The Brazilian digital bank Banco Inter now has a license from the Federal Reserve Board and the state of Florida to establish a virtual "branch" in Miami.

Banks have extra reason to be concerned by the news that a commonly used piece of software could be exploited by hackers.

-

The debate over the "macro" questions about cryptocurrency in the U.S. has been largely settled. We're now entering the "micro" phase, where specific rules and regulations will be written to chart the industry's future.

-

The CEO spoke with American Banker about the company's plans for AI, blockchain, taking its digital wallet global and making PayPal and Venmo work together for the first time.

-

The technology company recently announced iris authentication in smart glasses, bringing new attention to a nascent high-tech payment option that has also attracted Mastercard and Bank of America.

The American Fintech Council publicly declared support for California SB 69, which would require "internal expertise" for artificial intelligence regulation.

A recent $450 million loan is par for the course at Beal Bank USA, which has developed a reputation for seeking out nine-figure loans backed by tangible property.

The Consumer Financial Protection Bureau in an advisory opinion said that "covered" earned wage access products should not be considered an extension of credit under the Truth in Lending Act. It also said that expedited delivery fees and tips should not be considered finance charges.

-

The Office of Management and Budget has prevented billions of dollars from flowing to community development financial institutions, preventing those funds from supporting housing development.

-

By encoding and decentralizing on-chain identity management, soulbound tokens enable institutions to streamline compliance while introducing a base for new services.

-

We don't need to reinvent banking to support cannabis. But we do need a clear, federally coordinated compliance framework tailored to the sector. That means establishing uniform standards.

-

The payment company is betting on agentic commerce to get its checkout tech in front of more merchants and consumers.

-

The Consumer Financial Protection Bureau has backed off enforcement and supervision of consumer protection laws, leaving states to fill the void — and potentially creating a "patchwork" of state laws that banks will have to comply with.

-

The Minneapolis-based regional saw its fourth-quarter profits jump 23%. Consumer deposits bumped up, while operating expenses remained muted.

-

A New Jersey courier scam highlights the severe liability risks consumers face when using debit cards compared to credit cards.

-

In the 11 months after Fifth Third completes its acquisition of Comerica, the Cincinnati bank plans to send 13 million-to-14 million pieces of paper mail to retail customers. CEO Tim Spence says the old-fashioned method "still works," and actually has some advantages over more modern modes of communication.

-

The financial market infrastructure providers are taking advantage of political tailwinds and technology advancements to offer 24/7 trading over distributed ledgers.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

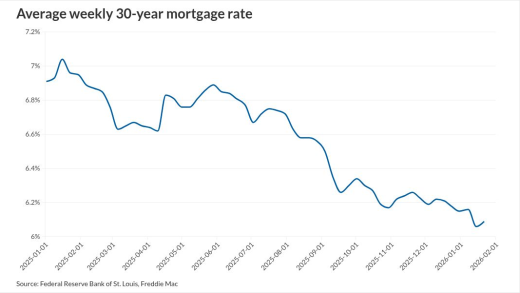

As the Federal Open Market Committee announces its near-term interest rate plans Wednesday, market watchers expect the central bank to hold interest rates steady as policymakers seek greater clarity on the health of the economy.

The 23rd annual ranking of women leaders in the banking industry.

-

- Partner Insights from Infosys

-

- Sponsored by S&P Global

- Sponsored by S&P Global

- Sponsored by S&P Global