The challenger bank in the third quarter launched Cash Coach, an AI-powered customer insights engine that helps consumers optimize earned interest in deposit accounts and minimize interest charges on credit cards. SoFi plans to roll out a "more comprehensive" SoFi Coach that incorporates all areas of financial services as part of its strategy to rival banks.

Instead of sitting around waiting for the next cyberattack, banks are trying to get a little ahead — without breaking the law.

-

Deconsolidation from Seven & i resulting from a reduction of its stake in Seven Bank would make such a scenario more possible, according to CEO Masaaki Matsuhashi.

-

A digital dollar is likely on the way out in favor of non-government crypto, but those betting for fewer restrictions on fees and less antitrust litigation will likely be disappointed.

-

The buy now/pay later company beat analysts estimates on revenue and net income and is trying to get more frequent usage out of its customers.

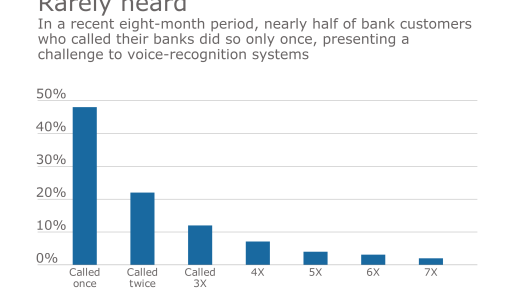

The artificial intelligence engine will handle simple queries directly, feed information to customer service reps for others and analyze all calls.

Reading Cooperative's combination with Wakefield Cooperative, the third deal involving Boston-area banks announced in the past month, would create a $1.2 billion community bank.

Banks scored well in the tax bill out of Ways and Means this week, with wins on S Corps and rural lending, but have so far lost out on credit union taxes and additional burdens on payments competitors.

-

January is Human Trafficking Prevention Month, and the financial services industry should take the opportunity to step up for survivors.

-

The leader of the Financial Services Forum takes issue with a recent BankThink article that challenged the industry's claims about proposed rules for implementing the Basel endgame capital requirements.

-

Past crises have created opportunities for criminal organizations to inject their funds into the legitimate banking system. Bankers can't allow that to happen again.

-

The bank asks a federal court to toss claims from five certified classes, arguing victims have been paid and that fraudsters are included in the suit.

-

BNY's Carolyn Weinberg believes blockchain technology could be the key to an always-on operating system for the New York-based custody bank.

-

The Richmond, Virginia-based bank expects to build 10 branches in Raleigh and Wilmington, North Carolina, over the next three years. M&A is on the back burner as the company also works to capitalize on its recent acquisition of Sandy Spring Bank in Maryland, CEO John Asbury said.

-

The North Carolina bank is the latest lender impacted by the bankruptcy of U.S. auto parts maker First Brands. First Citizens executives said credit was in good shape overall.

-

The agents could overcome the consumer inertia that keeps people in low-yield bank accounts, the consultants say.

-

The credit card issuer added two programs with home goods retailers Raymour and Flanigan and Bed Bath and Beyond during the quarter while also increasing its stock buyback allocation and dividend payouts.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

In a relatively mild oversight hearing in the House Financial Services Committee Tuesday morning, regulatory heads at the Federal Reserve, Office of the Comptroller of the Currency, National Credit Union Administration and Federal Deposit Insurance Corp. outlined plans for reduced capital requirements and debanking enforcement.

The Consumer Financial Protection Bureau and its union filed legal briefs Friday after a district court judge asked if a preliminary injunction aimed at preventing a mass layoff is still in effect.

The 23rd annual ranking of women leaders in the banking industry.