion-asset credit union for its BSA reporting, which contributed to solving one of several crimes.

June 16 -

IBM is set to announce new tools on Wednesday aimed at reducing the compliance burden of financial institutions and sifting through the mounds of data they collect by using Watson, its cognitive computer.

June 14 -

As payments get more complex, money laundering and other risks increase. Audits and advanced regulatory technology can help companies keep up, writes Performline CEO Alex Baydin.

June 6 Performline

Performline -

Recent NCUA prohibition orders have included restitution payments ranging from $14 million to $18 million, but it remains to be seen whether such stiff penalties will curb the incidence of fraud at CUs.

June 1 -

This is the second consecutive month that restitution payments for accompanying prohibition orders have exceeded $10 million.

May 31 -

Wells Fargo streamlines Western unit, shifts executives as post-scandal overhaul continues; Goldman Sachs gets grief for "cynical" purchase of Venezuelan bonds at deep discount.

May 31 -

The bank agreed to improve anti-laundering controls deemed "unsafe" by the Fed, including oversight of so-called mirror trades that may have helped foreign customers hide large sums of money.

May 30 -

Retail banking chief Mary Mack made several changes, including restructuring leadership in the Western region, where some of the worst incidents in the Wells scandal were said to have occurred.

May 30 -

Jo Ann Barefoot, a former deputy comptroller of the currency, discusses her regtech startup Hummingbird.

May 26 -

Readers weigh in on a proposal for encouraging small bank installment loans, a firm that uses AI to reduce false alarms, what security improvements are needed for sharing customer data, and more.

May 26 -

House Democrats are asking Deutsche Bank Chief Executive Officer John Cryan for documents related to two internal reviews, including one into accounts held by President Trump and his family.

May 24 -

Brian Moynihan won praise from the Wells Fargo CEO for his handling of subprime, legal and other post-crisis issues during his first years as Bank of America's top executive.

May 23 -

Merlon Intelligence, a startup launching Wednesday, plans to offer banks AI software that will help them with their expensive compliance responsibilities.

May 23 -

Bank agrees to pay $97 million as DOJ drops criminal charges involving money laundering at Citi uni; digital currency price roars past $2,200 as Japanese catch the bitcoin bug.

May 23 -

David McLaughlin, founder and CEO of QuantaVerse, discusses how artificial intelligence can improve anti-money-laundering compliance; the problems of de-risking and "defensive filing" of suspicious activity reports; the Clearing House's proposal to reduce banks' AML costs; and more.

May 23 -

Banamex USA will pay $97.4 million to the Justice Department over widespread anti-money-laundering abuses.

May 22 -

The Trump administration must weigh risks to national security in its review of the $1.2 billion deal. Its decision will shed light on whether — given the president’s “America First” rhetoric — Chinese investment is still welcome in the U.S. financial services sector.

May 18