Michigan State University Federal Credit Union avoided $2.57 million in fraud exposure through blocking AI deepfake fraud calls with Pindrop products.

Legacy financial firms like the big credit bureau are seeking out financial technology to diversify themselves, bring new products to market faster and meet the needs of global customers.

-

Western Union's North American money transfer business logged a decline in cross-border remittance revenue, led by drops in the U.S. to Mexico corridor, its largest remittance stream by far. The company is also bracing for the 1% remittance tax codified in the "Big Beautiful Bill," a levy that does not directly apply to banks.

-

Unlike rival Fiserv, the bank technology company does not plan to issue its own coin immediately, but it does feel the lure of the broader digital asset market.

-

Direct-to-consumer earned wage access provider EarnIn is rolling out Live Pay, a service that "streams" consumers' paychecks via a Visa card. It's a model banks could replicate.

In August's roundup of top tech news: Banks and retailers wrestle with the unseen consequences of artificial intelligence, Mastercard lays off roughly 3% of its workforce and more.

The largest bank in Missouri, which completed the acquisition of Heartland Financial USA early this year, is on track to switch Heartland's systems over to UMB's systems in mid-October. The conversion should help realize "the next big slug" of expense savings, UMB's CFO said.

Treasury Secretary Scott Bessent Thursday said the bank asset thresholds that trigger enhanced prudential standards like stress testing and additional capital requirements require a recalibration to account for inflation.

-

A blend of equity, private debt and public investment drove the country's growth in the Industrial Revolution. To remain globally competitive, the U.S. needs more creative financing of large infrastructure projects.

-

The question is no longer whether the financial services industry needs a unified approach to combating instant payment fraud but who will take the lead to make it happen. The onus is on the biggest players in the market to show the way forward.

-

Bipartisan legislation before Congress would create sensible regulation for stablecoins, opening a path to cementing the U.S. dollar's status as the world's most important currency.

-

The Swedish financial institution has developed an open standard that allows merchants' products to be catalogued and discovered by AI agents. It was designed to complement Stripe and OpenAI's Agentic Commerce Protocol.

-

The card networks have entered a series of partnerships in Europe and Asia amid signs of growing demand and Apple's waning control over the underlying technology.

-

Mercantile's pending acquisition of Eastern Michigan is approved by the Federal Reserve Bank of Chicago; the National Community Reinvestment Coalition and Rise Economy announce a $2.5 billion addendum to Columbia Bank's community benefits agreement following its acquisition of Pacific Premier Bank; the Federal Reserve Board and CFPB raise the thresholds for certain credit and lease transactions; and more in this week's banking news roundup.

-

Here are the 10 stories our readers paid the most attention to in a year of political, economic and technological change.

-

The Senate confirmed Travis Hill as the chairman of the Federal Deposit Insurance Corp. as part of a slate of nominations that were approved late Thursday. Hill has been serving as acting FDIC chair since January.

-

The Federal Reserve Board voted 6-1 on Friday to seek public comment on a proposed "skinny" master account.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

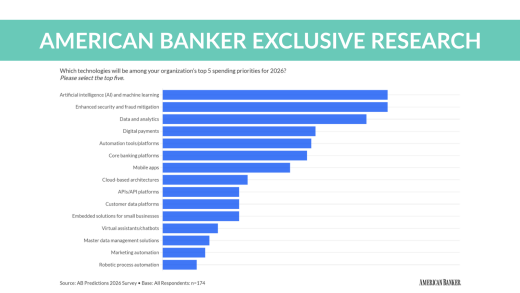

Research from American Banker finds that bankers are still extremely worried about fraud, but hope that raising budgets for artificial intelligence could help.

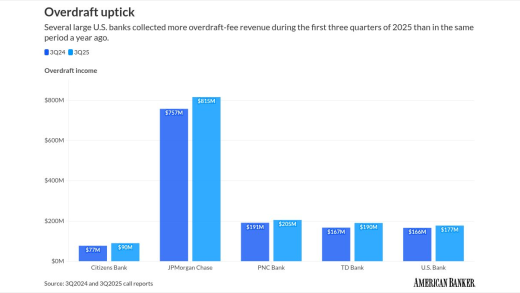

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

The 23rd annual ranking of women leaders in the banking industry.

-

-

- Sponsor Content from Argo

- Sponsor Content from Plaid