The head of the Managed Funds Association takes issue with a recent column calling for stricter oversight of nonbank financial institutions.

-

Jerry Plush had helmed the South Florida-based bank for nearly five years before agreeing to depart this week. News of the leadership change comes little more than a week after Amerant reported a 43% increase in nonperforming assets.

November 6 -

Michael Barr said he believes artificial intelligence will have a positive long-term impact on the economy, though it may cause job losses in the short term.

November 6 -

Custody is the foundation, but the real opportunity for TradFi lies in what comes next

November 6 -

In late 2021, Vast Bank, a regional bank operating throughout Northeast Oklahoma,

November 6 -

The Federal Reserve Board finalized changes to its supervisory rating framework, allowing large bank holding companies to be considered "well managed," even with one deficient rating.

November 6 -

As the emerging form of artificial intelligence impacts payments, pace of payment disputes and the workload will change.

November 6 -

The chairman and CEO of First Independence Bank in Detroit is the new chairman of the American Bankers Association. He said his extensive involvement in industry advocacy roles over the past eight years has made him a better leader.

November 6

Pinnacle and Peapack-Gladstone have sought to preserve their corporate cultures during periods of major change.

Banks with more than $10 billion of assets made up 12% of American Banker's 2025 Best Banks to Work For list.

Of the 90 honorees on American Banker's 2025 Best Banks to Work For list, 28 had between $3 billion and $10 billion of assets.

Reskilling and giving AI the boring work are two approaches banks take to making agentic AI palatable to workers who may fear that bots will take their jobs.

Federal Reserve Gov. Lisa Cook, citing several studies, outlined her concerns Thursday that generative AI could be used to manipulate markets, and regulators have not yet thought through how to police such activity.

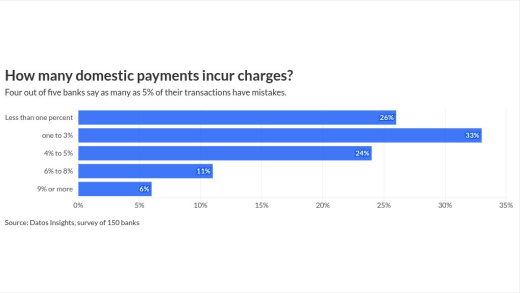

The migration to the standard and its more robust data is underway, but experts say the desired reduction in payment errors will come slowly.

The head of the Managed Funds Association takes issue with a recent column calling for stricter oversight of nonbank financial institutions.

Investigators found text messages, photos of cash and a conspirator wearing a diamond Truist logo ring while unraveling the $1 million fraud attempt.

The credit score firm partnered with Plaid to bring additional cash-flow data into its previously released UltraFICO score.

Reskilling and giving AI the boring work are two approaches banks take to making agentic AI palatable to workers who may fear that bots will take their jobs.

Federal Reserve Gov. Lisa Cook, citing several studies, outlined her concerns Thursday that generative AI could be used to manipulate markets, and regulators have not yet thought through how to police such activity.

The migration to the standard and its more robust data is underway, but experts say the desired reduction in payment errors will come slowly.

The head of the Managed Funds Association takes issue with a recent column calling for stricter oversight of nonbank financial institutions.

Big banks with the strongest financial performance varied in asset size, geographies and services.

Each of the top-performing banks with more than $50 billion of assets used their own mix of revenue streams to drive performance.

Growing loans was a tall order in 2024, but banks that could do just that were able to outperform their peers.

Federal Reserve Gov. Lisa Cook, citing several studies, outlined her concerns Thursday that generative AI could be used to manipulate markets, and regulators have not yet thought through how to police such activity.

The migration to the standard and its more robust data is underway, but experts say the desired reduction in payment errors will come slowly.

The head of the Managed Funds Association takes issue with a recent column calling for stricter oversight of nonbank financial institutions.

Reskilling and giving AI the boring work are two approaches banks take to making agentic AI palatable to workers who may fear that bots will take their jobs.

Federal Reserve Gov. Lisa Cook, citing several studies, outlined her concerns Thursday that generative AI could be used to manipulate markets, and regulators have not yet thought through how to police such activity.

The migration to the standard and its more robust data is underway, but experts say the desired reduction in payment errors will come slowly.

The head of the Managed Funds Association takes issue with a recent column calling for stricter oversight of nonbank financial institutions.

Synthetic fraud — which combines real and false identifying information — has been a niche variety of identity theft for some time. But recent advancements in artificial intelligence and people's access to it might bring it into the mainstream in a big way.

One area of focus for the bank is using advanced artificial intelligence to detect business-email compromise. The payment messaging network Swift and online gambling host Caesars are also using AI to stop people from gaming their systems.

A new inspector general report suggests that grifts were more pervasive than has previously been reported. The Small Business Administration, which drew blame in the watchdog report, took issue with the findings.

Most Influential Women in Payments honorees say the dramatic expansion in technology presents new opportunities and challenges as employers evolve away from traditional business models.

Honorees from American Banker's Most Influential Women in Payments discuss spotting tangible uses for innovation, rather than buying into hype.

Each year, American Banker recognizes the women who are advancing the payments industry in banking, retail, acquiring, processing and more.

-

Former Comptroller of the Currency Eugene Ludwig has written a book called The Mismeasurement of America that lays out the shortcomings of the standard economic data that U.S. government and businesses use to make decisions, and how this data obscures the truth about how low-income Americans are actually faring.

December 2 - The co-founder of Fintech Sandbox says fintech entrepreneurs will figure out how to help Americans struggling with economic stressors.Sponsored by IntraFi

-

BayFirst Financial, which has reported problems with SBA loans, expects to reach an agreement with its regulators in connection with credit administration and other issues.

October 31 -

A report from J.D. Power indicates that the neobank Chime gained the highest percentage of newly opened checking accounts in the third quarter of 2025.

October 31 -

The court upheld the Federal Reserve Board's right to block Custodia from direct access to its payment systems. The bank is considering asking for a rehearing.

October 31 -

The Tacoma, Washington-based bank, which has completed two mergers since 2023, said Thursday that it will buy back up to $700 million of its own shares over the next year.

October 31 -

New York State's former top regulator Adrienne A. Harris has rejoined Sullivan & Cromwell as of counsel and senior policy advisor; Founders Bank appointed Karen Grau to its board of directors; Deutsche Bank's DWS Group is opening an office in Abu Dhabi; and more in this week's banking news roundup.

October 31

- American Banker