-

The New Jersey company reported lower quarterly profit that included professional fees tied to addressing an informal order from regulators.

July 28 -

GlobalID stands out from scores of similar companies and projects by attempting to wed self-sovereignty with regulatory compliance. If its technology works, it could alleviate a major cost for banks.

July 28 -

The fine for BTC-e was the Treasury’s first action against a money-services business located in a foreign country, and the second against a virtual currency exchange.

July 27 -

A monitor's report detailing HSBC's compliance with a 2012 agreement with U.S. prosecutors to fix faulty money-laundering controls isn't a judicial document and shouldn't be made public, a federal appeals court said.

July 12 -

Despite assurances that the Department of Justice crackdown on banks' third-party relationships is ceasing, lawmakers say it is still having an impact.

July 11 -

Jerome Powell says it's “now or never” to cut the government’s role in mortgage finance; Justice Department is monitoring eight banks for suspected money laundering.

July 7 -

A judge has approved the inclusion of new payday lenders in a case seeking relief from the effects of Operation Choke Point, and denied defendants' motion for summary judgment against Advance America.

July 6 -

Transaction laundering is gaining steam, and since it uses familiar payment technology, it can be easier to use than virtual currency, writes Ron Teicher of EverCompliant.

July 5 EverCompliant

EverCompliant -

The bill would help financial institutions with customer due diligence and identifying corporate beneficial ownership of business customers.

June 28 -

Payment companies have lots of emerging regulations. Regtech can bring together different stakeholders to ease compliance.

June 27 Waymark Tech

Waymark Tech -

House Democrats are ultimately hoping that the Deutsche investigation will provide more information about President Trump’s business dealings with Russia.

June 22 -

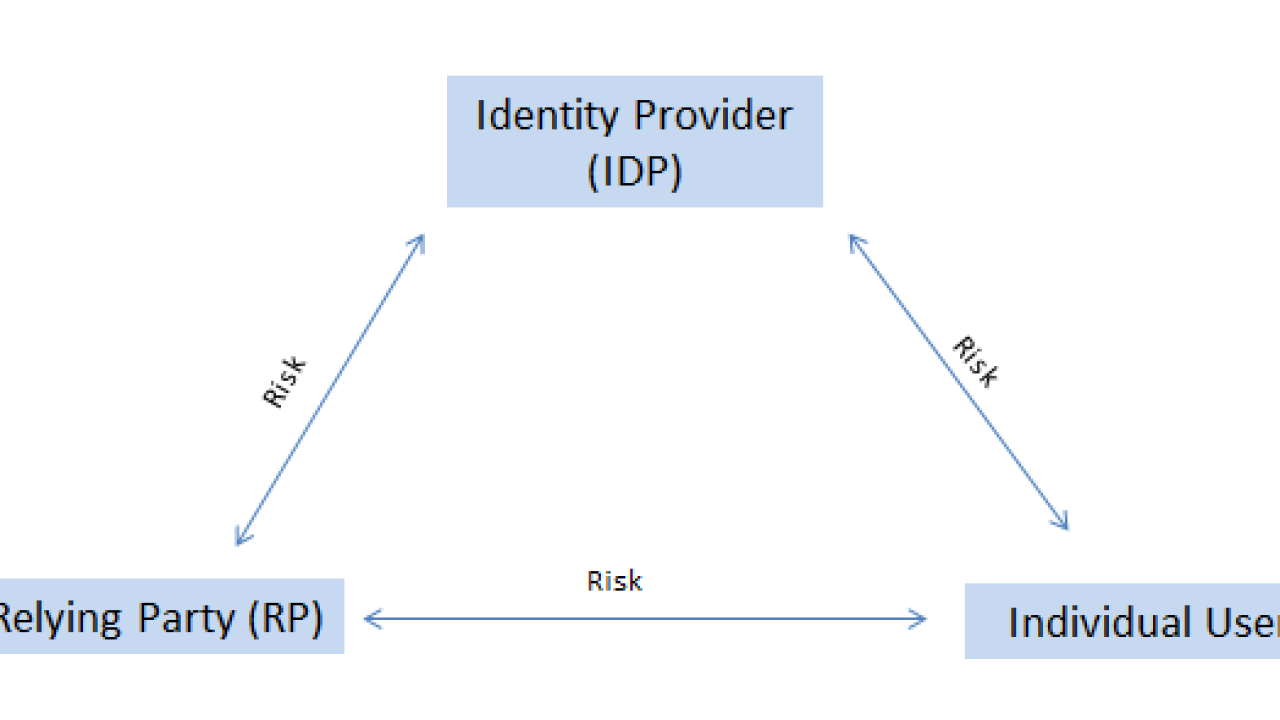

Portable digital identities could improve customer experience, cut costs and generate revenue for banks. But who’s on the hook when something goes wrong?

June 21 -

The plan places a greater burden on bank managers to stop money laundering, with board members overseeing companies caught breaching the law also facing punishment if they fail to intervene.

June 21 -

IBM is set to announce new tools on Wednesday aimed at reducing the compliance burden of financial institutions and sifting through the mounds of data they collect by using Watson, its cognitive computer.

June 14 -

As payments get more complex, money laundering and other risks increase. Audits and advanced regulatory technology can help companies keep up, writes Performline CEO Alex Baydin.

June 6 Performline

Performline -

Wells Fargo streamlines Western unit, shifts executives as post-scandal overhaul continues; Goldman Sachs gets grief for "cynical" purchase of Venezuelan bonds at deep discount.

May 31 -

The bank agreed to improve anti-laundering controls deemed "unsafe" by the Fed, including oversight of so-called mirror trades that may have helped foreign customers hide large sums of money.

May 30 -

Jo Ann Barefoot, a former deputy comptroller of the currency, discusses her regtech startup Hummingbird.

May 26 -

Readers weigh in on a proposal for encouraging small bank installment loans, a firm that uses AI to reduce false alarms, what security improvements are needed for sharing customer data, and more.

May 26 -

House Democrats are asking Deutsche Bank Chief Executive Officer John Cryan for documents related to two internal reviews, including one into accounts held by President Trump and his family.

May 24