-

Banks could be busy supplying credit to manufacturers, hotels, multifamily developers and other businesses that will be helping residents get their lives back on track after two fierce storms.

September 14 -

New clients will use vendor’s KeyStone core processing system.

September 13 -

The hurricane was expected by many to deliver catastrophe. Instead, bankers are largely looking to restore power and confirm the status of employees.

September 11 -

The agency has earmarked all funds from a Hurricane Harvey recovery package for direct relief, despite calls to get more bankers involved in the process. It remains to be seen how the agency will handle the cleanup for Hurricane Irma.

September 11 -

Former lawyer Kenneth Lehman will pay at least $10 million for a controlling stake in ABB Financial in Atlanta.

August 25 -

Lynn Harton was finally named CEO of United Community Bank after a five-year apprenticeship, though Jimmy Tallent remains CEO of the parent company. The executives have long touted an ability to bounce ideas off each other as a reason for United's success.

August 17 -

Like many banks its size, CenterState in Florida may need to venture out of state to find a big enough acquisition to make additional compliance costs worthwhile.

August 14 -

Increased dealings in direct consumer lending and guaranteed student loans offset a decline in mortgage-related income. A lower loan-loss provision also helped the bottom line.

July 21 -

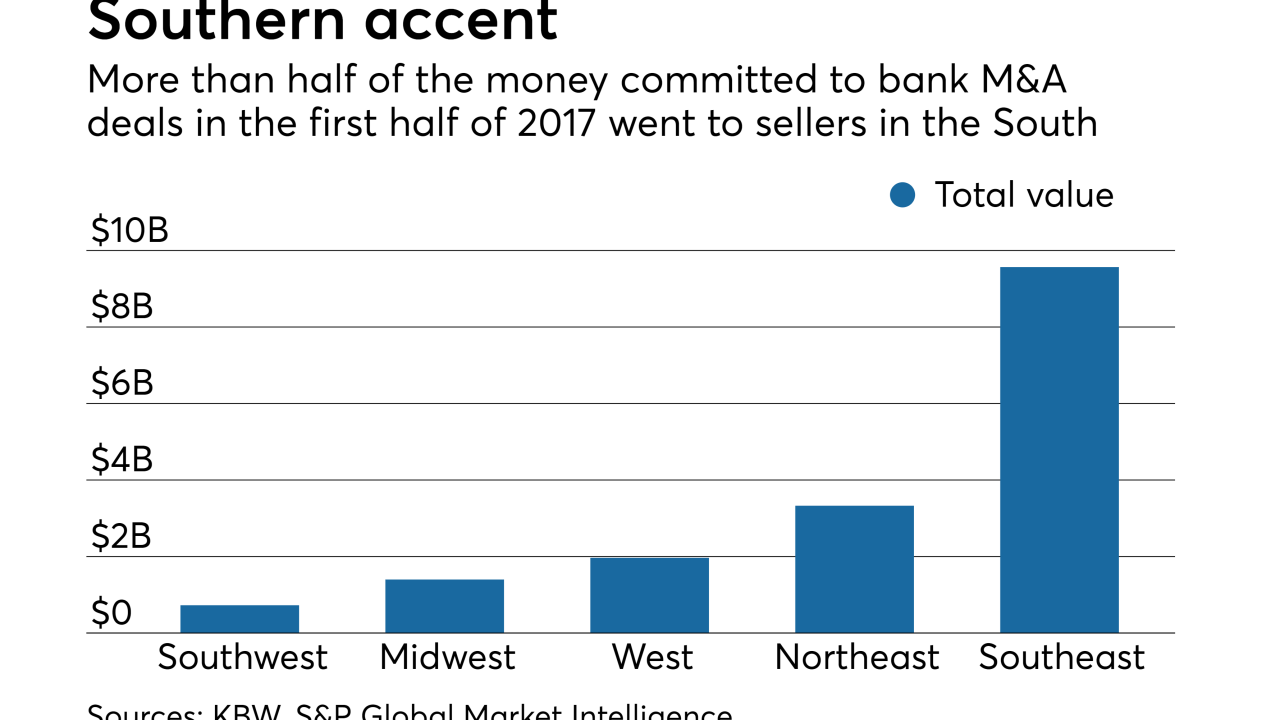

The region is responsible for a third of all bank sellers — and more than half of the industry's overall deal volume.

July 10 -

The North Carolina company's purchase of Chattahoochee Bank will add a branch and loan production office to its existing operations in northern Georgia.

June 28 -

The Georgia bank will pay $124 million for Four Oaks Fincorp, buying a bank with a large operation in Raleigh, N.C.

June 27 -

Pinnacle Financial Partners closed in on $20 billion in assets by buying BNC. It now has to integrate the North Carolina bank, while finding ways to boost profit and adapt to increased regulatory burden.

June 16 -

AloStar was formed in 2011 by an investor group that bought the failed Nexity Bank in Birmingham, Ala.

June 15 -

More than half of the company's loans and deposits would be in the Atlanta area after it buys Resurgens Bancorp.

June 2 -

Joseph Evans will step down as CEO on June 1, though he will remain the company's chairman. Thomas Wiley, a longtime associate of Evans, is set to take the helm.

April 27 -

The Atlanta company's profits rose on stronger net interest income and investment banking income as well as a tax maneuver.

April 21 -

The On the Rise Financial Center will provide consumers with affordable financial products and financial literacy training.

April 18 -

Jefferson Harralson, the Georgia company's new chief financial officer, had covered banks at Keefe, Bruyette & Woods for 15 years.

April 17 -

H. Palmer Proctor has been the Atlanta company's president since 2004.

March 17 -

The SEC is investigating the bank for selling clients mutual funds that charge marketing fees when other, cheaper funds were available. SunTrust expects an enforcement action.

February 27